Sberbank youth card is a card for young clients of the bank, which is issued in rubles and makes it possible to use modern banking services, and also allows you to manage your finances in a comfortable and safe environment.

Judging by the number of types of youth cards offered, Sberbank in Lately makes a special bet on the younger generation of customers. You can issue a card and become a client of Sberbank both from the age of 18 and from the age of 14, and you can even from the age of 7 - however, under the supervision of adults.

The design proposed by Sberbank for all youth cards looks like this:

Youth card

In 2016, Sberbank of Russia offers 2 youth debit cards, 1 youth credit card and 1 children's card. Sberbank youth cards are provided on the following attractive terms:

| №№ | Types of Sberbank youth cards / Terms of services provided | Age for issuing a card | Card expiry date | Annual service for the first year | Annual service for each subsequent year |

|---|---|---|---|---|---|

| 1. | Youth card 14+ (debit) | From 14 to 25 years old | 3 years | 150 rub. | 150 rub. |

| 2. | Youth card 18+ (debit) | From 18 to 25 years old | 3 years | 150 rub. | 150 rub. |

| 3. | From 21 years old | 3 years | 750 rub. | 750 rub. |

|

| 4. | Children's card 7+ is issued as additional card To card account parents | 7 to 14 years old | like the parent's main debit card | By tariff plan parent's main card | According to the tariff plan of the parent's main card |

At the beginning of 2016, Sberbank set the following tariffs for basic youth card services:

Distinctive features of Sberbank youth cards:

- Only Russian rubles can be stored on the card account.

- The card is used for payment on the Internet.

- It offers the provision of a special mobile application.

- Up to 10% of the purchase amount is "returned" to the account in the form of bonuses - "THANKS"

- The Mobile service in the first two months after connecting the bank is provided free of charge.

| №№ | Free services / Type of youth card | Youth Card 14+ | Youth card 18+ | Youth credit card 21+ | Children's card 7+ (additional card to the parents' account) |

|---|---|---|---|---|---|

| 1. | Possibility to replenish the phone using SMS in seconds | + | + | + | - |

| 2. | Transfers by phone number | + | + | - | - |

| 3. | The best Internet bank according to Global Finance, 2014 | + | + | + | - |

| 4. | 24/7 service (with Internet access) in the Sberbank Online Internet bank (registration) | + | + | + | - |

| 5. | SMS notifications for all card purchases | - | - | + | + |

| 6. | Program "Thank you from Sberbank" | - | - | + | - |

Top up your phone with SMS

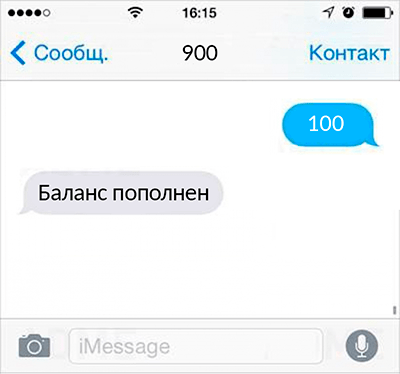

How is the phone recharge via SMS? To do this, send an SMS from your phone with the amount of replenishment to number 900. For example, we transfer 100 rubles. In this case, the text of the SMS message is formatted as follows:

Phone refill message

The limit for your phone registered in the Mobile Bank is 3,000 rubles per day.

Transfers by phone number

How to make a transfer by phone number using a youth card?You don't need a card number to make a transfer. We transfer 300 rubles. It is necessary to send an SMS command to number 900 with the following text:

Messages to transfer to a phone number

Where:

8123XXXXXXX – recipient's phone number;

300 - conditional transfer amount in rubles.

The maximum transfer amount in rubles is limited to 8,000 rubles per day.

The amount of one transfer can be from 10 to 8000 rubles.

Sberbank cares about its young clients, cares about their safety and comfort, therefore it offers youth cards for clients from 14 to 25 years old at special rates with a special range of interesting programs and advantageous services. For younger people, there are special ones. Today we will look in detail what are the benefits, what is the peculiarity of these cards and how to get them.

Page content

So, Sberbank of Russia issues debit and credit youth cards for its young clients. When issuing a card, you can choose one of the two proposed payment systems: Visa or MasterCard.

Debit Card 14+ and Debit Card 18+

Why do you need a debit card?

