In this article, we will briefly review the main functionality for accounting for income tax in the configuration "1C: ERP Enterprise Management 2.0" (hereinafter referred to as 1C: ERP). In this case, the main emphasis will be placed on the differences with the configuration "1C: Manufacturing Enterprise Management 8. Ed. 1.3" (hereinafter referred to as UPP).

In the 1C: ERP system for accounting and tax accounting, unified chart of accounts. As a result, accounting and tax accounting operations are reflected simultaneously in both accounting and tax accounting in the same accounting register, there is no separator “Accounting type”, and there is also no need to establish correspondence between accounting and tax accounting, as it was in the UPP.

The need to reflect a business transaction on an account in tax accounting is determined by the “NU” sign in the chart of accounts.

This innovation greatly simplifies the analysis of accounting data in 1C: ERP compared to the SCP, where accounting and tax accounting was organized on different charts of accounts and different accounting registers.

The tax accounting parameters are configured individually for each organization. Parameters are specified:

- taxation system (general or simplified);

- application of UTII;

- income tax rates;

- application of PBU 18/02.

Consider how tax accounting is organized under the general taxation system using PBU 18/02.

Documents in regulated accounting are reflected simultaneously in accounting and tax accounting, for this it is not necessary to establish additional signs, as in the SCP.

Not all expenses reflected in accounting are accepted for tax accounting. To reflect such transactions, expenses in tax accounting are recorded as permanent or temporary differences.

When conducting documents, as well as in the SCP, the rule must be followed: BU = NU + PR + VR, where BU is accounting, NU is tax accounting, PR is a constant difference, VR is a temporary difference.

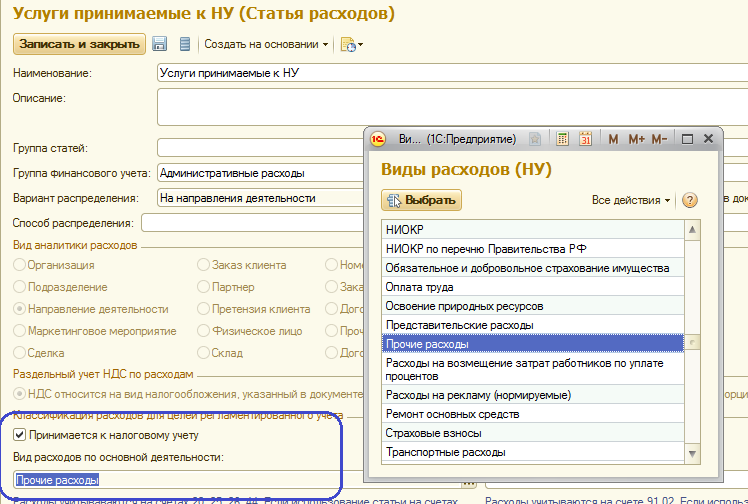

Formation mechanism constant difference in 1C: ERP is similar to SCP. Whether or not an expense under an item is accepted for tax accounting is determined by the sign “Accepted for tax accounting”. If the attribute is removed, the attribute “Type of expenses for the main activity” is automatically set to the value “Not taken into account for tax purposes”. If the sign “Accept for tax accounting” is set, the attribute “Type of expenses for the main activity” is filled in with one of the proposed values. This value will be used when carrying out routine tax accounting operations and generating a tax return.

For example, let's draw the document "Receipt of services and other assets". Let's introduce expenses for two items: accepted and not accepted for tax accounting:

We receive postings on the expense account. As you can see, services not accepted for NU were reflected in the column Amount PR Dt, accepted - Amount NU Dt. For tax accounting, debit and credit entries are formed separately, since not all accounting accounts are subject to tax accounting.

Temporary differences arise when costs are accounted for differently in accounting and tax accounting. For example, when accepting a fixed asset for accounting, different periods of operation are established in accounting and tax accounting. When depreciating, a temporary difference arises:

Based on the postings entered by the primary documents, formed permanent, temporary differences, the income tax is calculated.

Permanent differences affect the calculation of permanent tax assets and liabilities, temporary differences affect the calculation of deferred tax assets and liabilities.

The tax is calculated in the process of processing "Closing the month". It is carried out by the document "Regulatory operations" with the type of operation "Calculation of income tax".

The result of our calculations is a tax return.

The principles for the formation of regulated reporting do not differ from similar functionality in the SCP. There is an unloading of the report in electronic form for transfer to the tax office.

In this article, we briefly reviewed the principles of organizing tax accounting for income tax in the 1C: ERP Enterprise Management 8 program. In articles that have already been prepared and are being prepared for publication, we consider in more detail the issues of regulated and managerial accounting in the 1C: ERP Enterprise Management 2.0 program.