Tax accounting for income tax in the program "1C:ERP Enterprise Management 2"

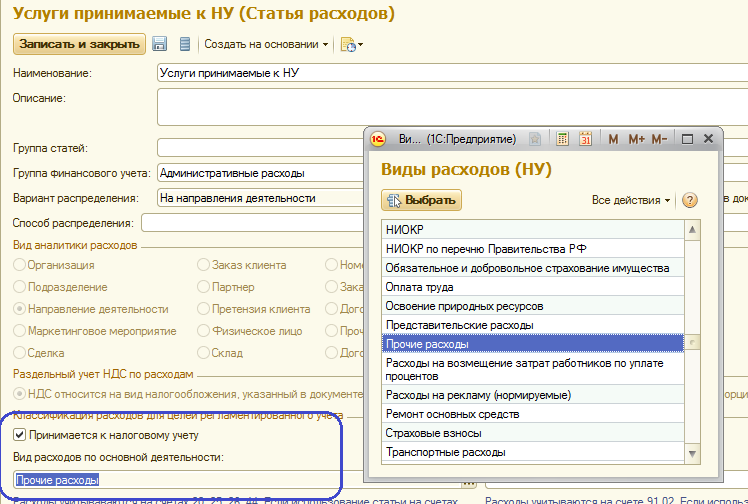

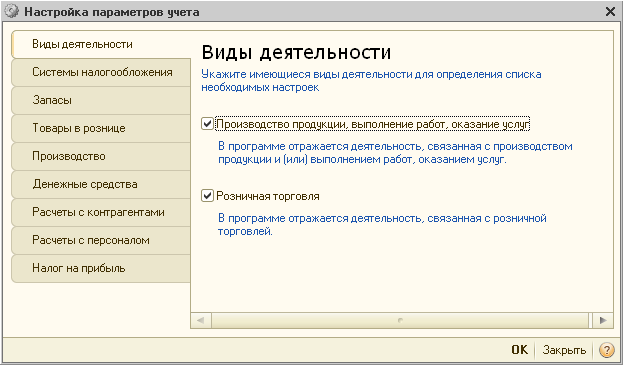

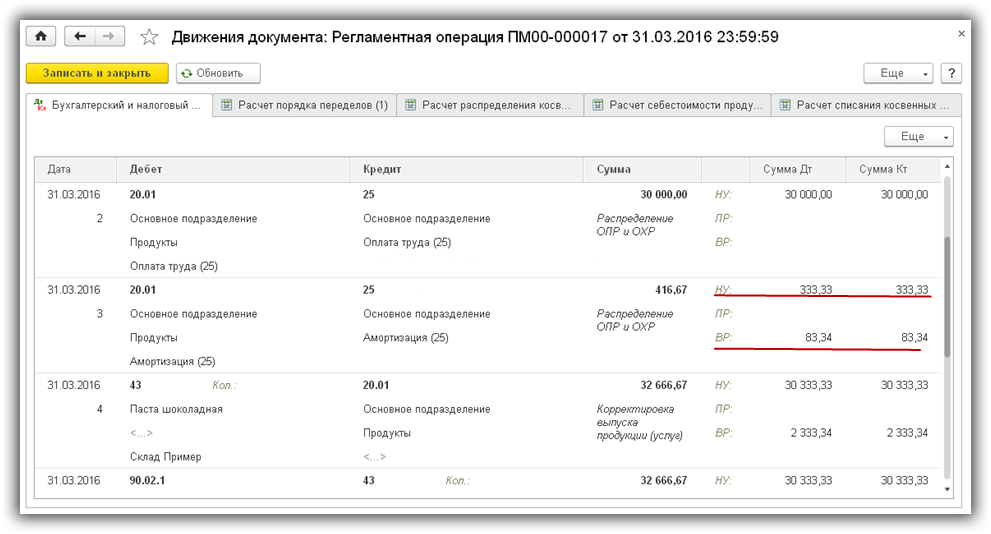

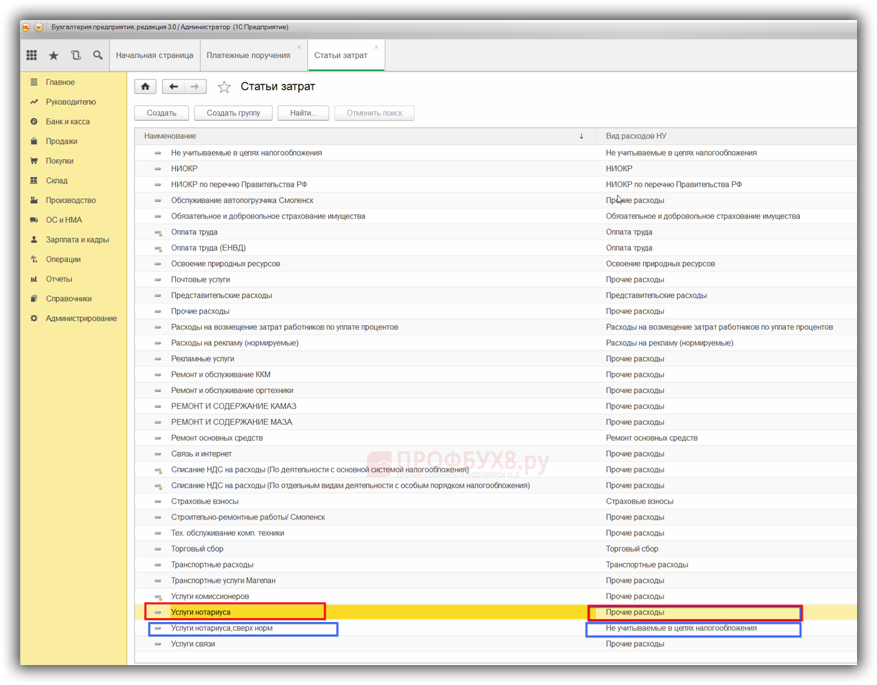

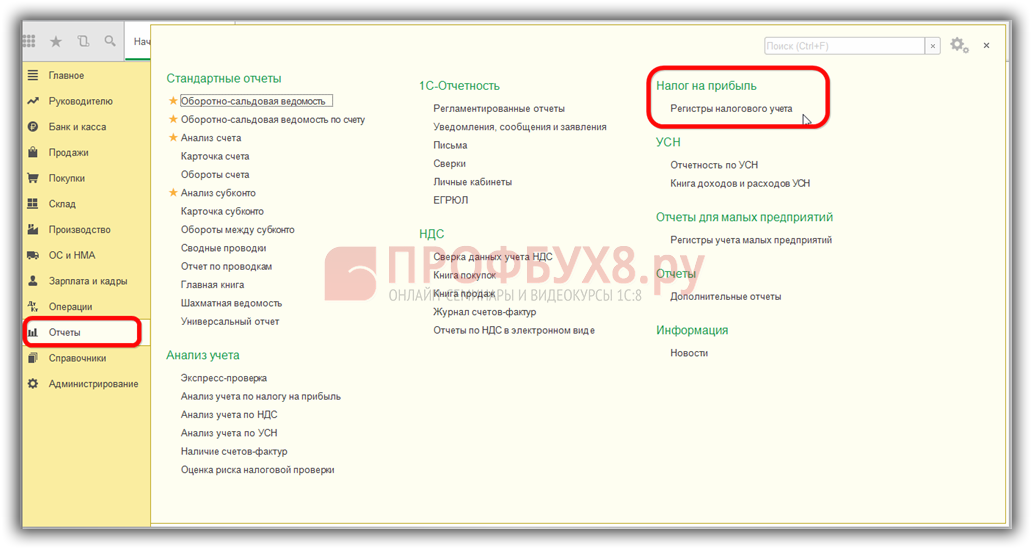

In this article we will briefly look at the main functionality for accounting for income tax in the 1C:ERP Enterprise Management 2.0 configuration (hereinafter referred to as 1C:ERP). In this case, the main emphasis will be placed on the differences with... Read