What is tax accounting for and how to determine it?

The main task of tax accounting in 1C is the calculation of income tax, or rather the tax base for it.

Determining the income tax base is quite simple. This is the difference between income and expenses.

The difficulty lies in the fact that income and expenses are recognized differently in different types of accounting. Part of the income and expenses can be recognized only in one of the types of accounting. As a result, permanent and temporary differences appear.

The “friendship” of accounting and tax accounting is expressed by a formula consisting of four values:

BU = NU + PR + VR,

- BU – accounting amount

- NU – tax accounting amount,

- PR – constant difference,

- TD – time difference.

How tax accounting is implemented in 1C Accounting 8.3

In accounting configurations 1C 8.3, to implement this formula, a special register is used, in which each value has its own resource (Fig. 1).

It is not necessary for the user to understand the structure of the registers in detail, but for a deeper understanding of the mechanism for calculating tax transactions, it is worth having at least a general understanding of the internal “kitchen”. Moreover, the connection between the register and postings is obvious.

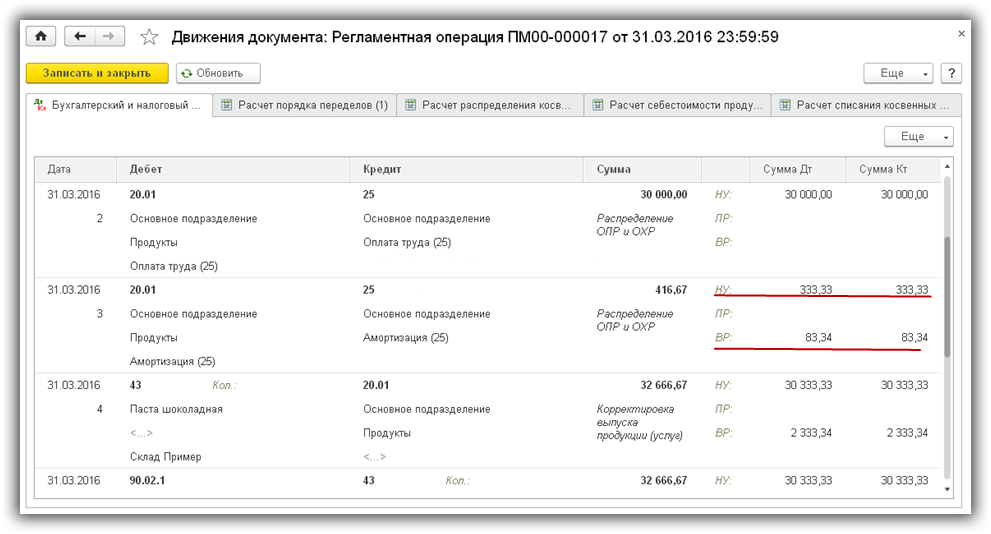

In 1C transactions, instead of one amount, 4 may appear at once (according to the number of values from the above formula). In Fig. 2 we see different amounts of depreciation for accounting and tax accounting. The difference between them (83.34) forms a temporary difference and is located in the line with the abbreviation “ VR».

When posting documents, the program itself calculates the required amounts for accounting and accounting records, and also controls the equality of accounting and accounting records using a formula. After the period is closed, the base we need is formed based on these values.

The chart of accounts in 1C also has its own characteristics. All accounts on which income tax accounting is kept have the “NU” flag checked (Fig. 3). For example, accounts 20, 23, 25 take part in generating profit, but account 19 does not affect profit; the “NU” flag is not selected for it.

Because of this, some tax accounting entries may contain either a debit or a credit amount. In Fig. 4 we see that in the entry for accrual of contributions in the lines for NU there is a debit amount, but no credit amount.

The fact is that account 68.01 does not apply to tax accounts. The “NU” sign has not been established for it (Fig. 5).

For intermediate calculations of income tax, account 68.04.2 is used, which is not in the standard chart of accounts; this sub-account was added by the 1c developers (Fig. 6). Posting Dt 68.04.2 Kt 99.09 in the amount of 0.15 rub. needed to round the tax amount to whole numbers.

Finding and eliminating errors in calculating income tax

Despite the fact that almost all income tax calculations in the program are performed automatically, errors may occur. They arise especially often when entering manual transactions.

For control, the report “Analysis of income tax accounting” is used (Fig. 7).

You can double-click each section of the report to find the erroneous document. “Suspicious” sections are highlighted with a red outline (Fig. 8).

Let’s expand the section “Other sales costs...”. Below (Fig. 9) we see the documents on the basis of which these amounts were obtained.

To display documents, you need to enable the “By documents” checkbox

We correct the errors and get a “beautiful” report (Fig. 10).

Setting up tax accounting in 1C 8.3

In conclusion, about two options for maintaining tax accounting in 1C programs. Since the use of PBU 18/02 in some cases is not mandatory, a number of organizations can keep records without the formation of permanent and temporary differences. The necessary settings are made on the “Income Tax” tab in the accounting policy (Fig. 11)

At the same time, from the user’s point of view, the data input does not change; nothing additional needs to be calculated. As a result, the final amounts of income tax will be the same both with and without the use of PBU.

Reports will vary. For example, when using PBU/18, the balance sheet will contain data on accounts 77 and 09 (deferred tax assets and liabilities - the result of the formation of permanent and temporary differences), as well as amounts on account 68.04.2 (Fig. 12).

The report discussed above (Fig. 10) will show the correct data for the option with PBU/18. Thus, it is easier to analyze income tax in 1C if you have detailed information about the formation of the tax base, which is provided by the use of PBU/18.

Based on materials from: programmist1s.ru