In this article we will look at an example when a third-party organization (lessor) acquires ownership of a Steepline 4SL03 CNC lathe and transfers it to us for use for a long period. During this period, we will pay the lessor this cost along with interest. At the end of the period, the machine will become our property.

First of all, we need to reflect in the program the arrival of the Steepline 4SL03 CNC lathe, which the lessor is purchasing for us. This operation must be carried out through the document “Receipt of leasing”. You can find it in the “OS and intangible assets” menu.

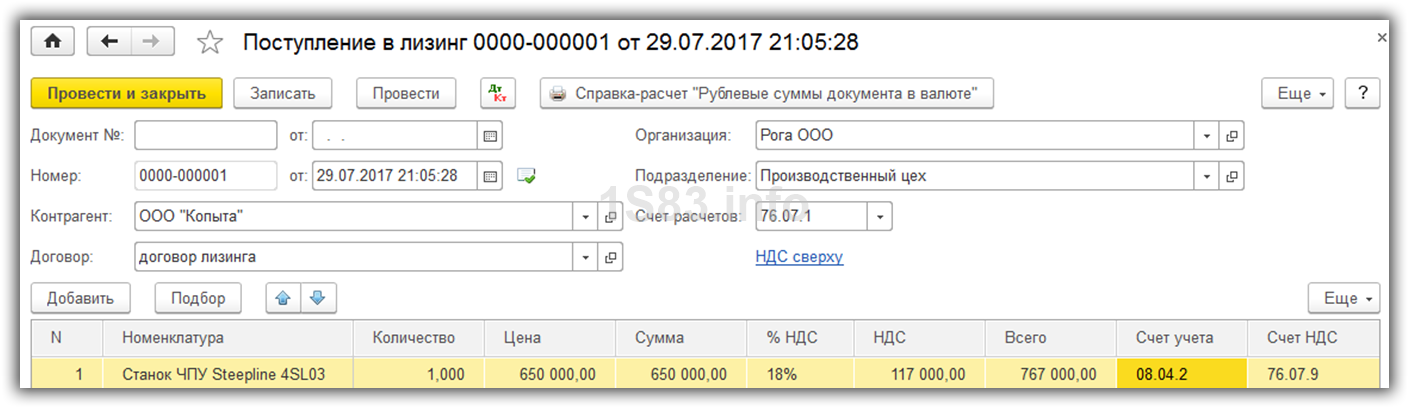

In the header of the document we indicated our organization, the counterparty - the lessor and the agreement with him. The warehouse with the department that will own our machine is also reflected here. We will leave the settlement account as it is set by default (76.07.1).

The Steepline machine itself has been added to the tabular section, indicating a price of 650 thousand rubles. We will set the accounting account to 04/08/02 - acquisition of fixed assets.

Let’s review the document and see that entries have been generated for the cost of the leased machine.

Acceptance of fixed assets for accounting

We have reflected the receipt of our lathe for leasing, and now it needs to be taken into account as fixed assets. To do this, go to the “OS and intangible assets” section and select “”.

In the header of the created document, fill in the organization, financially responsible and location of the OS. The event will be “Acceptance for accounting with commissioning”.

On the first tab of the document we will indicate the method - under a leasing agreement. For the equipment itself, we will choose our Steepline 4SL03 CNC machine. The division and warehouse are also indicated here. The account in our example will be 08.04.2.

On the next tab - equipment, it is enough to indicate the main tool itself, which is located in the directory of the same name. Inv. the number will be entered automatically. We will not describe in detail the creation of filling out the OS directory. You shouldn't have any problems with this.

The accounting account in our case is 01.03. We also indicated that we will calculate depreciation using the straight-line method (in equal parts). Depreciation will take place on account 02.03. We will take into account the expenses for it on account 20.01 - “Main production”. Our machine will be depreciated over five years (60 months).

These settings are not the only correct ones. You can fill in this information in your own way.

The tab with NU in this situation is almost identical to the accounting tab.

We have already indicated all the necessary data, and we can process the document.

Now, for this commercial machine, the data that we just filled out in the document on the corresponding tabs will appear in the fixed assets directory.

Monthly lease payments

Go to the “Purchases” menu and select “Receipts (acts, invoices)”.

When creating a new document, select the type of operation “Leasing services”. Let's fill out the document, leaving all accounts at default. This payment will be in the amount of 20 thousand rubles.

As a result, this 1C 8.3 document created the postings shown in the image below.

If you need to change the reflection of leasing payment expenses, or make adjustments to depreciation accounting, you can use the document “Asset Depreciation Parameters” from the “Assets and Intangible Assets” menu.

Select the appropriate type of operation when creating a new document, depending on what goals you are pursuing.

Equipment depreciation

Despite the fact that the equipment was purchased on lease and does not yet belong to us, we still registered it with our company. In this regard, depreciation will be calculated at the close of the month (monthly for this example). This procedure is standard and if difficulties arise, you can contact, where everything is described in detail.