Art. obliges to maintain tax registers for income tax payers. 313 and 314 of the Tax Code. However, only the list of mandatory details of this document is clearly stated there:

- Name;

- Date or period;

- The name of the operation;

- Meters;

- Responsible for the drafting and their signatures.

The form of the registers, their list and contents are left to the discretion of the taxpayers themselves. The main thing is that they disclose the procedure for forming the tax base. It is even allowed to use accounting registers in this capacity if they contain enough data to calculate the tax. In the 1C 8.3 program, these can be balance sheets if they are configured as follows:

In the balance sheet (account card, etc.) on the Indicators tab, you need to uncheck the accounting box and check tax accounting. Thus, the report will only reflect tax accounting data on invoices.

However, these documents should not be taken lightly, since the lack of registers is a reason for a fine for gross violation of accounting. The list and form of registers must be approved in the Tax Accounting Policy, taking into account that these registers must be provided to the tax authority upon request.

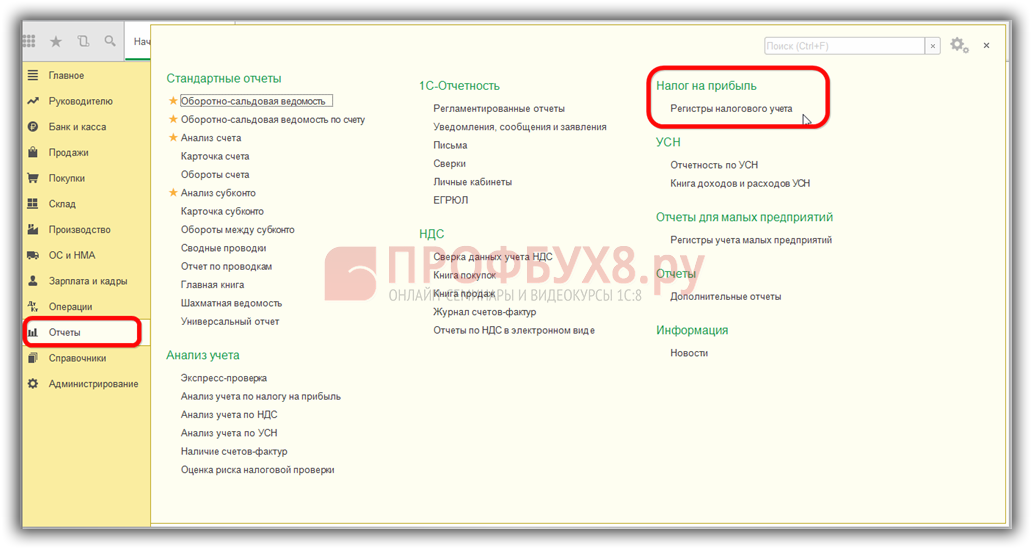

The 1C 8.3 Accounting 3.0 program presents four blocks of analytical registers: Reports – Income Tax – Tax accounting registers:

This does not mean that they are all required. You need to choose those that are relevant specifically for the organization. Let's take a closer look at them. The first block contains registers that reflect information about income and expenses that fall directly into the income tax return:

The remaining registers are informative, auxiliary in nature, detailing information from various accounting areas. You can use them as a guide when checking your declaration and finding errors. By button Settings You can only mark those reports that you use in the 1C 8.3 database, the rest will be hidden:

You can always return automatic settings using the function Reset my settings on the menu More:

Sample of filling out tax accounting registers in 1C 8.3

Let's look at what settings are available inside the registers themselves. As usual, these are Grouping, Selection, Additional fields, Sorting, Design:

Anything that may be of interest within this material is on the Design tab. In order for the printed register to comply with legal requirements, it must contain all the mandatory details mentioned above. To do this, you need to check the boxes next to the required details:

After generation, the report will contain all the necessary information:

You can assign someone responsible for maintaining the register in 1C 8.3 Accounting in the menu section Main - Organization details - Signatures:

Link Responsible for preparing reports A list of responsible people will open, where you need to select the necessary employees of the organization. The entire sequence of changing responsible persons is stored in the 1C 8.3 database, it can be viewed at the link Story:

Another interesting register setting is Selection:

By adding this attribute to the report, we will see the parameters by which the 1C 8.3 program is configured to select data into a specific register:

In 1C 8.3, you can customize the report as necessary and click the More button - Save settings, or Save option report:

In the second option, the modified report will appear in the list of registers:

In addition, in 1C 8.3 you can configure its availability to other users:

How to print tax register forms for Accounting Policies

In configuration 8.3, the developers of the 1C program provided the opportunity to print tax accounting registers for accounting policies in the Main section:

After the accounting policy has been configured and recorded, you can print a list of selected registers and their forms by checking the necessary boxes: