We learn to draw up a statement of reconciliation of calculations (1C: Accounting 8.3, edition 3.0)

2016-12-08T13:37:38+00:00In this lesson we will learn how to correctly draw up a statement of reconciliation of mutual settlements with a counterparty for 1C: Accounting 8.3 (edition 3.0).

Situation. We have long-term cooperation with our counterparty Prodmarket LLC. The food market supplies us with some goods, and we provide it with some services.

Once a quarter, we draw up reconciliation acts for mutual settlements in order to avoid accounting errors, as well as to legally fix the debt to each other, because the act certified by both parties can be used in court.

On October 10, we decided to draw up a reconciliation report for the 3rd quarter. Thus, we initiated the preparation of an act of reconciliation of mutual settlements with the counterparty.

According to our data (analysis of accounts 60, 62, 66, 67, 76), at the beginning of the 3rd quarter we had no debt to each other.

- On September 2, we received goods from the food market in the amount of 4,000 rubles.

- On September 3, we paid 4,000 rubles from the cash register to the food market for goods.

- On September 24, we provided services to the food market in the amount of 2,500 rubles.

Thus, according to our data at the end of the 3rd quarter the food market owes us 2,500 rubles.

Go to the “Purchases” section, “Calculation Reconciliation Acts” item:

![]()

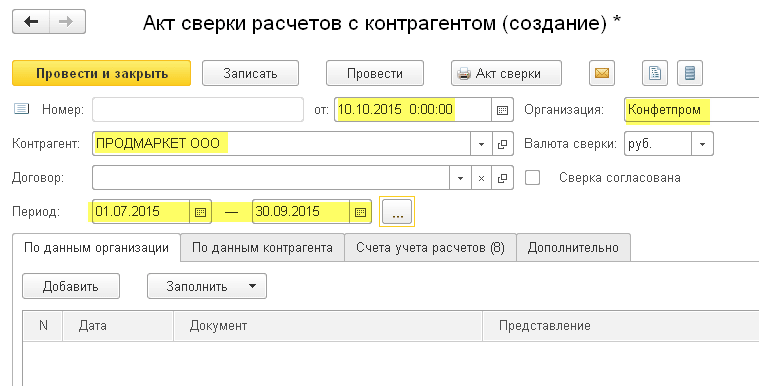

We create a new document “Act of reconciliation of settlements with the counterparty”. We fill in the counterparty of the food market and indicate the period for which the reconciliation report is drawn up (3rd quarter):

If it were necessary to make a reconciliation for a specific agreement, it would be necessary to indicate it in the “Agreement” field. But we carry out a general reconciliation of all contracts, so we leave the contract field empty.

Go to the “Additional” tab and indicate representatives of our organization and representatives of the food market.

Since we are reconciling all contracts, it will be convenient if in printed form the lines are divided according to contracts. To do this, check the “Split by contracts” checkbox:

We go to the “Accounts” tab and mark here the accounting accounts that need to be analyzed to reconcile our settlements with the counterparty. The most typical accounts are presented here (60, 62, 66...), but it is possible to add new ones (the "Add" button):

Finally, go to the “According to organization data” tab and click the “Fill in according to accounting data” button:

The tabular part is filled with primary documents and settlement amounts:

We post the document and print the reconciliation report:

It shows that we have zero debt to each other at the beginning of the period, and at the end of the period the food market owes us 2,500 rubles.

Please note that this form contains only our data for now. We have yet to find out the details of the counterparty (food market).

We send this version to the counterparty

Let’s save this version of the act by clicking on the floppy disk button above the printed form:

The act was saved to the desktop as an Excel file:

We send this file by mail to the food market counterparty.

The counterparty makes its reconciliation

Prodmarket received this file, carried out its reconciliation and identified discrepancies regarding the receipt dated September 2. According to his data, the goods were shipped to us not for 4000, as indicated by us, but for 5600 rubles.

We receive a statement with discrepancies from the counterparty

Prodmarket indicated this error in the Excel file that we sent to it, and then returned this corrected file to us by mail.

We are correcting our accounting error.

Having learned about these discrepancies, we looked up the primary documents and found out that the operator missed one item when filling in the invoice. We corrected this error, went back to the created act and again clicked the “Fill in according to accounting data” button:

Since we are sure that this act will be final, we go to the “According to the counterparty data” tab and click the “Fill in according to the organization’s data” button:

The tabular part from the first tab is completely copied into this one, only the amounts in Debit and Credit are inverted (swapped):

We send the counterparty a new (final) act

We print out the reconciliation report again. In duplicate. We sign both, put a stamp and send it to the food market (by mail or courier) to get back one certified copy:

After receiving a return copy of the act from the food market, go back to the document and check the “Reconciliation approved” checkbox. This will protect the document from accidental changes in the future:

In this lesson we learned how to draw up a reconciliation report with a counterparty in 1C: Accounting 8.3, edition 3.0.