In paragraph 1 of Art. 54 of the Tax Code of the Russian Federation states that errors can be corrected in the current quarter if the error is related to overpayment of income tax for the previous period. That is, if expenses in the previous period were not taken into account, then the error can be corrected in the current period, since there was an overpayment of income tax in the previous period.

From the point of view of the position of the Ministry of Finance, pass reflection of the document in tax accounting not considered an error. The Ministry of Finance refers to clause 2 of PBU 22/2010 and exercises the right under clause 1 of Art. 54 of the Tax Code of the Russian Federation is not possible in this example. Therefore, expenses in tax accounting must be included in the period in which they were incurred, that is, in the second quarter. It is necessary to submit the updated one for the first half of the year.

Position of the Ministry of Finance

The Ministry of Finance of the Russian Federation in its letter dated October 17, 2013 No. 03-03-06/1/43299 based on PBU 22/2010 “Correcting errors in accounting and reporting” explains that:

According to the Ministry of Finance of the Russian Federation, expenses should be taken into account in the period in which the documents were received, even if they were issued in the previous period, since this is not an error in accordance with PBU 22/2010.

Thus, the Ministry of Finance says that if documents were received in the third quarter, then we have the right to reflect it in the third quarter. But in this case, you need to be prepared to confirm a later date for receiving the documents. This is important because:

- The Ministry of Finance must confirm the fact that the document on communication services, which they forgot to reflect in the 2nd quarter, was received from the supplier in the 3rd quarter.

- But if the accountant simply forgot to reflect the expense, then in the opinion of the Ministry of Finance there is only one way - to submit an updated income tax return for the second quarter, since to exercise the right under clause 1 of Art. 54 of the Tax Code of the Russian Federation in this situation is impossible.

Position of the Federal Tax Service

The Federal Tax Service, in letter No. AS-4-3/13421 dated August 17, 2011, writes that errors are taken into account in the current period if it is not possible to determine the period of their occurrence. In other cases, it is necessary to submit updated declarations, since according to paragraph 1 of Art. 272 of the Tax Code of the Russian Federation, expenses are taken into account in the period in which they arose.

Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 2449/12 dated July 24, 2012, decided that expenses are taken into account in the period in which they arose according to the terms of the transaction.

Thus, if you forgot to enter an invoice in the 2nd quarter, then you need to confirm the receipt of the document in the 3rd quarter and take it into account in the 3rd quarter. Or submit an updated tax return for the second quarter.

How to reflect expenses of the previous period in 1C 8.3 step by step

Let's simulate a situation where you forgot to submit an invoice, and there is no confirmation of the acceptance of primary documents in the third quarter. That is, the document was received in the second quarter, but they forgot to take it into account in the second quarter.

Instructions for reflecting expenses of the previous period in 1C 8.3

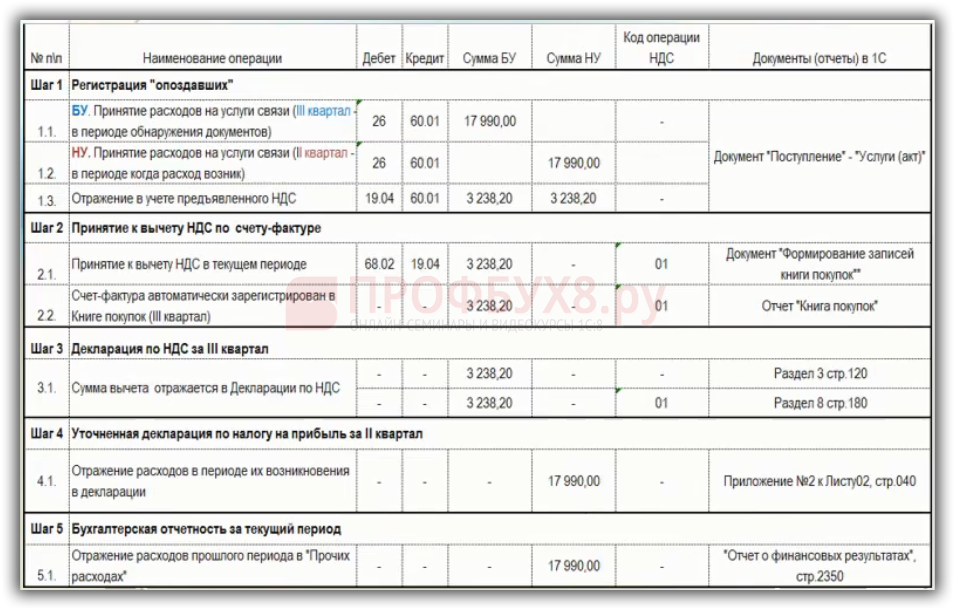

Instructions on what to do if you forgot to enter an invoice in 1C 8.3 are presented in the table step by step:

Step 1. Registration of a “late” document in 1C 8.3

In accounting, you need to accept the “forgotten” expense during the period of discovery of documents, that is, in the third quarter. In tax accounting, the “forgotten” expense must be included in the second quarter.

In 1C 8.3, open the document “Receipt of services. Act”, where we indicate

- The number and date of the primary document is the 2nd quarter, that is, 06/30/2015.

- The date of recording when the document was discovered is the third quarter, that is, 09/30/2015.

- The correspondence of the invoice will be Dt 26 invoices, while 91 invoices do not need to be indicated.

- We register an invoice dated September 30, 2015:

Step 2. Reflection of the “forgotten” expense in the VAT return for the third quarter

VAT can be deducted in the third quarter and it is not necessary to make an updated VAT return for the second quarter, because you can use the “Three years” rule. Thus, you can take advantage of the deduction within 3 years from the date of acceptance of goods for registration. Therefore, from a VAT point of view, it is necessary to deduct the VAT on the invoice in the third quarter, and it is included in the regular VAT return for the third quarter.

Step 3 – Reflection of the “forgotten” expense in the updated income tax return for the second quarter in 1C 8.3

Next, in 1C 8.3, you need to register expenses in accounting in the third quarter, and in tax accounting in the second quarter, in order for an updated income tax return to be automatically generated. In the document “Receipt of services. Act” button, you need to manually adjust the postings. For this:

- The “Manual adjustment” checkbox is checked.

- In the first posting you need to leave only the amount in the accounting record with the date 09/30/2015 and remove the posting for tax accounting.

- The first transaction is copied with the F9 button, resulting in a new line. We change the date to 06/30/2016, after which expenses in tax accounting will be reflected in the second quarter, that is, 06/2016:

Before creating an updated tax return, in 1C 8.3 you should re-do the “Month Closing” for June. In this case, before “Closing the month” you need to make an archive copy of the database and then make the correction.

After this, a profit tax declaration will be generated in 1C 8.3, which will reflect the expense in the form of an updated declaration for the first half of the year. In the DNP you need to enter the adjustment number “1”, fill it out and the expense will be reflected in Sheet 2 of Appendix 2 on line 040:

It turns out that the updated declaration indicates more expenses for the first half of the year than is reflected in the primary declaration. Accordingly, the income tax is less than in the primary declaration.

Therefore, it should be taken into account that there is paragraph 3 of clause 3 of Art. 88 of the Tax Code of the Russian Federation, which states that when conducting a desk audit of the updated DNP, where the amount of tax is reduced, the Federal Tax Service has the right to demand:

- Primary documents confirming changes in data in the DNP.

- Analytical registers for NU before and after changes.

Features of reflecting cost accounting operations in 1C 8.3, including basic documents, accounting accounts, recognition of expenses in accounting and NU are discussed in the module.

Please rate this article: