The key to successful business is the excess of income over expenses. In accounting, all transactions are recorded on the balance sheet. However, some entrepreneurs do not pay enough attention to tracking their debts, and this is a necessary condition for identifying errors and inaccuracies on a daily basis. The simplest way to check mutual settlements is to analyze the balance sheets of accounts with suppliers and customers.

The purchase of all purchased valuables, materials for production and goods for resale creates a connection with counterparties - sellers. When drawing up contracts, it is necessary to take into account the procedure for settlements under executed agreements. Typically, mutual settlements for the transfer of funds can occur in the following order:

- Advance payments for inventory items.

- Postpayment (specifies the period within which funds for the goods must be transferred).

Count 60

This account is used to summarize all transactions between the organization and its suppliers and contractors, such as:

- receipt of materials, goods or works;

- consumption of services, including data on used electricity, gas, water, etc.;

- payment for goods, works, services.

All delivery transactions are displayed regardless of whether payment has been made for them or not.

Attention! Account 60 is active-passive, that is, at the beginning and end of the analyzed time, both debit and credit balances can be displayed.

A more visual form of assessing interaction with suppliers for a period is the preparation of a balance sheet.

Turnover - balance sheet for settlements with suppliers and contractors

Its formation is one of the key elements that makes it possible to control the document flow at the enterprise for further reporting to the tax authorities

Statement structure

In general, it is represented by the following figure:

Balance sheet for account 60

The first column contains the names of all sellers. The opening balance allows you to see debts and advances transferred previously. The debit balance indicates the transfers of funds made, for which there was no delivery of materials or the documents were not submitted to the accounting department on time; for a loan - the sum of all received inventory items, the purchase of which was not paid for.

During the period, current mutual settlements arise. Similarly to the balance, all payments are included in the debit turnover, and receipts are included in the credit turnover. The length of time for analysis is arbitrarily selected (from operations on one specific day to any arbitrarily chosen interval). The ending balance indicates any unresolved issues with supplies and allows you to clearly track document flow and payments.

Advice! When maintaining accounting in specialized software products, you can consider not only the general type of calculations, but also statements separately for advances paid and purchases.

Filling example

The organization purchased a new computer for 20,000 rubles. Under the terms of the agreement, payment can be made in installments of 5,000 rubles per month. In accounting, these actions are reflected in the following entries:

- Dt10 Kt 60 - 20000 received a computer from the supplier

- D60 Kt51 - 5000 transferred the first payment on the computer

Based on the results of checking mutual settlements, we see that the organization’s debt to the counterparty is 15,000 rubles at the end of the period. It is necessary to track debt data so that selling companies are interested in working with the company.

Errors that occur

In the era of active development of technology, the manual method of drawing invoices is almost never used, but various software products are widely used, the leaders of which are 1C developments. Accounting registers can be created in them to better analyze the status of all payments and receipts.

The advantage of using the balance sheet in 1C for control is the ability to analyze not only the general statement, but also to consider separately paid advances (60.02) and the resulting debt for received goods, works, services (60.01). In addition, from the statement you can go to account analysis specifically for transactions with a given counterparty and, if questions arise, immediately see the presence or absence of documents.

There are situations when the same amount falls into circulation at 60.01 and 60.02 and does not overlap. This may be due primarily to a violation of the sequence of documents. If re-execution does not change the situation, then you should pay attention to the possible linking of payments and receipts to various contracts or accounts.

How to create a balance sheet for account 60 in 1C can be seen in the video:

Settlements with buyers and customers

Buyers and clients for any organization are the key to receiving revenue. To expand their business and search for potential customers in a highly competitive market, sellers often resort not only to all kinds of discounts and promotions, but also to deferred payments. Here there is a need for daily checking of mutual settlements. All transactions with customers are recorded on account 62.

Attention! Account 62 is also active-passive, that is, at the beginning and end of the selected period of time, both debit and credit balances can be displayed.

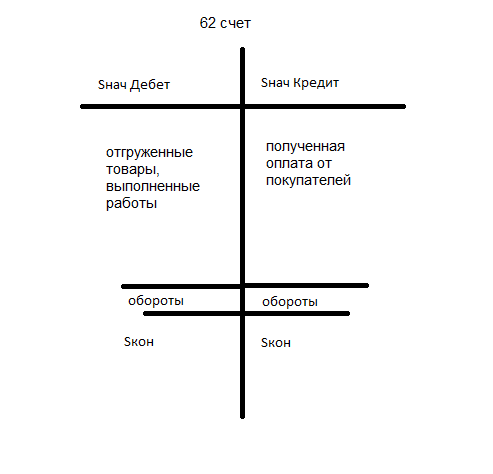

Score 62

All settlements with buyers and customers are formed on this account, namely:

- sold products of own production;

- goods sold;

- services provided;

- receiving advances against future deliveries;

- payment from buyers.

For a detailed consideration of settlements with customers, a balance sheet can also be used.

Turnover - balance sheet for settlements with customers

Allows you to summarize data for all customers to identify debts. As in settlements with suppliers, the balance sheet of 62 accounts makes it possible to analyze indicators for the period in a context.

Structure

The debit balance at the beginning and end of the period indicates the unfulfilled terms of the agreement, i.e., obligations under the contract to customers were fulfilled, however, payment was not received. The credit balance indicates the presence of unshipped goods. Turnovers that record transactions during the selected time: on debit - shipment, on credit - incoming payments.

Filling example

The organization received an advance payment for its goods worth 10,000 rubles. The company shipped half of it. In accounting, movements under the terms of the contract can be represented by the following entries.

- Dt51 Kt 62 - 10000 advance payment received for future delivery

- D62 Kt 41 - 5000 first batch shipped

From the analysis of the statement, we can conclude that further shipment is necessary to close all obligations.