In the case when an organization uses a simplified accounting method, a separate document “Reflection of VAT to be deducted” is applied.

To study it, you can consider it together with the document "Entering balances". For example, the organization in question at the beginning of the year has a credit balance for one of the counterparties. In particular, the invoice for the purchased goods was received only at the beginning of the coming year.

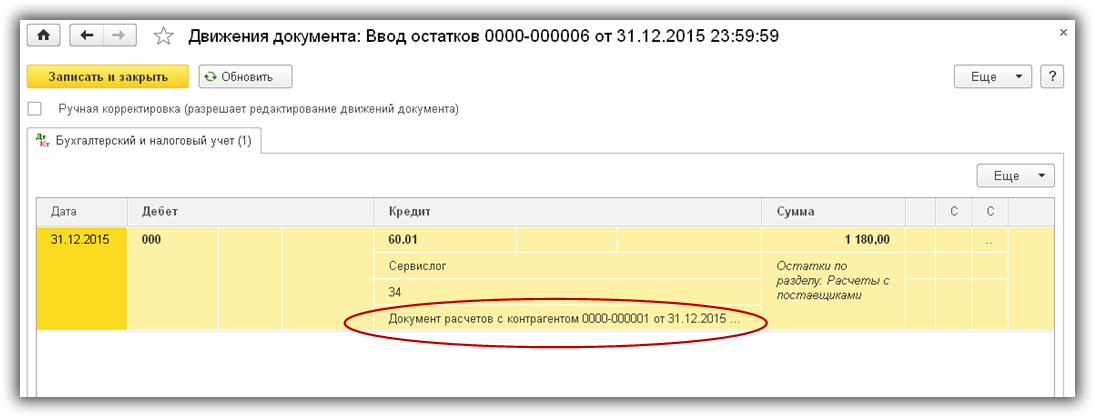

To reflect this document in accounting, you need to create a document "Enter balances". The settlement document will be the "Document of settlements with the counterparty", presented in virtual form.

In the generated transactions, the settlement document takes the place of the incoming invoice.

After the invoice is received from the supplier, the organization is entitled to receive a VAT deduction. This possibility is documented by the creation of the document "Reflection of VAT to be deducted". It is in it that the received invoice is registered.

For the "Products and Services" tab, it is required to fill in the proposed columns. In this case, the main thing is to indicate the type of value, and the complete filling of the header is not mandatory.

Taking into account the fact that in the 1C program the condition for generating postings and making entries in the purchase book is set by default, the corresponding movements will be reflected in the accounting register and "VAT purchases".

If you click on the "More" button, you can return to the screen all the created documents.

Despite the fact that the user does not fill out the document "Formation of purchase book entries", the corresponding operation is reflected. This is due to the fact that the data in the "VAT purchase" register is entered through the document "Reflection of VAT deduction".

The required amount is also shown in the VAT return.

In general, it must be stated that the 1C program provides users with the opportunity to change the value of VAT manually, displaying the adjusted amounts in all reports where necessary.