Often, when maintaining accounting records, checking entries in the purchase book for previous periods, the accountant discovers errors in filling out the purchase book. One of the common mistakes is recording the same invoice twice in the purchase ledger.

Example: The organization TH “Romashka”, which applies the general taxation system, on October 15, 2015, after submitting the VAT return for the third quarter. 2015, I discovered errors in accounting: documents Act, invoice, reflecting the transaction for the purchase of advertising services from the counterparty TV SHOP, accordingly, an invoice entered incorrectly twice in the purchase book for the third quarter of 2015. In this article we will look at , how to make corrections for VAT accounting purposes (Fig. 1).

In accordance with Art. 54 of the Tax Code of the Russian Federation, if it is necessary to make changes to the purchase book (after the end of the current tax period), the cancellation of the entry on the invoice, adjustment invoice is made in an additional sheet of the purchase book for the tax period in which the invoice, adjustment invoice was registered before corrections are made.

Additional sheets of the purchase book are its integral part and are compiled in accordance with sections III and IV of this document.

According to paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, a taxpayer who discovers non-reflection or incompleteness of information, as well as errors, in the declaration submitted to the tax authority, is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority, if errors (distortions) led to an understatement of the tax amount, payable.

Conclusion: When making corrections to the purchase book, you must provide an additional sheet of the purchase book and a tax return for the period being adjusted.

To do this we need only two documents:

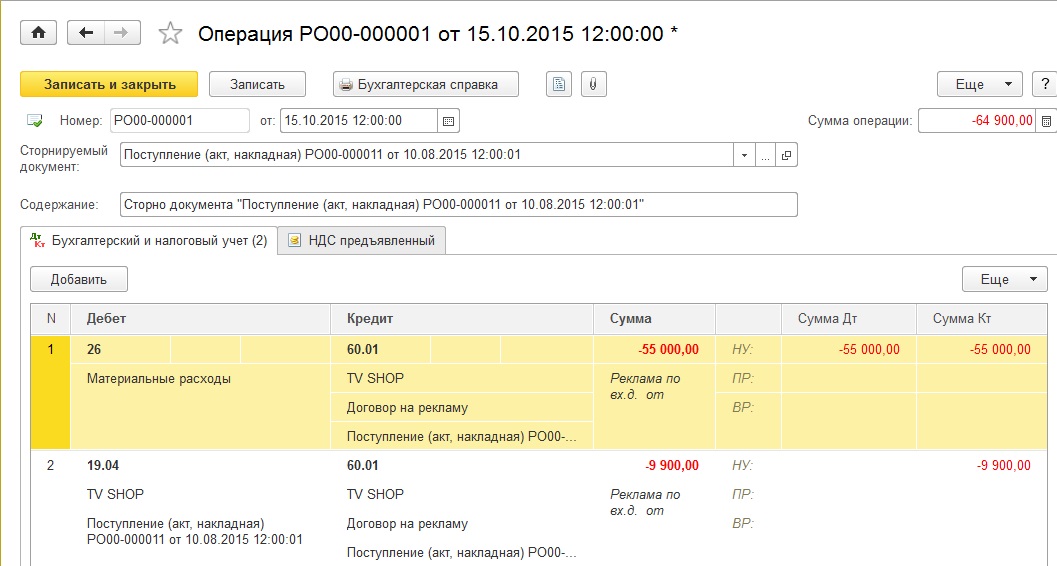

- “Reversal” document to correct an error in accounting;

- document Reflection of VAT for deduction.

To reverse movements and postings of a re-entered document, we will use the Transaction document entered manually. When creating this document, we will select the Storno type. In the created document, you must select the document to be reversed. The tabular part will be automatically filled in with the transactions of the document being reversed, only with negative amounts. The VAT accumulation register movements presented must be deleted.

To cancel an erroneous entry in the purchase book, we will use the document Reflection of VAT for deduction. To do this, go to the Operations menu - Reflection of VAT for deduction. Let's create a document. In the document details, we need to select the Counterparty, the counterparty agreement, the Receipt document (act). You must check all the boxes in the document settings.

In the Goods and Services tab, you need to fill out the tabular part of the document using the Fill in settlement document button. Also in the details the amount must be set with a minus sign. The document settings and movements are shown in Fig. 3 and 4.

Result: When posting, the document in accounting will be reversed upon acceptance of VAT for deduction and will create an entry in the purchase VAT accumulation register (purchase book).

To get the final result, let's go to the purchase book and create an additional sheet for the adjusted period (Fig. 5).

In this article we do not consider a number of operations, but before generating an updated VAT return, you need to do the following:

- additional income tax assessment;

- payment of arrears and penalties on taxes;

- generation of an updated VAT return for the third quarter.

Consultations on working with the 1C program

The service is open specifically for clients working with the 1C program of various configurations or who are under information and technical support (ITS). Ask your question and we will be happy to answer it! A prerequisite for obtaining consultation is the presence of a valid ITS Prof. agreement. The exception is the Basic versions of PP 1C (version 8). For them, a contract is not necessary.