Unfortunately, sometimes employees get sick, so almost any accountant has to deal with the calculation of sick leave benefits in their work. Currently, for the convenience of users, the calculation of such benefits is automated in the 1C: Enterprise Accounting 8 edition 3.0 program, and in this article we will look at an example of calculating payment for sick leave.

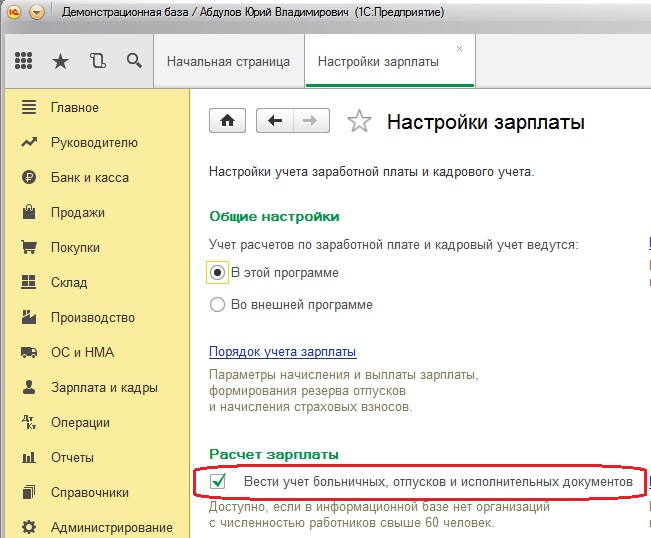

In order to enable automatic calculation, you must check the “Keep records of sick leave, vacations and executive documents” checkbox in the program. To do this, open the “Salary and Personnel” section, the “Directories and Settings” tab, “Salary Settings”.

The sick leave must be entered into the program before payroll is calculated, since the period of absence of the employee must be taken into account when calculating the main accruals, in addition, the final calculation of personal income tax will be made in general for the employee in the “Payroll” document.

In our example, the employee was sick from July 22 to July 31. His total insurance experience is 11 years. Let’s create a “Sick Leave” document. To do this, open the section “Salaries and Personnel”, “Salaries”, “All Accruals”.

Click on the “Create” button and select “Sick leave”

Fill in the empty fields of the document that opens:

- Full name of the employee

- the month in which he was on sick leave

- date.

On the “Main” tab we indicate

- number of certificate of incapacity for work

- reason

- terms of release from work

- percentage of payment depending on the employee’s insurance experience (in our case 100%).

Now we need to calculate the average earnings for the two previous calendar years. If in the previous two years the employee’s salary was calculated in the same program, the calculation will be carried out automatically. If there is no data on wages, for example, an employee recently got a job and provided a certificate from his previous place of work, then information about income must be indicated when calculating average earnings. To do this, click on the “pencil” in the lower right corner.

A table opens in which we enter salary data for the previous two years. Click the “Refill” button and “OK”.

Go to the “Advanced” tab and set “Benefit Limits”. In our case, this is the “Limit value of the base for calculating insurance premiums.” If an employee has benefits when accruing sick leave, for example, as a victim of radiation exposure, then you need to check the “Apply benefits” checkbox and fill out the additional settings that open in this case.

We return to the “Main” tab and see accruals for our sick leave, which are divided by funding source

We can look in more detail on the “Accruals” tab.

We post the document and look at the postings

In the program we can also view and, if necessary, print “Calculation of average earnings”

And if you have any questions, you can ask them in the comments to the article.