- You can get a scholarship or a salary for it. To do this, just contact the accounting department of your educational or work organization and provide them with your number. bank card;

- you can (cash through an ATM, or from cards of third-party banks, transfer by card number through an operator at a Sberbank branch, replenishment from a phone);

- you can withdraw cash from the card without commission in a wide network of ATMs throughout Russia, as well as in subsidiary banks abroad;

- the card can be used to pay for purchases and services both in various establishments and via the Internet;

- using a card, you can pay for the Internet or;

- You can control the state of the card balance through SMS notification, through the Internet bank or mobile bank.

IMPORTANT: the difference between youth cards 14+ and 18+ is that the card 18+ can be used in salary project from the employer and is issued by the working organization to employees who have reached the age of 16 for the calculation of wages on it. The 14+ youth card can also be used for payroll, but the cardholder must independently go to the accounting department and express their desire to accrue the earned funds to it.

Terms, rates and service

- the age of the holder is from 14 to 25 years;

- card currency - rubles;

- the card is valid for 3 years;

- annual maintenance- 150 rubles, which is 5 times cheaper than servicing other Sberbank debit cards;

- free of charge (both upon expiration and early at the request of the client);

- free Additional services(we will consider below);

- the ability to connect to the Internet bank and mobile bank(behind additional fee);

- service 24 hours 7 days a week in .

Benefits and profitable programs

- easy and instant replenishment of the phone balance without commissions. To do this, send an SMS to number 900 with the content "50", where 50 is the amount of replenishment;

- the possibility of transferring funds by phone number, so remembering or knowing the card number is not necessary. To do this, you need to send 900 SMS to a short number in the form “Transfer 9ХХХХХХХХ 500”, where 500 is the transfer amount in rubles.

- discount programs and special offers from Visa and MasterCard;

- round-the-clock customer support through the Sberbank contact center;

- the possibility of linking the card to electronic wallets;

- Possibility to order a card from . The cost of the service is 500 rubles. You can choose a design on the Sberbank website in a special gallery, or upload your own image.

IMPORTANT: a card with an individual design can become exclusive and unique in the world, so this opportunity is often used by young creative people.

The design you have chosen may be rejected by Sberbank employees if it does not meet the parameters of the bank's solid reputation;

- bonus . This program is very popular and allows you to return up to 10% of your purchases in the form of bonuses, which can then be spent on new purchase. For example, if a purchase in the amount of 500 rubles is paid not in cash, but with a youth card, 50 bonus points will be credited to it. 1 point - 1 ruble. In the future, these points can be used to pay for new purchases.

IMPORTANT: bonus program“Thank you” must be connected via SMS service by sending a message to number 900 in the form “Thank you XXXX”, where XXXX is the last 4 digits of your card.

Disadvantages of the youth card

- age limit of cardholders - only up to 25 years;

- the cost of servicing a mobile bank is 60 rubles, which is twice the standard cost.

How to issue a card?

A debit youth card can only be issued by citizens of the Russian Federation aged 14 to 25 who have permanent residence permit on the territory of the Russian Federation. You can do this in two ways:

- apply with a passport, sign an application. The card is issued and delivered within 3-14 days;

- leave an application for issuing a card on the official website. To do this, you must fill out a special form. The application will be reviewed by the bank's specialists within 2 days. The staff will then contact you the specified number phone and inform further algorithm of actions. You will need to show up for a card at a branch of Sberbank with a passport.

Credit youth card 21+

Sberbank offers its young clients who have reached the age of 21 to issue a youth credit card on special favorable conditions, namely:

- renewable on the card from 15 to 200 thousand rubles. As soon as the amount credit debt is repaid credit limit recovering;

- – 50 days. You can make a purchase using a credit card and not pay interest on the loan if the amount of the debt is fully repaid within 50 days;

- interest rate on credit – 33.0%;

- the cost of annual card maintenance is 750 rubles;

- the validity of the card is 3 years.

A youth credit card has the same benefits and special programs as debit cards: instant top-up of a mobile account, top-up of a card different ways, cash withdrawal, shopping in stores and via the Internet, participation in the Thank You program from Sberbank, various systems discounts, SMS notifications about all transactions made on the card, round-the-clock service through the contact center.

Step 2 The bank will consider the application within two days and inform about decision by contacting the phone number provided as contact details.

Step 3 On the appointed day (the bank will notify you additionally by phone call or SMS), you need to come to the bank branch and pick up the card.

IMPORTANT: commission for withdrawing cash from a credit card at ATMs of Sberbank and partners - 3%, at ATMs of third-party banks - 4%.

Please also note that one request for recent credit card transactions, both at Sberbank ATMs and at third-party ATMs, will be charged an amount of 15 rubles. More information about the tariffs for servicing youth credit cards can be found on the Sberbank website.

Youth cards enable modern boys and girls to save time, plan a budget, keep track of all card transactions and, if necessary, quickly receive or send cash. Special programs discounts and the “Thank you” program allow you to save money, and a credit card gives confidence in the future, because money is always at hand if necessary, and you do not need to pay interest on using a loan (during the grace period). Cards are issued quickly and easily, you only need to present a passport and a certificate of income or scholarship (to obtain a credit card).

Sberbank takes care of its young clients, cares about their safety and comfort, therefore it offers youth cards for clients from 14 to 25 years old at special rates with a special range of interesting programs and advantageous services. For younger people, there are special children's cards from Sberbank. Today we will look in detail what are the benefits, what is the peculiarity of these cards and how to get them.

So, Sberbank of Russia issues debit and credit youth cards for its young clients. When issuing a card, you can choose one of the two proposed payment systems: Visa or MasterCard.

Debit Card 14+ and Debit Card 18+

Why do you need a debit card?

- You can get a scholarship or a salary for it. To do this, just contact the accounting department of your educational or working organization and provide them with your bank card number;

- the card account can be replenished in various ways (cash through an ATM, online transfer from other Sberbank cards or from cards of third-party banks, transfer by card number through an operator at a Sberbank branch, replenishment from the phone);

- you can withdraw cash from the card without commission in a wide network of ATMs throughout Russia, as well as in subsidiary banks abroad;

- the card can be used to pay for purchases and services both in various establishments and via the Internet;

- using the card you can replenish the balance mobile phone, pay for the Internet or utilities;

- You can control the state of the card balance through SMS notification, through the Internet bank or mobile bank.

IMPORTANT: the difference between youth cards 14+ and 18+ is that the 18+ card can be used in a salary project from the employer and is issued by a working organization to employees who have reached the age of 16 for payroll. The 14+ youth card can also be used for payroll, but the cardholder must independently go to the accounting department and express their desire to accrue the earned funds to it.

Terms, rates and service

- the age of the holder is from 14 to 25 years;

- card currency - rubles;

- the card is valid for 3 years;

- annual service - 150 rubles, which is 5 times cheaper than servicing other Sberbank debit cards;

- free reissue (both upon expiration and early at the request of the client);

- free additional services (consider below);

- the ability to connect Internet banking and mobile banking (for an additional fee);

- service 24 hours 7 days a week in the Internet bank "Sberbank Online".

Benefits and profitable programs

- easy and instant replenishment of the phone balance without commissions. To do this, send an SMS to number 900 with the content "50", where 50 is the amount of replenishment;

- the possibility of transferring funds by phone number, so remembering or knowing the card number is not necessary. To do this, you need to send 900 SMS to a short number in the form “Transfer 9ХХХХХХХХ 500”, where 500 is the transfer amount in rubles.

- programs of discounts and special offers from Visa and MasterCard;

- round-the-clock customer support through the Sberbank contact center;

- the possibility of linking the card to electronic wallets;

- the possibility of ordering a card with an individual design. The cost of the service is 500 rubles. You can choose a design on the Sberbank website in a special gallery, or upload your own image.

IMPORTANT: a card with an individual design can become exclusive and unique in the world, so this opportunity is often used by young creative people.

The design you have chosen may be rejected by Sberbank employees if it does not meet the parameters of the bank's solid reputation;

- bonus program "Thank you" from Sberbank. This program is very popular and allows you to return up to 10% of your purchases in the form of bonuses, which can then be spent on a new purchase. For example, if a purchase in the amount of 500 rubles is paid not in cash, but with a youth card, 50 bonus points will be credited to it. 1 point - 1 ruble. In the future, these points can be used to pay for new purchases.

IMPORTANT: the "Thank you" bonus program must be activated via SMS service by sending a message to number 900 in the form "Thank you XXXX", where XXXX is the last 4 digits of your card.

Disadvantages of the youth card

- age limit of cardholders - only up to 25 years;

- the cost of servicing a mobile bank is 60 rubles, which is twice the standard cost.

How to issue a card?

A debit youth card can only be issued by citizens of the Russian Federation aged 14 to 25 who have a permanent residence permit on the territory of the Russian Federation. You can do this in two ways:

- go to the nearest branch of Sberbank with a passport, sign the application. The card is issued and delivered within 3-14 days;

- leave an application for issuing a card on the official website. To do this, you must fill out a special form. The application will be reviewed by the bank's specialists within 2 days. After that, the staff will contact you at the specified phone number and inform you of the further algorithm of actions. You will need to show up for a card at a branch of Sberbank with a passport.

