Learning to work with VAT part 4 - adjustment invoice (1C: Accounting 8.3, edition 3.0)

2016-12-08T14:06:08+00:00We continue the series of lessons () on working with VAT in 1C: Accounting 8.3 (edition 3.0).

Today we will look at: "Adjustment Invoice".

Most of the material will be designed for beginner accountants, but experienced ones will also find something for themselves. In order not to miss the release of new lessons, subscribe to the newsletter.

Let me remind you that this is a lesson, so you can safely repeat my steps in your database (preferably a copy or a training one).

So let's get started

An adjustment invoice is a separate document with its own form.

It is issued in a situation where the seller first issued a regular invoice, and then the value or quantity of goods shipped changes.

The reason for this change may be:

- Discount to the buyer for the volume of purchases.

- Clarification of the quantity (volume) of goods shipped.

- Clarification of the price (tariff) of the product.

A correction invoice should not be used to correct errors made when filling out the initial invoice.

Before drawing up an adjustment invoice, the seller is obliged to notify the buyer about this by concluding a contract or agreement with him on changes in the cost of shipped goods.

After drawing up the agreement (contract), the seller is obliged to issue an adjustment invoice to the buyer within 5 calendar days.

Accordingly, the buyer and seller are required to additionally charge or restore the difference between the amount of VAT before and after the adjustment.

This is done during the period of issuing (respectively receiving) the adjustment invoice.

Situation to consider

In the 1st quarter, we (VAT LLC) sold 2 chairs to Buyer LLC at a price of 3,000 rubles each (including VAT).

At the same time, we issued an invoice to the buyer in the amount of 6,000 rubles (including VAT).

In the 2nd quarter, according to the terms of the agreement, we (VAT LLC) provided a discount for Buyer LLC in the amount of 25% for the volume of purchases. This discount also applies to goods already shipped in the 1st quarter.

On April 1, 2016, we drew up an agreement with Buyer LLC to change the price for the supply of chairs in the 1st quarter (it decreased by 2 * 3,000 * 0.25 = 1,500 rubles).

On 04/03/2016, we issued an adjustment invoice to Buyer LLC indicating the negative difference between the previously accrued VAT (6,000 * 18 / 118 = 915.25 rubles) and its adjusted value due to the discount (6,000 * 0.75 * 18 / 118 = 686.44). The tax difference was: 686.44 - 915.25 = -228.81.

According to the issued corrective invoice, we (NDS LLC) have the right to reduce our VAT liability in the amount of 228.81 rubles (through the purchase book) in the 2nd quarter.

According to the corrective invoice received from us, Buyer LLC is obliged to restore VAT payable in the amount of 228.81 rubles (through the sales book) in the 2nd quarter.

It is required to issue these operations in the program 1C: Accounting 8.3 (version 3.0) on the side of VAT LLC, and also calculate VAT for each quarter.

The essence of the lesson

We (VAT LLC) will charge VAT payable for the shipped chairs, reflecting the usual invoice issued (for Buyer LLC) in the sales book for the 1st quarter in the amount of 6,000 * 18 / 118 = 915.25 rubles.

Then we will restore VAT in the amount of 228.81 rubles, reflecting the adjustment invoice in the book of purchases for the 2nd quarter.

Total VAT:

- Payable for the 1st quarter is 915.25 rubles.

- Reimbursement for the 2nd quarter is 228.81 rubles.

1st quarter

We sell the goods to the buyer

Go to the “Sales” section, “Sales (acts, invoices)” item:

We create a new sales of goods:

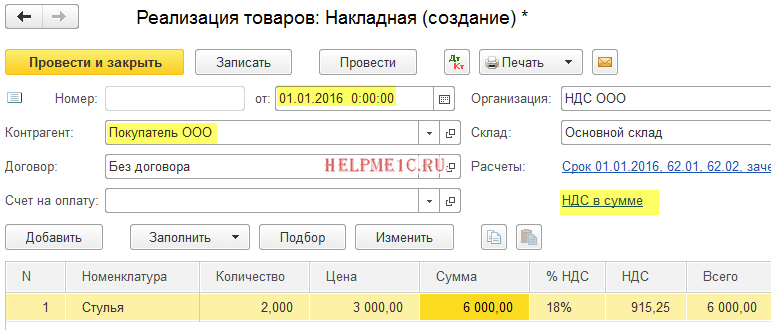

We complete the sale of 2 chairs at a price of 3,000 rubles each in the 1st quarter:

We post the document, and then at the very bottom of the document, click the "Issue invoice" button:

We print the created invoice in 2 copies (one for us, the other for the buyer):

We look at the VAT payable for the 1st quarter

Go to the "Reports" section, "VAT Accounting Analysis" item:

We generate this report for the 1st quarter:

VAT due for the 1st quarter is 915 rubles 25 kopecks.

2nd quarter

Making adjustments to the implementation

Again go to the “Sales” section, select “Sales (acts, invoices)”:

We select (with the left mouse button) the implementation for 6,000 rubles and on the panel select the "Create based on" command (it can be hidden in the "More" item), and in it the "Implementation adjustment" item:

The document "Implementation adjustment" dated 04/01/2016 was created. On the "Products" tab, we adjust the price downward by 25% (it was 3,000, now it's 2,250):

We post the document, and then issue the corrective invoice using the button at the very bottom:

We print out the created adjustment invoice in 2 copies:

We create purchase ledger entries

To do this, go to the VAT accounting assistant for the 2nd quarter:

Open the item “Creating purchase ledger entries”:

Go to the “Reducing sales cost” tab and click the “Fill out the document” button:

The program automatically found our downward adjustment to the implementation:

We carry out the document “Creating purchase ledger entries”.

We look at the VAT refund for the 2nd quarter

We create a “VAT Accounting Analysis” for the 2nd quarter:

VAT refundable due to the adjustment invoice amounted to 228 rubles 81 kopecks.