Many 1C configurations have functionality such as a payment calendar (PC). It helps you perform short-term cash planning (CF) and detect cash gaps on time. In the 1C:ERP Enterprise Management 2 configuration, the PC is presented as a convenient workstation that allows you to create documents, generate reports and analyze the results. In this article we want to dwell in detail on the features of working with a PC in the mentioned configuration (revision 2.4).

The PC as a whole is an analytical report reflecting receipts, write-offs and balances of financial assets, which can be grouped by type - cash and non-cash, as well as by their location - specific bank accounts or the organization's cash desk. In addition, from the payment calendar you can carry out planned write-offs of DS, manage their balances in different bank accounts and in the cash register, and move them to eliminate cash gaps. The PC will become a reliable assistant in managing cash flows even for novice financial managers, provided that the recommendations for working with it are taken into account.

Setting parameters for maintaining a payment calendar

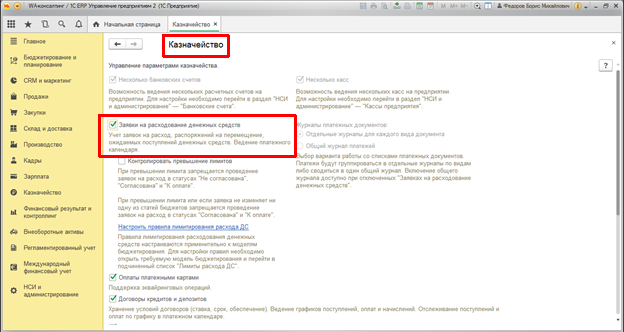

Working with a PC will become possible after first setting one important program parameter. Let's check it through the interface “Master data and administration/Setting up master data and sections/Treasury.”

This parameter is maintaining requests for spending funds. The PC is maintained in 1C:ERP with the flag set Let's install it.

This is enough to get started with your PC.

Access to PC is possible via interface “Treasury/Planning and control of funds/Payment calendar.”

Setting up a payment calendar in 1C 8.3

The appearance of the PC can be customized to suit the user's requirements and tasks. By default, the calendar opens in two window mode: applications/left, calendar/right.

You can change the PC output mode using the button "View", located in the upper left part of the calendar.

There are three modes in total for the calendar view:

- Applications/Calendar;

- Calendar/Payments;

- List of applications.

It is optimal to use the second mode; all documents that provide grounds for both receiving and spending DS are available in it.

The PC can be configured for a specific number of planning days (in the previous screenshot it is 20 days). Indicate the required organization (in our case it is “Prompostavka”). Set selection for a specific bank account/cash.

It is very important to configure your PC to control the visibility of its lines. It is available from the button's drop-down menu "More":

Several types of options are available for installation in the settings window:

- Display in the calendar – makes it possible to establish the visibility of yet unapproved expense requests;

- Expected receipts – includes visibility of DS receipt lines in the context of settlement documents;

- Expected write-offs – manages the visibility of expenses without applications and in the context of settlement documents.

In addition, in the settings you can select the type of currency - management or regulated accounting. An additional pleasant bonus is the ability to set a planning date and disable non-working days of the calendar.

Let's get acquainted with the structure of a PC that corresponds to the previously specified settings.

On the left is a list of the organization's current accounts, unless a selection has been previously established for any one account. The report contains balances, receipts, write-offs, and totals. The report columns make it possible to see overdue debt and planned movements by day. If you switch the activity of calendar cells, then in the lower tabular part the list of documents that decipher either receipts, or write-offs, or amounts of overdue debt will change.

Maintaining a payment calendar in 1C

As we mentioned earlier, the PC in ERP is a workstation, that is, the user can immediately manage the PC in an open manner.

Planning cash flows in the payment calendar

In the calendar, you can plan the movement of DS, followed by the creation of the necessary documents in the following areas:

- Transfer to another account;

- Issue to another cash desk;

- Collection to the bank;

- Collection from the bank;

- Currency conversion.

To do this, just select the required line from the drop-down menu of the button

Depending on the selected line, a dialog for creating documents will open:

- Order to move funds – for all lines except currency conversion;

- Application for spending DS - only for currency conversion.

Features of filling out payment documents for correct maintenance of the payment calendar

In order for the system to unambiguously classify a particular payment document as belonging to a movement from a specific bank account, it is necessary to indicate in this document the form of payment and specify the bank account and cash desk.

For example, a customer order that specifies any form of payment and does not include the names of the cash register and current account will not be able to be identified in the PC.

Such an order will fall into the so-called undisclosed receipts, and the line “Receipt not distributed” will appear in the PC form. A similar situation is possible with the write-off of DS if the payment documents with suppliers do not contain the cash register or current account from which payments will be made. Such amounts are reflected separately in the line “Write-off not distributed.”

To prevent such situations from arising, you must carefully monitor the procedure for filling out the details of payment documents. There are no lines in the PC with fully completed payment documents “Receipt not distributed/Write-off not distributed.”

Tracking and eliminating cash gaps using the payment calendar in 1C

In the process of maintaining PC, an organization may experience cash gaps, i.e. a temporary shortage of funds or an excess of available and incoming funds over payments that need to be made by the organization in the same period of time, usually on the same day. In the PC, cash gaps are very clearly reflected as negative balance amounts in a particular bank account or cash register of an organization:

Analyzing the state of your PC for the presence of cash gaps will allow you to quickly respond to their occurrence. There are several ways to eliminate the cash gap:

- Move money from one bank account to another, ensuring sufficient balance;

- Change the amount of DS write-off, reducing it and deferring payments until the date of planned receipts;

- Ensure sufficient supply of DS from customers.

Let's take an example of how to move funds between accounts. As you can see in the screenshot above, a cash gap has formed on the account “7231/Prompostavka (RUB)/Own account”. If we analyze the PC as a whole for the organization, we will see that there is another bank account with a sufficient amount of funds.

We will be able to move DS from one account to another, as described above, by creating a document

After this, we will update the PC and make sure that the cash gap has disappeared.

Applications for spending in the 1C payment calendar

The 1C:ERP 2 accounting system allows you to spend DS both with and without the mandatory use of applications in a particular bank account of the organization. We can manage applications through a specific bank account of the organization.

We will write off DS from a bank account without mandatory applications. To do this on a PC, use the button

In this case, a document will be generated "Write-off of non-cash funds" along which the DS will actually be moved.

In the case of mandatory use of expense requests based on supplier orders and other receipt documents awaiting payment, you will need to create these requests, which will go into the PC.

In a PC, you can quickly manage applications, moving them by payment dates, breaking down payments, thereby also managing cash gaps.

For the convenience of working with a large number of applications, the PC provides groupings of applications according to various criteria:

This concludes the description of the payment calendar capabilities in 1C:ERP 2. We hope that with the help of our instructions you will quickly master working with a PC and begin to manage your organization’s funds using this tool.