The main expenses not accepted for calculating profit, which are often encountered in practice in the operation of an enterprise, are:

- Penalties, fines, penalties and other sanctions paid to the budget and extra-budgetary funds;

- Interest on loans in excess of established norms;

- Contributions for voluntary and pension insurance exceeding the norms established by law;

- Various types of payments to employees of the enterprise, in addition to payments prescribed in employment agreements or contracts;

- Expenses in excess of the normalized ones for the purpose of calculating profit: travel expenses, bonuses, compensation payments;

- Payment for sanatorium and resort vouchers, as well as expenses for maintaining non-production, cultural and social facilities. Carrying out festive and sporting events;

- Payment of expenses for notary services in excess of the approved tariffs. The notary fees are given in Art. 221 Fundamentals of the legislation of the Russian Federation on notaries dated February 11, 1993. No. 4462-1.

How to register non-acceptable expenses in 1C 8.3

All expenses of the enterprise are reflected on expense accounts 20, 23, 25, 26, 44 and on account 91 Other income and expenses.

Data for these accounts in 1C 8.3 is generated based on the correct completion of the Directory of Cost Items and the Directory of Other Income and Expenses.

Let's consider the principle of filling out directories in 1C 8.3 to correctly reflect costs in tax and accounting.

Go to the Directories menu and select Cost Items:

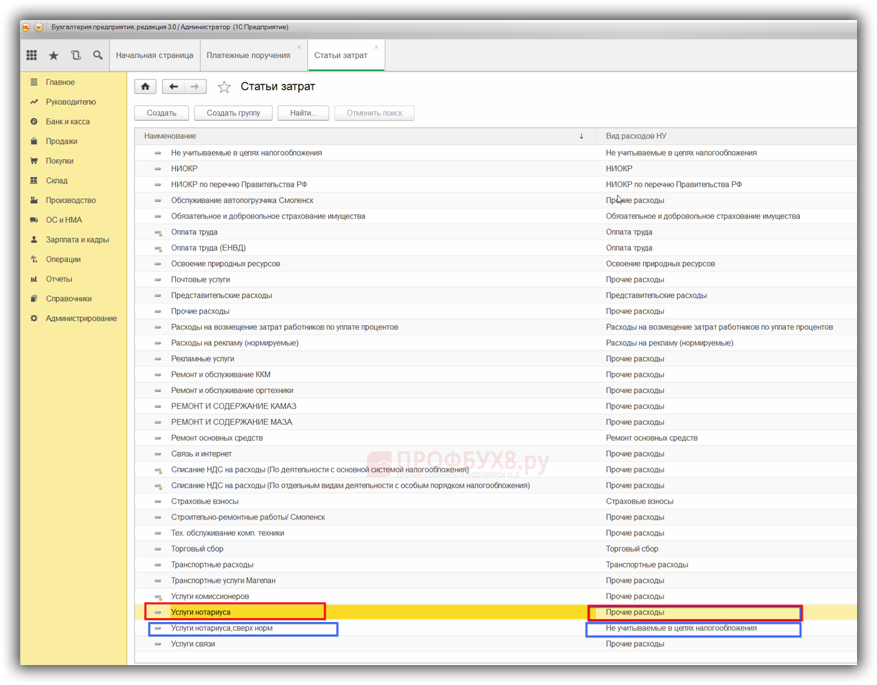

Double clicking opens a list of cost items. If the list has already been fully formed, then the accountant’s task is to check and correct the correct assignment in the directory. Type of expense NU.

For example:

- Notarial services for the type of expenses in accounting, it is classified as Other and accepted for accounting and accounting purposes;

- And the expense item Notary services beyond the norm cannot be recognized as an expense in tax accounting. The assignment in the column Type of fuel consumption should be corrected:

To do this, move the cursor over the Type of NU expense column, use the More button and select the Change function in the list that opens. The list of Types of expenses (NU) opens:

Since the amount of expenses per cost item Notary services beyond the norm cannot reduce the tax base and is reflected only in accounting, we set the Type of expense (NU) – Not taken into account for tax purposes:

In the same way, we check and correct the purpose of all cost items in the column Type of costs of the NU and, in accordance with the norms of Article 270 of the Tax Code of the Russian Federation, set the type of item in the NU - Not taken into account for tax purposes for all expenses not accepted for tax accounting.

Thus, in 1C 8.3, when generating transactions using these cost items in analytics, the expense amounts will be reflected only in accounting.

For example: an employee on a business trip, according to a written order/order from the manager, was paid in excess of the norms established by the order of the enterprise - in the amount of 3,500 rubles. per day. At the same time, the standard travel allowance for the enterprise is 2,000 rubles. per day.

To reflect daily allowances in excess of the norm in accounting, the accountant draws up an advance report in 1C 8.3 as follows:

And when posting the document, we see that in 1C 8.3, for the amount of daily allowance paid according to the norms, entries are generated in accounting and accounting records. And for daily allowances paid in excess of the norm, entries are generated only in the accounting department:

All non-accepted expenses in tax accounting are collected in account N 01.9. That is, this will be the difference between accounting and NU, which will additionally be charged income tax in NU. In short, this means PNO, that is, permanent tax liability.

Please rate this article: