A successful business involves cooperation with a large number of companies with whom cash payments are regularly made. A significant share is also occupied by settlements with the state - for taxes and insurance premiums. All these monetary relations require careful monitoring, and the easiest way to do this is through regular monitoring.

How to read the reconciliation report correctly

Purposes of signing

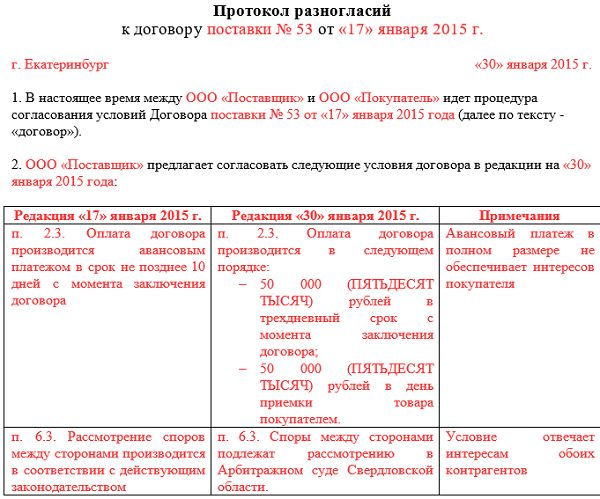

Sample act of disagreement

The act of disagreement is signed by the same person who signs the main acts of reconciliation. Copies of documents confirming the disagreement must be attached to it.

Varieties of such a document

Most common

The most common types of reconciliation acts include:

- Reconciliation report with the supplier. Contains transactions accounted for in account 60. The debit reflects all payments made to the supplier, and the credit reflects the amount of product deliveries.

- Reconciliation report with the buyer. In this case, accounting is kept in account 62. The amounts of shipments are recorded as a debit, and the payments transferred by buyers are recorded as a credit.

- Reconciliation report of completed work. It is drawn up according to the general rules, only instead of the amounts of product deliveries, it reflects the amounts according to the acts of work performed.

- Group reconciliation act. It is a set of reconciliation acts for all existing counterparties of the company. It is formed by installing a special extension to the accounting program. This method of generating acts is especially convenient at the end of the reporting period, when it is necessary to take inventory of the entire volume of settlements.

- Zero reconciliation report. A distinctive feature is the balance equal to zero at the end of the period considered in the document.

- . It is drawn up in the same way as acts for any other services. When the lessor generates the document, the rental amounts will be entered on the debit side according to the invoices issued, and on the credit side the payments transferred by the tenant will be entered.

Reconciliation acts are also classified depending on the status of the counterparty - or individual. Moreover, not only ordinary citizens with whom the company has any settlements can act as an individual. Such an act is formed according to the general rules, as in the case of reconciliation with organizations. The company does not have the right to refuse to provide an individual with a reconciliation report if it was requested by him.