Credit youth card 21+

Sberbank offers its young clients over the age of 21 to apply for a youth credit card on special favorable terms, namely:

- revolving credit limit on the card from 15 to 200 thousand rubles. As soon as the amount of credit debt is repaid, the credit limit is restored;

- Grace period– 50 days. You can make a purchase using a credit card and not pay interest on the loan if the amount of the debt is fully repaid within 50 days;

- interest rate on the loan - 33.0%;

- the cost of annual card maintenance is 750 rubles;

- the validity of the card is 3 years.

IMPORTANT: when withdrawing cash from a credit card, the grace period does not apply.

A youth credit card has the same advantages and special programs as debit cards: instant replenishment of a mobile account, replenishment of a card in various ways, cash withdrawals, shopping in stores and via the Internet, participation in the Thank You program from Sberbank, various discount systems, SMS notifications about all transactions made on the card, round-the-clock service through the contact center.

How to get a youth credit card?

Youth credit card is issued to citizens Russian Federation having a permanent residence permit, aged 21 to 25 years. It can be issued to both working and non-working students.

Step 1. You need to issue online application to a credit card on the official website of Sberbank, or write an application for a credit card at any branch of the bank, providing the following documents:

- passport;

- certificate 2-NDFL confirming income for the last 6 months (a certificate can be obtained from the accounting department at the place of work);

- certificate of scholarship (only for full-time students under the age of 24, issued by the dean's office of the educational institution).

Step 2. The bank will consider the application within two days and inform about the decision made by contacting the phone number indicated as contact details.

Step 3. On the appointed day (the bank will notify you additionally by phone call or SMS), you need to come to the bank branch and pick up the card.

IMPORTANT: commission for withdrawing cash from a credit card at ATMs of Sberbank and partners - 3%, at ATMs of third-party banks - 4%.

Please also note that one request for recent credit card transactions, both at Sberbank ATMs and at third-party ATMs, will be charged an amount of 15 rubles. More information about the tariffs for servicing youth credit cards can be found on the Sberbank website.

Youth cards enable modern boys and girls to save time, plan a budget, keep track of all card transactions and, if necessary, quickly receive or send money. Special discount programs and the “Thank you” program allow you to save money, and a credit card gives confidence in the future, because money is always at hand if necessary, and you do not need to pay interest on using a loan (during the grace period). Cards are issued quickly and easily, you only need to present a passport and a certificate of income or scholarship (to obtain a credit card).

sbankin.com

Youth card from Sberbank

Sberbank of Russia is the first financial institution, which made it possible to manage financial accounts not only for adult citizens of our country, but also for teenagers. We are talking about a youth card, it is available for the younger generation and is not much different from classic plastic cards. Surely not everyone knows what a youth card from Sberbank is, so it makes sense to consider it in more detail.

Types of cards

The owner of this banking product Any teenager over the age of 14 can become. On this moment Sberbank of Russia offers three options for young people: 14+, 18+ and 21+. That is, they can be issued, respectively, from the age of 14, 18 or 21 years.

For minor customers, only debit cards are available, that is, the user can only dispose of own funds without the possibility of an overdraft. From the age of 21 you can get a credit card, not only for working young people, but also for students.

Debit Youth Card

Youth debit card Sberbank is profitable proposition for young people, young people aged 14 to 25 years or from 18 to 27 years old can become its owner. Users of this product can manage personal funds credited to the card account at their own discretion: withdraw cash, pay for purchases in stores.

Maybe not everyone fully understands why a bank card is needed for young people, although in fact it is a very useful tool, and there are several reasons for this:

- Firstly, the funds on it are reliably protected, because the plastic card is equipped with a chip, so third parties will not be able to use it.

- Secondly, the money stored on the account cannot be lost, even if it is lost. plastic card, it can be reissued at a bank branch.

- Thirdly, you can remotely pay for a mobile phone, goods and services on the Internet, and much more, while withdrawing cash is not a problem, because in any city there are quite a few ATMs operating around the clock.

The teenager himself can fill out the application directly, for this he needs only a passport and a questionnaire.

How to apply for a youth card? Everything is quite simple, you need to apply with a passport to any branch of Sberbank, the only requirement for the client is registration in the region of application and citizenship of the Russian Federation. To become the owner of this product, you just need to fill out a questionnaire, and you can do it on the official website of the bank. When the card is ready, the applicant will receive an SMS notification with a notification.

