ATTENTION: a similar article on 1C ZUP 3.1 (3.0) -

Hello dear blog readers. In today's article, we will continue to analyze the main features of the program 1c Salary and personnel management and get acquainted with the section payroll 1s zup. Let me remind you that the beginning was laid in the first part of this series of articles, which you can read. Let me also remind you that this review of the payroll capabilities in 1s zup will affect the following sections of the program accounting:

Payroll

✅

✅

✅

So, while getting acquainted with the personnel records section, we hired three employees in our fictitious organization Alpha:

- director - Ivanov - salary 40,000,

- accountant - Petrov - salary 30,000,

- manager - Sidorov - salary 20,000.

When hiring these employees, only the main planned type of calculation "Salary by days" was assigned. In 1c terminology, “planned type of calculation” means that the amounts for this type will be accrued regularly from month to month automatically when filling out the document “Payroll to employees of the organization”, but we will talk about this document in more detail a little later. “Main type of calculation” - each employee must have at least one type of accrual, and so it is the main one. The "main types of calculation" include:

- daily salary;

- hourly salary;

- payment according to the daily rate;

- payment for production orders;

- pay by the hour.

The program has a number of predefined calculation types created by the program developers. They can be viewed in the "Basic accruals" and "Additional accruals" lists, which can be accessed on the "Payroll" tab of the program desktop. The main accruals are characterized by duration in time, they do not have additional dependencies on time.

We will have to create this type of calculation for the simple reason that the developers did not provide for this kind of accrual. Let's call it "Bonus Percentage of Salary". This type of calculation will belong to the group of basic accruals since it will depend on the amount accrued by the type of calculation “Salary by day”. So, let's go to the list of basic accruals and add a new one. There are several tabs in the form of a new calculation type. Let's consider everything in turn.

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Bookmark "Calculations":

- Calculation sequence - "Dependent of the first level" means that it depends on some kind of calculation. In our case, from "Salary by day." As for the levels of dependency, I won't go into that now until it's important to us;

- Method of calculation - Select "Percentage". This selection results in a predefined formula appearing in the Calculation Formula Description field. You do not need to edit anything in this field.

The “Contributions” tab is used to set up the calculation of insurance premiums from the amounts accrued for this type of calculation and contains the following fields. Here, in fact, only the “Type of income” field is valid. We will set it to the value “Income fully taxed by insurance premiums”.

The "Management Accounting" tab is not filled in.

Bookmark "Other". Despite such a non-key name, this bookmark is very important for us. On it, we will indicate the type of calculation “Salary by day” and the percentage for calculating our bonus will be calculated from the amounts accrued for this type of calculation. Also, the type of calculation "Salary by days" must be specified in the "Leading accruals" field, so that when the salary amounts change, the bonus is automatically recalculated. The bookmark will look like this:

|

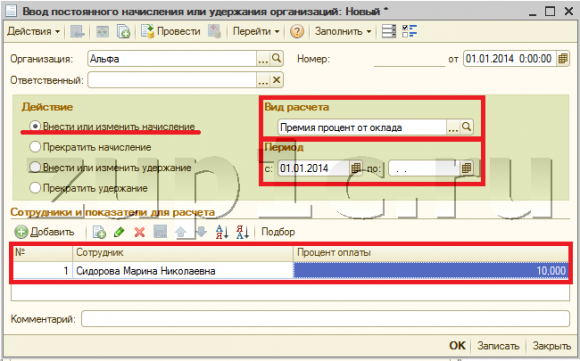

After that, click OK and the new type of calculation is saved as part of the "Basic charges". Now it is necessary to assign this accrual to the employee Sidorova as a planned one, i.e. which will accrue from month to month. To do this, in the 1s zup program, you can use the document “Entering a permanent accrual or deduction”. It can be found on the "Payroll" tab of the program's desktop in the left column at the bottom. You need to add a new document and fill in the following fields in the form of this document:

- Action - "Make or change the accrual";

- Type of calculation - "Bonus percentage of salary";

- Period - from 01.01.2014;

- Add employee Sidorov to the table field and indicate the percentage - let it be 10%.

Click OK the document is recorded and posted. Now Marina Nikolaevna Sidorova has two planned accruals “Salary by day” and “Bonus percentage of salary”. This can be seen if you go to the "Employees" directory (the "Personnel records" tab of the program desktop) and open the employee form. On the "Accruals and deductions" tab, you can see all the planned accruals that are valid for the employee.

These planned accruals will automatically fall into the tabular part of the document "Payroll" when filling it out. This is the final payroll document that is entered every month at the final payroll. But I will talk about it in more detail a little later.

Before finally calculating the salary with the document “Payroll”, the program should reflect intermediate accruals and calculations. These calculations include:

- , And ,

Also, this category of documents can be attributed (or you can read how to reflect both the transaction and the salary at the same time). I have reviewed each of these payments in detail in separate articles, links to which I have just given you. Therefore, I will not consider them in detail here. Just keep in mind that all these accruals must be calculated and posted before the final calculation by the Payroll document.

In addition to all of the above, the program 1s zoom there is such a thing as one-time charges. And we will talk about it in more detail. Suppose the director decided to pay the accountant a one-time bonus of 5,000 rubles. To reflect such an accrual, we do not have a suitable predefined type of calculation as part of "Additional accruals" (as part of additional ones, since this kind of bonus has no duration in time), so we will create a new type of "One-time bonus". On the payroll tab of the program desktop at the very bottom, go to "Additional accruals" and create a new type of calculation. Let's quickly go over the bookmarks:

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

- Bookmark "Calculations":

o Calculation sequence – primary accrual, since it is a fixed amount and does not depend on other accruals, but is based only on the wishes of the director;

o Calculation method - in fact, the “Fixed amount” is indicated here.

- "Usage":

o Prizes - not a premium. Here we mean a bonus based on the results of work for a certain period, therefore, despite the fact that we have a bonus, in this setting we indicate “is not a bonus”;

o Not a benefit;

o Not holiday compensation;

o Payout is not controlled.

- "Accounting" is all by default;

- "Taxes" - subject to income code: 2000 and not included in labor costs;

- "Contributions" - income. Fully subject to insurance premiums;

- "Management accounting" and "other" do not fill out.

|

Click OK, the type of calculation is recorded. In order to accrue the amount for this type of calculation, it is necessary to use the specialized document "Registration of one-time charges". The document is located on the "Payroll" tab of the program desktop in the left column.

Separately, I want to note the field "Date of payment of income for personal income tax". Depending on the date specified in this field, the calculated personal income tax will be attributed to a specific month of the tax period (we have the date 01/31/2014, so the tax period is January 2014).

Next, you need to calculate the planned charges. For this, the “Payroll” document is used, which can also be found on the “Payroll Calculation” tab of the program desktop in the top left column. This document is monthly. Let's add a new document. Specify month of accrual "January 2014". The program provides automatic filling of the tabular part. To do this, click the "Fill" -> "For all employees" buttons. As a result, lines with planned employee accruals will be created.

To automatically calculate the result, you must click "Calculate" -\u003e "Calculate (full calculation)". In this case, all 4 lines will be calculated, plus the “Personal Income Tax” tab. At the same time, please note that the employee Sidorova will automatically calculate the “bonus from salary”.

Thus, we calculated the wages for three of our employees. I will talk about the numerous printables available in the program in. Now I just want to mention the ability to print pay slips. To do this, on the "Payroll" tab of the program desktop in the "Reports" section, open the link "Payrolls". In the form that opens, specify the period "January 2014" and click the "Generate" button:

In the next article, we will consider. That's all for today, see you on the pages.

To be the first to know about new publications, subscribe to my blog updates: