In this article, we will look at an example of calculating insurance premiums for an entrepreneur if he did not work for the whole year; we will learn how to calculate contributions independently or using the service on the tax service website.

Legislative regulation of the issue

Legislative regulation of the issue is carried out by such legal acts and documents:

- Information letter dated March 30, 2017 with number BS-4-11-4091, which describes the procedure for calculating insurance premiums;

Amount of insurance premiums (IC) for a full year

The amount of CB no longer depends on minimum size payment, it is prescribed in the Tax Code for three years in advance for 2020, 2020 and 2020. The fixed amount of SV payments for the year includes two types of SV - pension and medical. There is also a variable part pension contributions- this is one percent of the excess income of three hundred thousand rubles. The amounts of contributions in accordance with Article 430 of the Code are presented in the table.

| Year | 2020 | 2020 | 2020 |

| Pension, rub. | 26545 | 29354 | 32448 |

| Medical, rub. | 5840 | 6884 | 8426 |

| Total, rub. | 32385 | 36238 | 40874 |

Features of payment of SV

The entrepreneur is obliged to pay the amount of SV for the entire year within the time limits specified by law. Let's look at the payment deadlines in the table.

| Peculiarities | Fixed part of contributions – If the entrepreneur was registered with the tax office for the entire year | Fixed part of contributions - If the entrepreneur ceased activities and was deregistered during the year | Contributions from excess income of 300 thousand rubles - If the entrepreneur was registered with the tax office for the whole year | Contributions from excess income of 300 thousand rubles - If the entrepreneur ceased operations and was deregistered during the year |

| Deadlines | Until December 31 current year | Within 15 calendar days from the date of deregistration of the individual entrepreneur | Until July 1 next year | Within 15 calendar days from the date of deregistration |

The deadlines for paying SV are described in the Tax Code in Article 432. For fixed contributions, you must pay before December 31 of the current year, for 1% from exceeding 300,000 rubles - before July 1 of the next year. If an entrepreneur decides to terminate his activities and deregisters, then he has fifteen calendar days to pay the fees.

Example.

Ivanov A.A. registered as an individual entrepreneur in January 2020. On June 21, 2020, he deregistered as an entrepreneur. During his work, he received an income of 200 thousand rubles. Ivanov A.A. Must pay contributions within 15 calendar days from the date of deregistration, that is, until July 6, contributions must be paid. If Ivanov A.A. fails to pay contributions by this date, the tax office will begin to charge penalties on contributions for each day of delay.

How to calculate the amount of SV for an incomplete year

If an individual entrepreneur does not begin its activities from the beginning of the year or is deregistered during the year, then the amount of the SV must be calculated by him independently. The amount is calculated based on the number of days that individual was registered as an entrepreneur.

Example.

IP Vasiliev began operations in December 2017, and on April 10, 2020, he was deregistered. The amount of income for 2020 was 150,000 rubles. The number of months during 2020 when IP Vasiliev was registered is three - January, February, March. During this time you need to pay:

Pension:

26545/12=2212.08 (monthly amount of SV)

2212.08*3=6636.24 (for three months)

Medical:

5840/12=486.67 (monthly amount of SV in FFOMS)

486.67*3=1460.01 (for three months)

Total: 8096.25 rubles for three full months.

Now let's calculate the contributions for April:

Pension:

2212.08*10/30=737.36 (for 10 days of April)

Medical:

486.67*10/30=162.22 (for 10 days of April)

Total for 2020, individual entrepreneur Vasiliev must pay:

6636.24+1460.01+737.36+162.22=8995.83 rubles.

Detailed calculations can also be found here:

Services for calculating the amount

In fact, in order to calculate the size of the SV of an entrepreneur who has not been registered for a full year, one cannot help but pick up a calculator and calculate formulas. The tax office has an excellent service for such cases - Calculation of contributions. All you need to know for an individual entrepreneur is the start date of activity and the end date. Enter the dates and the system will calculate the amount of contributions. The only exception is that it does not take into account the amount of contributions in excess of income of three hundred thousand. But this part of the SV does not depend on when the individual entrepreneur began and ended his activities. It is calculated as 1% of the difference between the amount of income and 300 thousand. It is important to note that in addition to calculating the amount, the tax service provides information about codes budget classification, for which you need to pay SV.

conclusions

When starting an activity not from the beginning of the year and when deregistering during the year, the individual entrepreneur has the right not to pay the fixed part of the SV in full for the year. The amount of SV must be calculated by him based on the actually registered days as an individual entrepreneur. The easiest way to calculate the amount is through the tax office website.

Individual entrepreneurs (IP) are required to annually transfer fixed insurance premiums in the Pension Fund of Russia (PFR) and FFOMS ( Federal Fund compulsory health insurance).

Insurance premiums from 2018

Starting from 2018, the amount of insurance premiums no longer depends on the minimum wage. Now these are fixed values established by law for 2018, 2019 and 2020:

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Pension Fund | RUR 26,545 | RUB 29,354 | RUB 32,448 |

| FFOMS | 5840 rub. | 6884 rub. | 8426 rub. |

| Total | RUB 32,385 | RUR 36,238 | RUR 40,874 |

If your annual income exceeds 300,000 rubles, then you must pay another 1% of the excess amount to the Pension Fund, as before. Nothing has changed here. Contributions to the FFOMS do not depend on income.

The maximum contribution amount is now also calculated in a new way. This is now also a fixed value and for 2018 it is equal to 212,360 rubles.

The deadline for paying fixed contributions has not changed - they must be paid before December 31 of the current year. However, the deadline for paying the additional 1% has changed. Now this part of the contributions must be paid before July 1, and not until April 1, as before.

Calculation of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund until 2017

- Amount of contribution to the Pension Fund = minimum wage * 12 * 26%

- Amount of contribution to the Compulsory Medical Insurance Fund = minimum wage * 12 * 5.1%

where the minimum wage (Minimum Wage) from 07/01/2017 is set at 7800 rubles

Please note that when calculating the amount of insurance premiums, the minimum wage is used, which was set on January 1 of the current year, despite its changes during the year.

Thus, the amount of fixed insurance premiums in 2017 is equal to 27 990 rub.

Also, starting from 2014, upon receipt of income in excess of 300,000 rubles per year, the individual entrepreneur is obliged to pay 1% to the Pension Fund of the Russian Federation on the amount exceeding 300,000 rubles. For example, when receiving an income of 400,000 rubles, 1% must be paid on the amount of 400,000 - 300,000 = 100,000 rubles, we get 1,000 rubles.

At the same time, the amount of contributions to Pension Fund will not exceed(8 * minimum wage * 12 * 26%). In 2017 this is187,200 rubles, in 2016 - 154,851.84 rubles.

The procedure for calculating insurance premiums for an incomplete year

When paying the insurance premium for an incomplete year (when starting a business activity not from the beginning of the year or when terminating the activity), the amount of the contribution is correspondingly reduced in proportion to calendar days. In this case, the day of registration or the day of termination of activity MUST be included.

History of insurance premiums

| Year | Amount, rub. |

|---|---|

| 2018 | 32,385.00 (+1% of income from amounts over RUB 300,000) |

| 2017 | 27,990.00 (+1% of income from amounts over RUB 300,000) |

| 2016 | 23,153.33 (+1% of income from amounts over RUB 300,000) |

| 2015 | 22,261.38 (+1% of income from amounts over RUB 300,000) |

| 2014 | 20,727.53 (+1% of income from amounts over RUB 300,000) |

| 2013 | 35 664,66 |

| 2012 | 17 208,25 |

| 2011 | 16 159,56 |

| 2010 | 12 002,76 |

| 2009 | 7 274,4 |

| 2008 | 3 864 |

Insurance premiums and reduction of tax simplified tax system

An individual entrepreneur who has chosen the simplified tax system (simplified tax system) and the “income” tax regime can reduce the amount income tax the amount of insurance premiums paid. Individual entrepreneurs without employees can reduce tax by 100%, with employees - by 50%.

Both annual tax and quarterly advance payments can be reduced. To reduce advance payments, it is necessary to pay insurance premiums in quarterly installments.

If the object of taxation is “income reduced by the amount of expenses”, then paid insurance premiums can be included in expenses.

Responsibility for non-payment of insurance premiums

For late payment of insurance premiums, penalties are charged in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each calendar day of delay (clause 6 of Article 25 of Law 212-FZ)

For non-payment or incomplete payment, a fine is provided in the amount of 20% of the unpaid amount or 40% if there is intent (Article 47 of Law 212-FZ).

The debtor has the right to forcibly recover unpaid amounts of insurance premiums along with penalties and fines.

Since 2018, the procedure for determining the amount of a fixed payment for individual entrepreneurs has changed - now this amount will not be tied to the minimum wage.

Let us remind you that individual entrepreneurs must pay a contribution to compulsory medical insurance and a contribution to compulsory health insurance.

Amounts of fixed contributions of individual entrepreneurs.

Read more about paying fixed contributions for individual entrepreneurs 2019.

Fixed payment IP-2018: contributions for compulsory medical insurance

The amount of the fixed payment of individual entrepreneurs in 2018 for contributions to compulsory health insurance amounts to 5840 rub.(Clause 2, Clause 1, Article 430 of the Tax Code of the Russian Federation (as amended, valid from 01/01/2018)).

You can read more about contributions to compulsory medical insurance for individual entrepreneurs for yourself in our.

Fixed payments for individual entrepreneurs in 2018: contributions to compulsory pension insurance

Absolutely all individual entrepreneurs, regardless of the amount of income received in 2018, must transfer a contribution to compulsory pension insurance for themselves in the amount 26545 rub. ().

Individual entrepreneur contributions: 1% contribution

If the annual income of an individual entrepreneur exceeds 300,000 rubles, then the entrepreneur must transfer to the budget, in addition to the fixed contribution to compulsory pension insurance, a contribution to mandatory pension insurance in the amount of 1% of the amount of income exceeding 300 thousand rubles.

At the same time, the Tax Code establishes maximum amount contributions to compulsory pension insurance for yourself ( fixed fee+ 1% contribution), which the individual entrepreneur must transfer for the year (clause 1, clause 1, article 430 of the Tax Code of the Russian Federation (as amended, valid from 01/01/2018)). So, total amount contributions to compulsory insurance for oneself cannot exceed eight times the fixed amount of insurance premiums established for a certain year. That is maximum size contributions to compulsory pension insurance, which individual entrepreneurs must pay for 2018, amount to 212,360 rubles. (RUB 26,545 x 8), and the maximum 1% contribution is 185815 rub.(212,360 rubles (total maximum amount of contributions to the compulsory pension insurance of an individual entrepreneur for himself for 2018) - 26,545 rubles (fixed contribution to the compulsory pension insurance for 2018)).

Please note that as of 2018 deadline payment of 1% contributions was postponed from April 1 to July 1.

If the deadline for payment of individual entrepreneur's contributions is violated, penalties will be charged (Article 75 of the Tax Code of the Russian Federation).

You can check the correctness of the calculation of penalties made by tax authorities using our website.

Fixed payments for individual entrepreneurs: KBK

When paying contributions for yourself in 2018, individual entrepreneurs must indicate payment order the following KBK.

What are insurance premiums

Insurance premiums are obligatory payments for pension, medical and social insurance workers and individual entrepreneurs. Since 2017, control over the calculation and payment of contributions has again been transferred to the Federal tax service, which until 2010 was already collecting such payments under the name Unified Social Tax (UST).

IN tax code a new Chapter 34 has been introduced, which regulates the calculation and payment of contributions for:

- compulsory pension insurance;

- compulsory health insurance;

- social insurance in case of temporary disability and maternity.

These types of contributions must no longer be paid to the funds, but to your own tax office. Contributions for injuries for workers remained in the introduction of the Social Insurance Fund; nothing has changed regarding them.

Among the payers of insurance premiums listed in Chapter 34 of the Tax Code of the Russian Federation, individual entrepreneurs are also named. An individual entrepreneur has a dual status - as an individual and as a business entity. An individual entrepreneur is his own employer, so the responsibility to provide himself with a pension and health insurance falls on him.

Who should pay insurance premiums

The procedure for calculating and paying mandatory insurance premiums causes a lot of controversy. Entrepreneurs who do not conduct business or do not receive profit from it believe that paying mandatory insurance premiums in such situations is not justified. The state proceeds from the fact that a person who continues to be included in state register Individual entrepreneurs, despite the lack of activity or profit from it, have their own reasons for this. Relatively speaking, no one is stopping him, due to lack of income, from stopping his business activities, deregistration, and, if necessary, re-registering.

Courts, including higher ones, always indicate that the obligation to pay insurance premiums arises for an individual entrepreneur from the moment he acquires such status and is not related to the actual implementation of activities and receipt of income.

Calculation of insurance premiums for individual entrepreneurs for themselves

An individual entrepreneur is obliged to pay insurance premiums for himself as long as he has the status of a business entity, with the exception of grace periods for their non-payment.

Article 430 of the Tax Code of the Russian Federation allows individual entrepreneurs not to pay insurance premiums for compulsory pension and health insurance if they are temporarily not operating in the following cases:

- passing military service upon conscription, caring for a child up to one and a half years old, a disabled child, a disabled person of the 1st group, elderly people over 80 years old;

- living with a spouse who is a military serviceman under a contract in the absence of employment opportunities for a total of up to five years;

- living abroad with a spouse sent to diplomatic missions and consulates of the Russian Federation (also no more than five years).

The absence of activity during such periods must be documented, and the suspension of payment of contributions must be reported to your Federal Tax Service.

If an individual entrepreneur has the right to a benefit, but continues to receive income from business activities, then he must pay insurance premiums on a general basis.

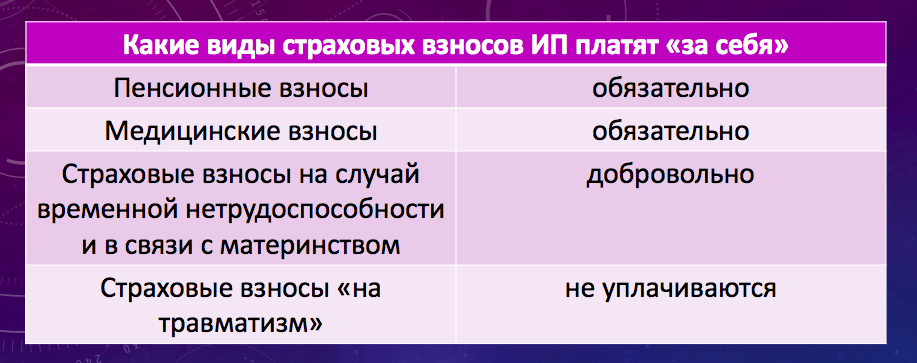

And now the most important thing - about what amounts? mandatory contributions Are you talking about IP? For yourself in 2019 individual entrepreneur must transfer payments only for compulsory pension and health insurance. Transfer of social insurance contributions for sick leave and maternity payments IP produces on a voluntary basis.

Insurance premiums for individual entrepreneurs in 2019 no longer depend on the size of the minimum wage (minimum wage), but are fixed amounts approved by the Government:

- Contributions for compulsory health insurance (CHI) - 6 884 rubles per year.

- Contributions to compulsory pension insurance (OPI) are partially differentiated and consist of a fixed amount of 29 354 rubles and an additional contribution.

- An additional contribution is paid if the income of an individual entrepreneur is more than 300 thousand rubles per year. It is calculated as 1% from the amount of income exceeding this limit.

Insurance premium calculator for 2019:

It is necessary to pay insurance premiums in the amount of: - r.

The payment consists of:

✐Example ▼

Let’s assume that an entrepreneur received income in the amount of 1,200,000 rubles in 2019. Let's calculate the amount of insurance premiums payable by individual entrepreneurs:

- contributions to pension insurance will be calculated as follows: 29,354 + ((1,200,000 - 300,000) * 1%) = 38,354 rubles.

- Health insurance premiums will remain at the same level and amount to 6,884 rubles at any income level.

Total: the total amount of insurance premiums for yourself in this example is 45,238 rubles.

An upper limit on the amount of contributions to compulsory pension insurance has also been introduced - in 2019, this amount cannot exceed 234,832 rubles.

The above formulas showed the calculation of the cost of a complete insurance year, if the entrepreneur was not registered at the beginning of the year or ceased activity before its end, then all calculated amounts are proportionally reduced. In these cases, you only need to take into account full months and calendar days (if less than a month), in which a person had the status of an entrepreneur.

Let's summarize:

- In 2019, individual entrepreneurs’ contributions for themselves with an annual income not exceeding 300 thousand rubles, including in the absence of activity or profit from it, will amount to 36,238 rubles, based on: 29,354 rubles of contributions to compulsory health insurance plus 6,884 rubles of contributions to compulsory medical insurance .

- If the amount of income exceeds 300 thousand rubles, then the amount payable will be 36,238 rubles plus 1% of income exceeding 300 thousand rubles.

What is considered income when calculating insurance premiums?

Determining income for calculating individual entrepreneur contributions depends on

- - income from sales and non-operating income excluding expenses, including when applying

In our service you can prepare a notification about the transition to the simplified tax system for individual entrepreneurs absolutely free of charge (relevant for 2019):

- on - imputed income, calculated taking into account basic yield, physical indicator and coefficients;

- on - potential annual income on the basis of which the cost of the patent is calculated;

- on - income taken into account for tax purposes, without deducting expenses;

- on - income received from business activities, .

If an individual entrepreneur combines tax regimes, then income on different modes are summed up.

To choose the most profitable system taxation specifically for your business, we recommend taking free advice from professionals who will help you choose a regime with minimal payments.

Deadlines for payment of insurance premiums for individual entrepreneurs

The entrepreneur must pay insurance premiums for himself in terms of income not exceeding 300 thousand rubles (i.e. the amount of 36,238 rubles) by December 31 of the current year. At the same time, it is worth taking the opportunity to reduce, in some cases, the amount of accrued taxes by paying insurance contributions quarterly, which will be discussed in more detail in the examples.

Please note: there is no such thing as “insurance premiums of individual entrepreneurs for the quarter.” The main thing is to pay the entire amount of 36,238 rubles before December 31 of the current year in any installments and at any time. The division of the indicated amount into four equal parts is used only for conditional examples.

For example, if you don’t expect to have income in the first and (or) second quarter using the simplified tax system, then there is no point in rushing to pay your contributions. It may be more profitable for you to pay 3/4 or even all annual amount in the third or fourth quarter when significant revenue is expected. And vice versa - if the main income is expected only at the beginning or middle of the year, then the main amount of contributions must be paid in the same quarter.

The essence of the opportunity to reduce the accrued single tax is that in a quarter in which significant advance payment for taxes, you were able to take into account the amount of insurance premiums paid in the same quarter. In this case, contributions must be transferred before you calculate the amount of single tax payable.

As for UTII, there is no concept for it zero declarations according to imputed tax. If you are a payer of this tax, then lack of income will not be a reason for non-payment. You will still have to pay the imputed tax, calculated using a special formula, at the end of the quarter based on the quarterly declaration. It would be reasonable to pay insurance premiums every quarter in equal installments if quarterly amounts imputed income does not change.

An additional amount equal to 1% of annual income exceeding 300 thousand rubles must be transferred before July 1, 2020 (previously the deadline was April 1 of the year following the reporting year). But if the limit is exceeded already at the beginning or middle of the year, then these additional contributions can be made earlier, because they can also be taken into account when calculating taxes. The same rule applies here - tax reduction due to contributions paid in the same quarter before the tax payable is calculated.

Insurance premiums for individual entrepreneurs and employees

Having become an employer, in addition to contributions for himself, the entrepreneur must pay insurance premiums for his employees.

IN general case, the amount of insurance premiums for employees under employment contracts is 30% of all payments in their favor (except for those that are not subject to taxation for these purposes) and consists of:

- contributions to compulsory pension insurance for employees of community pension insurance companies - 22%;

- contributions to compulsory social insurance OSS - 2.9%;

- contributions for compulsory medical compulsory medical insurance - 5,1%.

Additionally, a contribution is paid to the Social Insurance Fund for compulsory insurance from accidents at work and occupational diseases - from 0.2% to 8.5%. By civil contracts remuneration to the performer in mandatory is subject to insurance contributions for compulsory health insurance (22%) and compulsory medical insurance (5.1%), and the need for social insurance contributions must be provided for by contractual terms.

After the amount paid to the employee since the beginning of the year exceeds the maximum base for calculating insurance premiums (in 2019 this is 1,150,000 rubles), payment rates for compulsory insurance are reduced to 10%. Limit value The base for calculating insurance premiums for OSS in 2019 is equal to 865,000 rubles, after which contributions for sick leave and maternity leave are not accrued.

Unlike individual entrepreneurs’ contributions for themselves, insurance premiums for employees must be paid monthly, no later than the 15th day of the month following the billing month.

If you need help selecting activities that offer the lowest insurance premiums for workers, we recommend using free consultation our specialists.

It is interesting that an entrepreneur has the right to be an employee of another individual entrepreneur, but cannot issue a work book for himself. At the same time, insurance premiums paid for him as an employee do not exempt the individual entrepreneur from paying contributions for himself.

How to reduce the amount of taxes payable through insurance premiums

One of the advantages when choosing the legal form of an individual entrepreneur, in comparison with an LLC, is the ability to reduce the accrued tax on transferred insurance premiums. The amount of possible tax reduction payable will vary depending on the tax regime chosen and the availability of employees.

Important: the amounts of individual entrepreneur insurance premiums themselves, calculated above, cannot be reduced, but in some cases, due to the contributions paid, the amounts of taxes themselves can be reduced.

The accrued tax itself can be reduced only by simplified taxation system modes“Income” and UTII, and reduce tax base, i.e. the amount from which the tax will be calculated can be used on the simplified tax system “Income minus expenses”, unified agricultural tax and on OSNO. Entrepreneurs working only on the patent system, without combining modes, cannot reduce the cost of a patent by the amount of insurance premiums. This applies to individual entrepreneurs’ contributions both for themselves and for their employees.

Our specialists can help you choose the most profitable tax regime and will tell you how to properly reduce your insurance premiums.

Contributions of individual entrepreneurs to the simplified tax system with the object of taxation “Income”

Entrepreneurs in this regime who do not have employees have the right to reduce the accrued single tax by the entire amount of contributions paid (Article 346.21 of the Tax Code of the Russian Federation). There is no need to notify about this tax authorities, but it is necessary to reflect the paid contributions in the Book of Income and Expenses and in the annual tax return according to the simplified tax system. Let's look at a few simplified examples.

✐Example ▼

1. IP using tax system STS “Income” and working independently, received an annual income in the amount of 380,000 rubles. The calculated tax was 22,800 rubles. (380,000 * 6%).During the year, 36,238 rubles were paid. insurance premiums, i.e. only a fixed amount (an additional contribution of 1% of income over 300,000 rubles will be transferred by the individual entrepreneur until July 1 of the next year). The entire amount of the single tax can be reduced by the contributions paid, so there will be no tax payable at the end of the year at all (22,800 - 36,238<0).

2. The same entrepreneur received annual income in the amount of 700,000 rubles. The accrued single tax amounted to 42,000 rubles (700,000 * 6%), and contributions paid quarterly during the year - 40,238 rubles, based on (36,238 + 4,000 ((700,000 - 300,000) * 1%) .The amount of tax payable will be only (42 000 - 40 238) = 1,762 rubles.

3. If an entrepreneur uses hired labor in this mode, then he has the right to reduce the accrued single tax at the expense of the amounts of contributions paid (contributions for himself and for employees are taken into account) by no more than 50%.

The individual entrepreneur discussed above with an annual income of 700,000 rubles. has two employees and paid 80,000 rubles as contributions for himself and for them.The accrued single tax will be 42,000 rubles. (700,000 * 6%), however, if there are employees, it can only be reduced by 50%, i.e. for 21,000 rub. The remaining 21,000 rubles. the single tax must be transferred to the budget.

Contributions of individual entrepreneurs using UTII

Individual entrepreneurs on UTII without employees can reduce the tax by the entire amount of contributions paid in the same quarter (Article 346.32 of the Tax Code of the Russian Federation). If hired labor is used, then until 2017 it was allowed to take into account only contributions paid for employees, and in an amount of no more than 50% of the tax. But in 2019, the procedure for reducing the quarterly tax on UTII through contributions is exactly the same as on USN Income, i.e. Individual entrepreneurs have the right to take into account contributions paid for themselves.

When using taxation in the form of UTII, the tax is calculated for each quarter separately. In the quarter in which hired labor was not used, the tax can be reduced to 100%. And in the quarter when hired workers were hired, the tax is reduced only to 50%. Thus, an important condition for reducing the tax payable on the simplified tax system “Income” and UTII is the transfer of contributions quarterly and before the tax itself is paid.

Individual entrepreneur contributions when combining simplified taxation system and UTII

When combining such regimes, you need to pay attention to the workers engaged in these types of activities. If there are no employees in the “simplified” activity, but in the “imputed” activity they are hired, then the simplified tax system tax can be reduced by individual entrepreneurs’ contributions for themselves, and the UTII tax can only be reduced to 50% by the amount of contributions transferred for employees (letter of the Ministry of Finance no. 03-11-11/130 dated 04/03/2013).

And, conversely, in the absence of employees on UTII, individual entrepreneurs’ contributions for themselves can be attributed to the reduction of “imputed” tax, and the “simplified” tax can be reduced to 50% by the amount of contributions for employees (clarification of the Ministry of Finance No. 03-11-11/15001 dated 04/29/2013).

According to Art. 346.18 of the Tax Code, when combining special regimes, taxpayers must keep separate records of income and expenses, which can be quite complicated and require contacting specialists.

Individual entrepreneur contributions when combining the simplified tax system and a patent

It was already mentioned above that entrepreneurs on the patent tax system cannot reduce its value by the amount of contributions. In the case of combining the simplified tax system and a patent, an entrepreneur who does not have employees can reduce the amount of the single tax on activities on a simplified basis by the entire amount of insurance premiums paid for himself (letter of the Federal Tax Service of Russia dated February 28, 2014 No. GD-4-3/3512@).

Individual entrepreneur on the simplified tax system “Income minus expenses”

Entrepreneurs in this mode take into account paid contributions in expenses, thereby reducing the tax base for calculating the single tax. Expenses can include both individual entrepreneurs’ contributions for themselves and contributions for employees. They cannot reduce the tax payable itself, so the amounts saved will be less than under the simplified tax system “Income”.

Individual entrepreneur on the general taxation system

These entrepreneurs include paid contributions in their expenses and thus reduce the amount of income on which personal income tax will be charged.

Individual entrepreneur reporting on insurance premiums

An individual entrepreneur who does not have employees does not have to submit reports on the payment of insurance premiums for himself. In 2019, the individual entrepreneur must submit the following reports, which reflects the amounts of contributions transferred for his employees:

- to the Pension Fund on a monthly basis, according to the form - no later than the 15th day of the month following the reporting month;

- to the Social Insurance Fund on a quarterly basis - no later than the 20th day of the month following the reporting quarter;

- to the Federal Tax Service on a quarterly basis - no later than the end of the next month after the end of the reporting quarter;

- to the Federal Tax Service on a quarterly basis - no later than the 30th day of the next month after the end of the reporting quarter;

- to the Federal Tax Service once a year in form 2-NDFL - no later than April 1 for the previous year.

Responsibility of individual entrepreneurs for non-payment of insurance premiums

In 2019, the following sanctions are provided for failure to submit reports and late payment of insurance premiums:

- Failure to submit a calculation on time - 5% of the unpaid amount of contributions due for payment for each full or partial month from the day established for its submission, but not more than 30% of the amount and not less than 1000 rubles (Article 119(1) ) Tax Code of the Russian Federation).

- A gross violation of accounting rules, resulting in an underestimation of the base for calculating insurance premiums - 20% of the amount of unpaid insurance premiums, but not less than 40,000 rubles (Article 120(3) of the Tax Code of the Russian Federation).

- Non-payment or incomplete payment of insurance premiums as a result of underestimation of the base for their accrual, other incorrect calculation of insurance premiums or other unlawful actions (inaction) - 20% of the unpaid amount of insurance premiums (Article 122(1) of the Tax Code of the Russian Federation).

- Intentional non-payment or incomplete payment of contributions - 40% of the unpaid amount of insurance premiums (Article 122(3) of the Tax Code of the Russian Federation).

- Failure to submit within the prescribed period or submission of incomplete or unreliable information of personalized reporting to the Pension Fund of the Russian Federation - 500 rubles in relation to each insured person (Article 17 No. 27-FZ)

If you want to avoid annoying financial losses, you need, first of all, to properly organize your accounting. So that you can try the option of accounting outsourcing without any material risks and decide whether it suits you, we, together with the 1C company, are ready to provide our users a month of free accounting services.

How much insurance premiums will an individual entrepreneur need to pay “for himself” in 2018? What has changed in the calculation of the amount? What are the features of paying fixed insurance premiums for individual entrepreneurs without employees? Is it true that the amount of insurance premiums no longer depends on the minimum wage as of 2018? Will there be an increase in the amount of contributions in 2018 if the income of an individual entrepreneur is less than 300,000 rubles? What is the maximum amount of contributions payable? We will answer these and other questions, give examples, and also provide the exact amounts of fixed insurance contributions for compulsory pension and health insurance in 2018. This article was prepared taking into account the provisions of Federal Law No. 335-FZ dated November 27, 2017.

What contributions do individual entrepreneurs pay: introductory information

Individual entrepreneurs are required to pay insurance premiums on payments and remunerations accrued in favor of individuals within the framework of labor relations and civil contracts for the performance of work and provision of services (Clause 1 of Article 419 of the Tax Code of the Russian Federation). But individual entrepreneurs must also transfer mandatory insurance premiums “for themselves” (Article 430 of the Tax Code of the Russian Federation):

- for pension insurance;

- for health insurance.

Individual entrepreneurs are required to transfer insurance premiums “for themselves” in any case. That is, regardless of whether they are actually conducting business activities or are simply registered as individual entrepreneurs and are not engaged in business. This follows Article 430 of the Tax Code of the Russian Federation. This approach is being applied in 2018.

There are also insurance premiums in case of temporary disability and in connection with maternity. Individual entrepreneurs, as a general rule, do not pay this type of insurance premiums (clause 6 of Article 430 of the Tax Code of the Russian Federation). However, payment of these contributions can be made on a voluntary basis. This is provided for in Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ. Why pay these contributions voluntarily? This is done so that in the event of, for example, illness, the individual entrepreneur can receive an appropriate sickness benefit at the expense of the Social Insurance Fund.

The deadlines for payment of individual entrepreneur contributions have changed

Individual entrepreneurs do not pay insurance premiums for injuries at all. Payment of this type of insurance premiums by individual entrepreneurs is not provided even on a voluntary basis.

How were insurance premiums calculated until 2018?

- Minimum wage at the beginning of the calendar year;

- tariffs of insurance contributions to the relevant fund;

- the period for calculating insurance premiums “for yourself” (it can be a whole year, or maybe less).

Taking these indicators into account, individual entrepreneurs until 2018 calculated:

- a fixed payment “for yourself”, which does not depend on the amount of income;

- additional contribution for yourself with income over 300,000 rubles. in a year.

As a result, for example, in 2017 the following indicators for payment were obtained:

Thus, until 2018, the amount of insurance premiums was influenced, in particular, by the minimum wage (minimum wage). For the calculation, we took the minimum wage as of January 1, 2017. Accordingly, if the minimum wage on this date increased, then the amount of insurance premiums payable by individual entrepreneurs also increased. Cm. " ".

New procedure for calculating insurance premiums for individual entrepreneurs from 2018

From January 1, 2018, the minimum wage will be 9,489 rubles. Cm. " ". If we adhere to the previous rules, then the amount of fixed insurance premiums for individual entrepreneurs should have increased since 2018. However, since 2018, a new procedure for calculating insurance premiums for individual entrepreneurs has been introduced. It is enshrined in the Federal Law of November 27, 2017 No. 335-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation.”

From January 1, 2018, a new fixed amount of insurance contributions for compulsory pension and health insurance is established for individual entrepreneurs without employees (paying contributions “for themselves”). These payments will no longer depend on the minimum wage (minimum wage). Why are such amendments introduced? Let me explain.

The Government of the Russian Federation has decided to bring the minimum wage to the subsistence level - this should happen at the beginning of 2019. This means that insurance premiums for individual entrepreneurs, if they are not decoupled from the minimum wage, will grow very strongly in the next couple of years. And the proposed changes will make it possible to maintain an “economically justified level of fiscal burden” for the payment of insurance premiums for individual entrepreneurs who do not make payments to individuals. This is stated in the explanatory note to the bill.

The idea of the bill was discussed and approved during a meeting between Russian President Vladimir Putin and President of Opora Russia Alexander Kalinin.

Pension contributions of individual entrepreneurs from 2018: new sizes

From 2018, insurance contributions for compulsory pension insurance will be calculated in the following order:

- if the payer’s income for the billing period does not exceed 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period;

- if the payer’s income for the billing period exceeds 300,000 rubles, - in a fixed amount of 26,545 rubles for the billing period plus 1.0% of the amount of the payer’s income exceeding 300,000 rubles for the billing period.

Let's decipher the new meanings and give examples of calculations of amounts payable in various circumstances.

Fixed amount for income of 300 thousand rubles or less

As we have already said, in 2017, fixed pension contributions of individual entrepreneurs “for themselves” with incomes of less than 300,000 rubles amounted to 23,400 rubles. This amount was determined using a special formula based on the minimum wage and insurance premium rates. However, from 2018 the fixed amount of pension contributions will not depend on these values. It will simply be enshrined in law as 26,545 rubles.

Thus, since 2018, fixed pension contributions have increased by 3,145 rubles. (RUR 26,545 – RUR 23,400). From 2018, all individual entrepreneurs, regardless of whether they conduct business or receive income from business, will need to pay 26,545 rubles as mandatory pension contributions.

It is envisaged that the fixed amount of insurance contributions for compulsory pension insurance (RUB 26,545) will be indexed annually from 2019 by decision of the Government of the Russian Federation.

Example 1. There were no activities in 2018

Individual entrepreneur Velichko A.B. was registered as an individual entrepreneur in 2017. Throughout 2018, he maintained the status of an entrepreneur, but did not conduct any activities and had no movements on his current accounts. But, despite this, for 2018 he still needs to transfer 26,545 rubles as fixed pension contributions.

Example 2. Income for 2018 is less than 300,000 rubles

For 2018, individual entrepreneur Kazantsev S.A. received an income of 278,000 rubles (that is, less than 300 thousand rubles). In such circumstances, for 2018 he also needs to transfer 26,545 rubles as fixed pension contributions.

If income is more than 300,000 rubles

If at the end of 2018 the income of an individual entrepreneur exceeds 300,000 rubles, then the individual entrepreneur will need to pay an additional plus 1.0% of the amount of the payer’s income exceeding 300,000 rubles for the billing period. There have been no changes in this part since 2018. This approach has been used previously.

Maximum amount of pension insurance contributions

Until 2018, there was a formula that calculated the maximum amount of pension contributions. There was no need to pay more than the amount calculated using this formula. Here is the formula:

The maximum amount of pension contributions of individual entrepreneurs for 2017, calculated using this formula, was 187,200 rubles. (8 x RUB 7,500 x 26% x 12 months).

However, since 2018, the procedure for establishing the maximum amount of pension contributions has changed. Try another formula:

As you can see, in 2018 the eight-fold limit will also be applied, but not to the minimum wage, but to a fixed amount of 26,545 rubles. Thus, more than 212,360 rubles. (RUB 26,545 x 8) in 2018, payment as pension contributions cannot be made.

It turns out that the maximum amount of pension contributions payable since 2018 has increased by 25,160 rubles. (RUR 212,360 – RUR 187,200).

Example 3. Income over 300,000 rubles

For 2018, individual entrepreneur Kazantsev S.A. received income in the amount of 6,800,000 rubles. This amount is more than 300,000 rubles for 6,500,000 rubles. (RUR 6,800,000 – RUR 300,000), therefore pension contributions for 2018 will include:

- 26,545 rubles – fixed part of pension contributions;

- 65,000 rub. (6,500,000 rubles x 1%) is 1 percent of the amount of income exceeding 300,000 rubles.

In total, the total amount of pension contributions of individual entrepreneurs “for themselves” to be paid will be 91,545 rubles. (RUR 26,545 + RUR 65,000). This amount does not exceed the maximum amount (RUB 212,360), and therefore must be transferred to the budget in full.

Medical contributions of individual entrepreneurs from 2018: new sizes

The amount of medical insurance contributions to the FFOMS in 2017 did not depend on the income of the individual entrepreneur, but was also calculated based on the minimum wage. In 2017, the amount of medical contributions was 4,590 rubles. Cm. " ".

Since 2018, the amount of compulsory medical insurance contributions has been “untied” from the minimum wage and is fixed at 5,840 rubles for the billing period. How much have individual entrepreneur insurance premiums increased since 2018? The answer is 1250 rubles. (5840 rub. – 4590 rub.).

5840 rubles is a mandatory amount. Since 2018, all individual entrepreneurs must pay it for the billing period, regardless of the conduct of activities, movement of accounts and receipt of income.

Where did such amounts come from?

The rate of pension contributions since 2018 has been fixed at 26,545 rubles, if the income of an individual entrepreneur does not exceed 300 thousand rubles. in a year. If the entrepreneur’s income exceeds 300 thousand rubles, then contributions to the Pension Fund will amount to 26,545 rubles. + 1% of income over 300 thousand rubles. For health insurance contributions, the payment is set at 5840 rubles. But where did these numbers come from? Unfortunately, the explanatory note to the bill did not explain in any way why the numbers are exactly as they are.

Annual indexation of insurance premiums

It is provided that the fixed amount of insurance premiums for compulsory pension and health insurance from 2019 is subject to annual indexation by decision of the Government of the Russian Federation. Insurance premiums under the new procedure will most likely be indexed ahead of inflation, which is projected to be around 4% in the next three years.

Insurance premiums for peasant farms

From January 1, 2018, the procedure for calculating insurance premiums for heads and members of peasant farms is also changing. The amount of insurance contributions for compulsory pension and health insurance in general for a peasant (farm) farm is determined by multiplying the fixed amount of 26,545 rubles and 5,840 rubles by the number of all members of the peasant farm, including its head.

Disability and maternity contributions

As we have already said, this type of insurance premium is not mandatory. Individual entrepreneurs have the right to transfer them voluntarily in 2018. To calculate the amount of voluntary contribution for this type of insurance for 2018, you should apply the formula established by Part 3 of Article 4.5 of Federal Law No. 255-FZ of December 29, 2006: Minimum wage at the beginning of the year x tariff x 12.

If from January 1, 2018 the minimum wage will be 9,489 rubles, then the amount of contributions for disability and maternity in 2018 for individual entrepreneurs will be 3,300 rubles. (RUB 9,489 × 2.9% × 12 months).

If individual entrepreneur status was acquired or lost in 2018

In 2018, an individual entrepreneur must pay fixed insurance premiums “for himself” only for the time he remained in the status of an individual entrepreneur. That is, we can say that you need to pay contributions only for the period while the person was registered in the Unified State Register of Individual Entrepreneurs as a businessman. Let us give examples of calculating insurance premiums for individual entrepreneurs “for themselves” in 2018 in a situation where a person acquired and lost the status of an individual entrepreneur.

Example conditions. The person received individual entrepreneur status on February 16, 2018. However, on November 14, 2018, he was already deregistered as an individual entrepreneur and was expelled from the Unified State Register of Legal Entities. For the entire period of entrepreneurial activity, the income of the individual entrepreneur will be 1,100,000 rubles. How to calculate mandatory fixed contributions “for yourself” for 2018? Let me explain.

So, the status of individual entrepreneur was acquired and lost during 2018. In such a case, take into account the following provisions of the tax legislation of the Russian Federation:

- the number of calendar days in the month of commencement of activities must be counted from the day following the date of state registration of the individual entrepreneur (clause 2 of article 6.1, clause 3 of article 430 of the Tax Code of the Russian Federation). That is, in 2018, fixed contributions of individual entrepreneurs must be calculated from February 17, 2017;

- count the number of calendar days in the month when the individual entrepreneur lost his status until the day of registration of termination of activity. Do not include the date of exclusion from the Unified State Register of Individual Entrepreneurs in the calculation of insurance premiums in 2017 (clause 5 of Article 430 of the Tax Code of the Russian Federation). That is, in our example, we will calculate insurance premiums for November 2018 from November 1 to November 13.

Calculations. The amount of mandatory pension contributions for one calendar month of 2018 is 2212 rubles. (RUB 26,454 / 12 months). The amount of mandatory medical contributions for one month is 486 rubles. (5840 RUR / 12 months).

Next, we will calculate insurance premiums for partial months of doing business in 2018. In our example, these are February and November. During these months we need to count the days of activity. The remaining months (March-October) will be counted in full.

| Month | Amount of contributions |

| February | In February 2017, business activity was carried out from the 17th to the 28th (12 calendar days). There are a total of 28 days in February. Therefore, the amount of contributions for February 2017 will be: pension contributions = 948 rub. (2212 RUR/28 days × 12 days); medical fees = 208 rub. (486 RUR / 28 days × 12 days). |

| November | In November 2018, business activity was carried out from November 1 to November 13, 2017 (13 calendar days). There are a total of 30 calendar days in November. Therefore, the amount of contributions for November 2018 will be: pension contributions = 958 rub. (2212 rubles / 30 days × 13 days); medical fees = 210 rub. (486/ 30 days × 13 days) |

| March – October (whole months) | For the period from March to October 2018 inclusive (for eight full months), the amount of contributions will be: pension contributions: RUB 17,696. (RUB 2,212 × 8 months); medical fees 3888 rub. (RUB 486% × 8 months). |

| TOTAL | Total fixed insurance premiums for individual entrepreneurs “for themselves” in 2018, which began and ceased operations, will be:

Since the individual entrepreneur received income in the total amount of 1,100,000 rubles during the period of its activity in 2018, it is required to transfer an additional pension contribution from an amount exceeding 300,000 rubles. The excess amount was 800,000 rubles. (RUB 1,100,000 – RUB 300,000). The amount of pension contributions for income over 300,000 rubles. equal to 8000 rub. (RUB 800,000 × 1%). In total, the total amount of pension contributions in 2018 will be 27,602 rubles. (RUR 19,602 + RUR 8,000). This amount does not exceed the maximum pension contribution established for 2018. The maximum amount of pension contributions in 2018 is 212,360 rubles (we wrote about it above). |