The owner of this product can use the service of remote management of his account, that is, Mobile Bank and Sberbank.Online. In addition, students and working teenagers have the opportunity to receive wages, scholarships and other payments through Sberbank.

Terms of Service and Tariffs:

- annual service - 150 rubles;

- international payment systems - Visa or MasterCard;

- validity period - 3 years;

- reissue at the end of the validity period - free of charge;

- reissue in case of loss - 150 rubles;

- bonus program "Thank you from Sberbank";

- individual design - 500 rubles.

Please note that the commission for cash withdrawals through cash desks and ATMs of Sberbank of Russia is not provided for youth debit cards 14+ and 18+.

You can use the payment instrument to pay for purchases and withdraw cash in Russia and abroad. For youth card holders, bonuses and discounts from international payment Visa systems and MasterCard, bonus program "Thank you from Sberbank", Mobile bank, Sberbank.Online and the Autopayment service. Bank customers have access to 24/7 remote service by phone hotline.

Card 21+ with credit limit

Young people over the age of 21 can use the credit limit. A credit card is available for working citizens, as well as students, confirmation is required for its issuance monthly income. How to apply:

- contact the nearest branch of Sberbank in the region of registration;

- fill out a card issue form;

- provide income statements for the last six months, about wages or scholarships.

You can send an application for a plastic youth card online on the official website of the bank.

The lender will notify the client of its decision via SMS, and it will take 2 working days to review the questionnaire. How much is the youth card of Sberbank, it is difficult to answer unambiguously, average term 2 weeks. The manager of the company will inform about its readiness for contact phone.

Terms of use and tariffs:

- the cost of maintenance for the year - 750 rubles;

- credit limit from 15 to 200 thousand rubles, determined individually;

- interest rate on the loan up to 33.9% per year;

- grace period - 50 days (does not apply to cash withdrawals);

- validity period - 3 years;

- cash withdrawal from an ATM - from 390 rubles or 3% of the amount;

- international payment systems - Visa or MasterCard.

How is the grace period calculated?

How is the grace period calculated? Individual design

Bank customers can get a card with a unique design, this service is paid, its cost is 500 rubles. The Sberbank youth card can be issued in a classic version or at the choice of the owner with an original image on the front side. The bank's website has a database with images, where the user can make a choice or upload an image from his computer.

There are several requirements for images that are prohibited:

- images of alcoholic products and tobacco products;

- flags of other states;

- pictures of pornographic content;

- frames from films or cartoons;

- celebrity images;

- photos and pictures downloaded from the Internet and protected by copyright;

- image of people in uniform;

- bills and coins;

- text and numbers.

It will take a little longer to issue a card with an individual design than a classic one.

Custom card design

Custom card design Advantages and disadvantages

The great advantage of the product is precisely that it is available to unemployed young people, even to schoolchildren. Credit funds are provided from the age of 21, even to a non-working student. You can use a credit card up to 30 years.

There are a few other clear benefits:

- the account can be linked to an electronic wallet, which is convenient for freelance students;

- high degree of protection of personal and borrowed money;

- young people can use all the services of Sberbank;

- SMS informing is free of charge.

Of the negative aspects, this applies to credit cards - the absence of an interest-free period for cash withdrawal operations, a high interest rate on a loan, a commission for cash withdrawals. In addition, not all unemployed students have access to a high credit limit, that is, it is almost impossible to get 200 thousand rubles even for working citizens.

Details can be found on the official website, namely, what is a Sberbank youth card, everything about it and its maintenance, as well as the conditions for registration. Also on the bank's website there is a huge collection of images for individual design, And detailed information about bonus programs and privileges.

znatokdeneg.ru

Sberbank youth card: overview, conditions for obtaining, main features

You can become the owner of a bank account from the age of 14. It is at this age that the Sberbank Youth Card is issued as the main one. It is debit, and was created for the comfortable disposal of personal funds. From the age of 21, the bank allows you to issue a Youth credit card. Both types of cards have favorable terms of use for young people.

More about the Molodezhnaya card

This card has three varieties, which depend on the age of the applicant:

- 14-25 years old;

- 18-25 years old;

- 21-30 years old.

In the first two cases, the cards are debit. The third type is credit.

Debit cards do not have much difference. They have similar conditions of registration and use. It is convenient to store personal funds of the owner on such accounts.

With the help of debit plastic card you can also perform various transactions:

- Accept a salary or stipend. To do this, it is enough to provide your account number to the accounting department of an educational institution or enterprise.

- Top up the card with everyone possible ways: using online transfers from other cards and accounts, through an ATM, through a bank branch.

- Convenient replenishment of a mobile account without any commissions. For the procedure, you need a phone with an online Sberbank application. If this resource is not connected, you can use SMS banking. It's not hard to set it up yourself.

- Interest-free cash withdrawal from an account at any Sberbank ATM.

- Payment for any services and online purchases.

- Control over the expenditure of funds using banking or mobile banking.

From the age of 21, you can also get a Youth credit card. It has a grace period of up to 50 days. The rate is 33%, and the cost of maintenance for the year is 750 rubles. To receive, you need proof of income - for example, a certificate of receipt of a scholarship. For the first loan, the bank allocates a maximum of 15 thousand rubles.

The features of a credit card are completely similar to those of a debit card. The only difference is the conditions for cashing out funds. For this operation, you will have to pay a 3% commission if you withdraw money at the terminals of Sberbank, and 4% if at the terminal of another bank.

Advantages of the "Youth" card

The youth debit card is known for several significant advantages:

- Card service is 5 times lower than others - only 150 rubles. for a year;

- Ability to use MasterCard or Visa;

- Card validity period - 3 years;

- Free renewal after the end of the period;

- Free connection to mobile banking.

You can also connect the "Thank you" bonus program, which returns up to 10% of total amount shopping. Bonus money is for new acquisitions. One earned bonus is equal to 1 promotional ruble. Many reputable stores and services support this program.

In addition, the user has access to round-the-clock service in the Sberbank Online Internet system and all types of money transfers.

Many young people earn money on the Internet. To quickly and conveniently receive well-deserved fees, you can link your card to electronic wallets. Another opportunity to order a card with a unique design - you can choose it from the existing gallery in the bank or offer your own version. The service is paid. It costs 500 rubles.

Debit cards for teenagers and children are a fairly popular product on the market. If earlier children were given pocket money in cash, now it is easier for parents to throw it on a card. There are products linked to the parent account, there are products linked to your own.

The Molodyozhnaya card from Sberbank, according to average estimates, is in the TOP-3 debit cards for teenagers and young people. Age category from 14 to 25 years old, i.e. from schoolchildren to already working citizens. Let's see who will be more interested in this card and whether it is worth getting it, let's deal with bonuses and the loyalty system, and also go through the pros and cons. Youth is very well advertised, but is the game worth the candle? We read the review!

The card is issued only in debit name on payment systems ah Visa and MasterCard linked to a ruble account.

- Age category from 14 to 25 years old, i.e. even if you are still a student, you can become the owner of a debit card

- Annual service - 150 rubles per year

- Validity - 3 years

- Additional card is not issued

- Can be ordered with custom design

- Paypass system, plus there is a link to a smartphone, thanks to ApplePay or Android Pay you can not carry plastic with you, but pay with a gadget

- Free replenishment at ATMs and cash desks of Sberbank

- Withdrawal at native terminals and cash desks without interest within the daily rate of 150 thousand rubles, then 0.5% of the amount exceeding the limit

- In other people's ATMs withdrawal with interest - 1% of the amount, but not less than 100/150 rubles

- The daily limit for cashing out is 150 thousand rubles, the monthly limit is 1.5 million rubles. But the limit does not apply to withdrawals at the cash desks of other banks, i.e. you can shoot more than 150 thousand

- The mobile bank is conditionally free - you do not need to pay for an economical package, but for a full one you need - 60 rubles per month.

MasterCard offers to issue a card Youth Savings Bank on their payment system, and for an incentive they offer a number of additional partners:

- Yandex.Poster

- RZD tickets

- Formula Kino

- CINEMA PARK

- kinohod.ru

- chocolate girl

- yoox.com

- Rendezvous

- The Body Shop

The specific discount percentage can be found on the official website.

Individual design

Some banks offer an individual design service to their customers, for example, Raiffeisenbank with a card. But servicing such products usually costs a pretty penny, while Sberbank put up a fairly reasonable price tag - only 500 rubles at a time. Perhaps, for young people, this service is especially relevant, because at this age you always want to stand out, so individual design is a great way to express yourself.

Sberbank has a good gallery of its own designs.

You can upload your photo from your computer.

How bonuses are calculated

Bonuses in Sberbank are a certain type of cashback, only in this case points are awarded, and not rubles, in the amount of 0.5% of the purchase amount. For example, you made a transaction for 5,000 rubles, from this amount you will receive 25 bonuses (1 point - 1 ruble). You can convert bonuses into rubles only if you are at the fourth level, there is no such function on all others.

