So, VAT is a value added tax paid by the seller of goods and services on that part of the cost that he adds to the cost of these goods before the sale stage.

At the same time, the seller includes VAT in the cost of the goods and services he provides and is himself a VAT payer for the goods and services he purchases during production. Thus, the amount of tax paid by the seller is the difference between the amount of tax received by the seller from the buyer and the amount of tax paid to suppliers.

In the Tax Code of the Russian Federation, Chapter 21 is devoted to VAT.

VAT is paid (Article 143 of the Tax Code of the Russian Federation):

- organizations;

- individual entrepreneurs;

- persons recognized as VAT taxpayers in connection with the movement of goods across the customs border of the Russian Federation.

In accordance with paragraph 1 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, the taxpayer (tax agent specified in paragraphs 4 and 5 of Article 161 of the Tax Code) is obliged to present, in addition to the price (tariff) of the goods (work, services) being sold, transferred property rights payment to the buyer of these goods (works, services), property rights, the corresponding amount of tax. Those. the amount of VAT is actually included in the final price of goods (work, services) presented to buyers.

The following operations are recognized as the object of taxation (clause 1 of Article 146 of the Tax Code of the Russian Federation):

- sale of goods (work, services) on the territory of the Russian Federation, including the sale of collateral and transfer of goods (results of work performed, provision of services) under an agreement on compensation or novation, as well as transfer of property rights. At the same time, the transfer of ownership of goods, the results of work performed, and the provision of services free of charge is recognized as the sale of goods (work, services);

- transfer of goods on the territory of the Russian Federation (performance of work, provision of services) for one’s own needs, expenses for which are not deductible (including through depreciation charges) when calculating corporate income tax;

- carrying out construction and installation work for own consumption;

- importation of goods into the customs territory of the Russian Federation.

An organization can receive an exemption from fulfilling the duties of a taxpayer and not be a VAT payer (the procedure for receiving benefits is established by Article 145 of the Tax Code of the Russian Federation). In this case, the organization does not have the obligation to prepare invoices, maintain a purchase book, a sales book and submit a tax return.

In configuration 1C: Accounting 8 for VAT accounting for acquired values, account 19 is presented “VAT on acquired values”, for accrued VAT – 68.02 “Value added tax”, for accounting for VAT on advances and prepayments – account 76.AB “VAT on advances and prepayments” and on the accounting account 76.VA “VAT on advances and prepayments issued” reflects transactions on advances to suppliers.

So, before you start accounting for VAT, you need to check the organization’s accounting policy settings. To do this, go to the “Enterprise/Accounting Policies/Accounting Policies of Organizations” menu on the “VAT” tab and check the correctness of the settings: does the enterprise carry out sales at a rate of 0% or without VAT, is it necessary to charge VAT on shipment without transfer of ownership, registration procedure invoices for advance payments, etc.

In the 1C: Accounting 8 program, the Purchase Book and Sales Book are filled out automatically, but only after performing certain regulatory procedures at the end of the month. The list of VAT regulatory documents can be viewed through the menu item “Operations/Documents/VAT regulatory documents”.

Fig.1 VAT regulatory documents

These documents analyze data from registers and generate the corresponding movements and postings.

Let's take a closer look at the document "Distribution of VAT on indirect expenses."

The need to distribute VAT on indirect expenses arises in two cases:

- - if the organization applies UTII;

- - if the organization carries out sales at the rate Without VAT or at the rate of 0%.

The document “Distribution of VAT on indirect expenses” must be completed and posted at the end of the month. The document is intended for the distribution of input VAT on values written off as expenses, for transactions either subject to VAT, or not subject to VAT, or taxed at a rate of 0%.

The document consists of 3 tabs “Revenue from sales”, “Indirect expenses” and “VAT write-off accounts”.

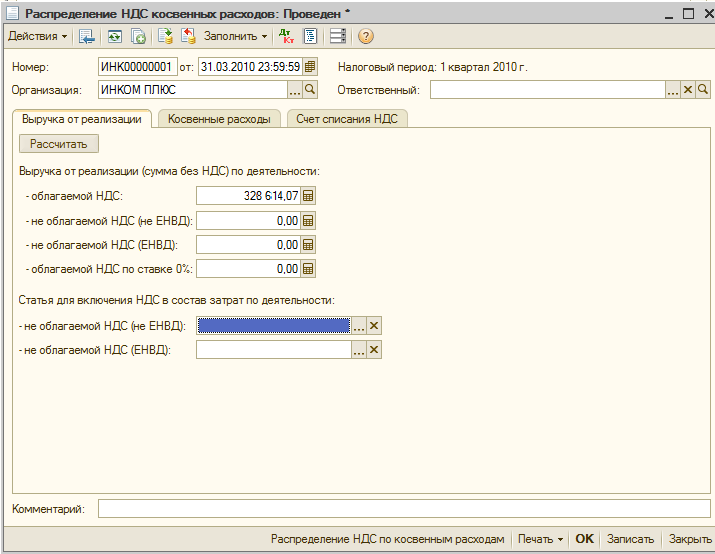

Fig.2 Tab “Revenue from sales”

On the “Sales Revenue” tab, the amounts of sales revenue for the period are indicated at various VAT rates to determine the proportion that will be used for the distribution of VAT (in accordance with Article 170 of the Tax Code of the Russian Federation).

Revenue amounts can be filled in automatically using the “Calculate” button.

In the part “Article for including VAT in activity costs” you need to indicate:

- - not subject to VAT (not UTII), if the organization carries out sales that are not subject to VAT and are not related to UTII

- - not subject to VAT (UTII), if the organization carries out sales subject to UTII.

Fig.3 Tab “Indirect costs”

The “Indirect Costs” tab contains data on values written off as expenses. The list of valuables can be filled in automatically by pressing the "Fill in / Fill in according to VAT registers" button and using the "Distribute" button, the distribution of incoming VAT amounts to indirect costs is carried out.

The tab contains two tabular parts. The upper part displays general information about the values: type of value, invoice, etc. and the amount without VAT and VAT. In the lower tabular part, information is filled in on the cost accounts to which the values are written off. These data correspond to the line selected in the upper tabular part and are used for cases when it is necessary to reflect the inclusion of VAT in the cost of activities that are not subject to VAT or subject to UTII.

When filling out the upper tabular part in the “Distribution” column. taking into account UTII revenue" the checkbox is set if the values were written off using an expense item intended to account for costs for various types of activities, while during the distribution the amount of VAT will be attributed to activities subject to VAT at normal rates, for activities subject to VAT at a rate of 0 %, and for activities subject to UTII (if a cost item is indicated for accounting for costs of activities subject to UTII, then the distribution of VAT on such expenses is not made). If the box is not checked, then the distribution will not take into account activities subject to UTII.

In the column “VAT included in the cost”, a checkbox is checked if before the distribution of VAT on the written-off value it was included in the cost, in this case, when posting the document, the exclusion of VAT from the cost may be reflected if part of the expenses relates to activities subject to normal VAT rates or at a rate of 0%.

Fig.4 Tab “VAT write-off account”

The tab "VAT write-off account" indicates the procedure for writing off VAT in the case when the expenses relate to activities that are not subject to VAT or subject to UTII, and the VAT amount was previously deductible:

- If it is necessary to write off VAT to the cost accounts indicated in the lower tabular section on the “Indirect costs” tab, then the “Write off VAT as well as valuables” flag is set.

- If it is necessary to write off VAT to another account and analytics, then the flag "Write off VAT differently than values" is set. In this case, it will be possible to select an account and analytics, in accordance with which the VAT write-off will be reflected.

Thank you!