Sberbank has a number of partners, for purchases from which you will be charged not 0.5%, but much more - on average, this is somewhere around 5-10%. Each partner prescribes his own percentage and conditions, which it is advisable to familiarize yourself with in advance. For example, you see a cinema chain in the list, come to the cashier and make a purchase using the Molodezhnaya card. Time passes, and bonuses are not credited, but all because it was written in the conditions in small print - you need to pay on the cinema’s website or in a mobile application.

Now Sberbank has 105 partners, but their composition is unstable and may change. Study the entire list before making a map, see if it contains places that you visit. Pay your attention to the fact that not all organizations from the list both accrue and accept bonuses at the same time - 49 places enroll, 99 - accept.

For clients at the levels Thanks a lot and More than Thank you categories with increased cashback are provided (see below). Depending on the level, you can choose one/two categories for free and buy another one/two for bonuses. In principle, the percentage for free categories is very good, on average 10% is good indicator by market. But with the paid ones, the situation is a little worse, here you need to wait for the official prices and see if the purchase of these categories will give some kind of output. We remind you that you will receive such porridge within 3 months until your level is reviewed.

Accrual occurs for all card transactions, except for cash withdrawals, payments utilities and making payments to the state (taxes, fines). If the purchase amount is less than 15 thousand rubles, then bonuses will be credited to your account within 5 working days, if more, then within 40 working days.

What can you spend bonuses on?

As we mentioned above, points cannot be converted into rubles (except for level 4 clients), but Sberbank using the Molodyozhnaya card provides the opportunity to pay with these same bonuses in stores. It is worth noting that you can spend bonuses far from everywhere, but only from official partners. To do this, you need to select the desired offline or online store and select the amount you want to deduct from your loyalty program account. When visiting retail store inform the seller about the desire to pay “Thank you”.

Read also

For what reasons can a card be blocked and what to do

Registration in the program

If you already have a Youth Card from Sberbank in your hands, then in order to receive various rewards, you need to register in the Thank You program, otherwise you will not receive any bonuses.

The whole process looks like this:

- register in the Sberbank Online Internet banking;

- go directly to the page of the loyalty program Thank you;

- in the Profile section, set a login and password for further access to your personal account.

There is another registration option - we send an SMS to number 900 with the text THANK YOU XXXX, where XXXX is the last 4 digits of your card.

Privilege

Since July 1, 2018, a number of changes have taken place in the Thank You program - now all privileges are divided into four levels: Thank you, Thank you very much, Thank you very much and More than Thank you. The higher your level, the more different nyashes you get, but first you need to earn your level and try to keep it.

So, everything happens as follows:

- draw up a card;

- join the program;

- start working hard on your level.

All new program participants with a Youth card automatically start at level 2. In order to maintain your privileges, you must monthly within three months perform a series of so-called tasks. As a result, you will either be left at the current level, or promoted to the third. And now let's figure out what you can squeeze out of each level, and what tasks you need to complete.

ATTENTION! To get a new level, you need to complete tasks of the desired category for three months, while you will receive privileges corresponding to the current level. Sberbank does not set any restrictions related to the order of transition, in other words, there is an option to jump from the second to the fourth immediately.

Privileges by Level

Thanks level:

- cashback - 0.5%;

- up to 20% bonuses for purchases from partners

Level Huge ATP:

- cashback - 0.5%;

- two categories with increased cashback to choose from;

- up to 20% for partners

Level Greater than ATP:

- cashback - 0.5%;

- four categories with increased cashback to choose from;

- up to 20% for partners;

- it is possible to exchange bonuses for rubles

ATTENTION! In fact, only one/two categories with increased cashback are provided for free, depending on the level. One/two more categories can be bought for bonuses Thank you. True, the rates are still unknown, according to the bank operator, such information will be received only in October, which is quite logical, because the program was updated in July, so now all participants are at the second level, and they will be able to move forward only in October.

Tasks by levels

Sberbank requires the fulfillment of all mandatory items, and one additional item to choose from.

Level Thank you very much.

Required tasks:

- Purchases by card in the amount of 5000 rubles each month;

- The ratio of purchases to cash withdrawals on a monthly basis should correspond to the following proportion of 30% / 70%, and the amount of spending on the Molodyozhnaya card from Sberbank can be increased up to 50% (for example, you buy for 6,000 rubles, withdraw 14,000 rubles in cash).

Choice tasks:

- The entire billing period on your card must be a minimum balance of 10,000 rubles

- If you have a credit card from Sberbank, spending on it must be at least 10% of the credit limit.

Level Thank you very much.

- Purchases on the card in the amount of 5000 rubles every month.

- The ratio of spending to cash withdrawal on a monthly basis should correspond to the following proportion of 50% / 50%, and the amount of expenses on the card can be increased up to 85% (for example, you buy for 10,000 rubles, withdraw 10,000 rubles in cash)

- You cannot make payments using the Molodyozhnaya card at branded ATMs and terminals, as well as Sberbank branches (payments include purchases, payment for various services, including utilities, fines and taxes)

Choice tasks:

- For the entire billing period, the account must have a minimum balance of 10,000 rubles

- If you have a credit card, spending on it must be at least 30% of the credit limit

- make at least one purchase every month for billing period using a smartphone, or the Sberbank Online application, or on Thank You Travel/Impressions/Online Market websites.

Level More than Thank you.

- you need to buy in the amount of 5000 rubles every month

- The ratio to cashing out the account on a monthly basis should correspond to the following proportion of 85% / 15%, and the amount of spending on the card can be increased up to 100% (for example, you buy for 17,000 rubles, withdraw 3,000 rubles in cash)

- You can not make payments at branded ATMs and terminals, as well as branches of Sberbank

- You must either make one valid credit card transaction, or open / replenish a deposit, and one of these actions must be performed once every 3 months

Choice tasks:

- Keep a minimum balance of 10,000 rubles on the account for the whole month

- If you have a credit card from Sberbank, then spending on it must be at least 50% of the limit

- Make at least one transaction per month during the billing period using a smartphone, or the Sberbank Online application, or on Thank You Travel/Impressions/Online Market websites

Youth card- this is a debit card of the issuing bank, to which the personal money of a young cardholder is credited (stipend, salary, simple investment), and this money is used to make purchases and pay for services anywhere where it is possible to pay with a card. The cardholder can only use the funds that are on his card.

Youth debit card holders can be individuals at the age of 14 to 25 years or from 18 to 27 years or more who have entered into an agreement with the bank to open a bank account for settlements and payment for various services using a bank card.

True, not all Russian issuing banks issue cards for young people. Today, a youth debit card is offered so far by such Russian banks as:

- Sberbank of Russia ( Visa Classic or MasterCard Standard)

- Rosbank (MasterCard Standard ISIC),

- OTP Bank (MasterCard Standard).

- Alfa-Bank (MasterCard - "Next" card)

Youth card of Sberbank of Russia

The Sberbank Youth Card is a debit card for young people that is issued in rubles and makes it possible to use all modern banking services and manage their finances in a comfortable and safe environment. And given the extensive network of ATMs and branches of Sberbank, the territorial radius of the card service is extensive.The design of a youth debit card offered by Sberbank is divided into:

- Typical standard drawing. The standard version of the card design is shown on the bank's website, and in my opinion, it has a fairly modern look.

- Your drawing. If a young man does not like the standard design, you can create your own individual drawing for an additional fee.

- Drawing from the bank's gallery. The bank's gallery offers a wide range of designs for youth cards.

A youth debit card design selected from the gallery might look something like this:

Procedure and conditions for registration

The conditions for issuing a card are as follows:- Mandatory presence of an identity document (passport);

- Age of the card holder - from 14 to 25 years;

- Citizenship of the Russian Federation;

- Permanent registration in the region where the card is issued.

- in any branch of Sberbank (with a specialist);

- through the website of Sberbank of Russia.

Youth debit card can be used for the following services of Sberbank:

- scholarships;

- receiving wages;

- payment for purchases in stores in Russia and abroad;

- withdrawing and depositing money to the account (at bank offices and through ATMs);

- payment for a mobile phone, Internet, TV and other services - through terminals and ATMs, Sberbank Online @ yn and Mobile Bank;

- to monitor the status of the account in real time through the "Mobile Bank", and "Sberbank Online @ yn";

- payment for online purchases.

- Carrying out services - "Autopayment".

Tariffs - Sberbank youth card

An attractive feature of the youth card of the Visa Classic or MasterCard Standard payment systems is rather preferential rates for its maintenance. So, the youth card of Sberbank for 2013 has the following basic service rates:- Annual maintenance fee - 150 rubles.

- The initial payment to the bank card account is at the discretion of the holder.

- Contribution to the reserve account is not provided.

- The next reissue of the card is free of charge.

- Early card reissue - free of charge.

- Re-issuance in case of loss of the card, loss of PIN-code, change of personal data of the Cardholder - 150 rubles.

- Making an individual card design - 500 rubles.

- Contribution to the reserve account - not provided.