Let's look at the types cash flows enterprises: economic sense indicators – net cash flow (NCF) and free cash flow, their construction formula and practical examples calculation.

Net cash flow. Economic sense

Net cash flow (EnglishNetCashflow,NetValueNCF, present value) – is a key indicator of investment analysis and shows the difference between positive and negative cash flow for a selected period of time. This indicator determines financial condition the enterprise and the ability of the enterprise to increase its value and investment attractiveness. Net cash flow is the sum of cash flow from operating, financing and investment activities enterprises.

Consumers of the net cash flow indicator

Net cash flow is used by investors, owners and creditors to evaluate the effectiveness of an investment in an investment project/enterprise. The value of the net cash flow indicator is used in assessing the value of the enterprise or investment project. Since investment projects can have a long implementation period, all future cash flows lead to the value at the present time (discounted), resulting in the NPV indicator ( NetPresentValue). If the project is short-term, then discounting can be neglected when calculating the cost of the project based on cash flows.

Estimation of NCF indicator values

The higher the net cash flow value, the more investment attractive the project is in the eyes of the investor and lender.

Formula for calculating net cash flow

Let's consider two formulas for calculating net cash flow. So net cash flow is calculated as the sum of all cash flows and outflows of the enterprise. AND general formula can be represented as:

NCF – net cash flow;

C.I. (Cash Inflow) – incoming cash flow, which has a positive sign;

CO (Cash Outflow) – outgoing cash flow with a negative sign;

n – number of periods for assessing cash flows.

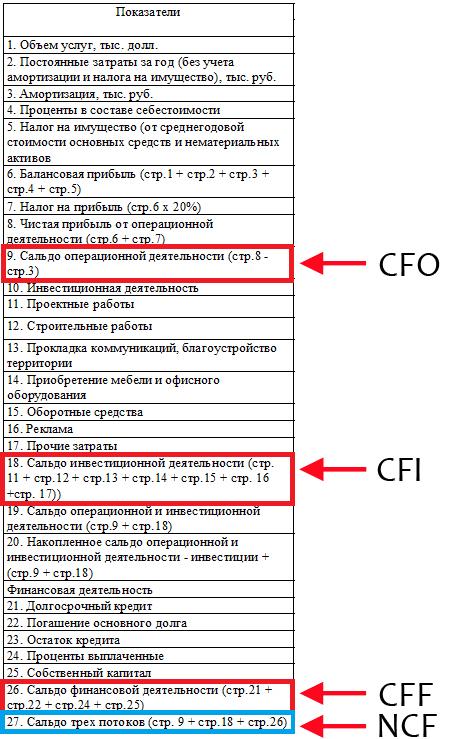

Let us describe in more detail the net cash flow by type of activity of the enterprise; as a result, the formula will take the following form:

![]() Where:

Where:

NCF – net cash flow;

CFO – cash flow from operating activities;

CFF – cash flow from financial activities;

Example calculation of net cash flow

Let's look at a practical example of calculating net cash flow. The figure below shows the method of generating cash flows from operating, financing and investing activities.

Types of cash flows of an enterprise

All cash flows of an enterprise that form net cash flow can be divided into several groups. So, depending on the purpose of use, the appraiser distinguishes the following types of cash flows of an enterprise:

- FCFF is the free cash flow of the company (assets). Used in valuation models for investors and lenders;

- FCFE – free cash flow from capital. Used in models for assessing value by shareholders and owners of the enterprise.

Free cash flow of the company and capital FCFF, FCFE

A. Damodaran distinguishes two types of free cash flows of an enterprise:

- Free cash flow of the company (FreeCashFlowtoFirm,FCFFFCF) is the cash flow of an enterprise from its operating activities, excluding investments in fixed capital. A firm's free cash flow is often simply called free cash flow, i.e. FCF = FCFF. This type cash flow shows how much is left Money from the enterprise after investing in capital assets. This flow is created by the assets of the enterprise and therefore in practice it is called free cash flow from assets. FCFF is used by the company's investors.

- Free cash flow at equity (FreeCashFlowtoEquity,FCFE) is the cash flow of an enterprise only from the equity capital of the enterprise. This cash flow is usually used by the company's shareholders.

A firm's free cash flow (FCFF) is used to assess enterprise value, while free cash flow to equity (FCFE) is used to assess shareholder value. The main difference is that FCFF evaluates all cash flows from both equity and debt, while FCFE evaluates cash flows from equity only.

The formula for calculating the free cash flow of a company (FCFF)

EBIT ( Earnings Before Interest and Taxes) – earnings before taxes and interest;

СNWC ( Change in Net Working Capital) - change working capital, money spent on acquiring new assets;

Capital Expenditure) .

J. English (2001) proposes a variation of the formula for a firm's free cash flow, which is as follows:

CFO ( CashFlow from Operations)– cash flow from the operating activities of the enterprise;

Interest expensive – interest expenses;

Tax – interest rate income tax;

CFI – cash flow from investment activities.

Formula for calculating free cash flow from capital (FCFE)

The formula for estimating free cash flow of capital is as follows:

NI ( Net Income) – net profit enterprises;

DA – depreciation of material and intangible assets;

∆WCR – net capital costs, also called Capex ( Capital Expenditure);

Investment – the amount of investments made;

Net borrowing is the difference between repaid and received loans.

The use of cash flows in various methods for assessing an investment project

Cash flows are used in investment analysis to evaluate various project performance indicators. Let's consider the main three groups of methods that are based on any type of cash flow (CF):

- Statistical methods for evaluating investment projects

- Payback period of the investment project (PP,PaybackPeriod)

- Profitability of an investment project (ARR, Accounting Rate of Return)

- Current value ( N.V.NetValue)

- Dynamic methods for evaluating investment projects

- Net present value (NPVNetPresentValue)

- Internal rate of return ( IRR, Internal Rate of Return)

- Profitability Index (PI, Profitability index)

- Annual annuity equivalent (NUS, Net Uniform Series)

- Net rate of return ( NRR, Net Rate of Return)

- Clean future value (NFV,NetFutureValue)

- Discounted payback period (DPPDiscountedPayback Period)

- Methods that take into account discounting and reinvestment

- Modified net rate of return ( MNPV, Modified Net Rate of Return)

- Modified rate of return ( MIRR, Modified Internal Rate of Return)

- Modified net present value ( MNPV,ModifiedPresentValue)

All these models for assessing project performance are based on cash flows, on the basis of which conclusions are drawn about the degree of project effectiveness. Typically, investors use the firm's free cash flows (assets) to evaluate these ratios. The inclusion of free cash flows from equity in the formulas for calculating allows us to focus on assessing the attractiveness of the project/enterprise for shareholders.

Summary

In this article, we examined the economic meaning of net cash flow (NCF), showing that this indicator allows us to judge the degree investment attractiveness project. We examined various approaches to calculating free cash flows, which allow us to focus on valuation for both investors and shareholders of the enterprise. Increase the accuracy of the assessment of investment projects, Ivan Zhdanov was with you.

Companies earn money not only from their core business activities, but also from investments. When a company spends or earns money through investments, it must be reported on the statement of cash flows. Cash flow from investments is calculated separately from funds received from core operating activities.

Investment cash flow

Unlike the income statement, the cash flow statement reports only the funds that have been paid out to or by the company. Let us assume that the borrower must pay a loan in the amount$ $9,000 at the end of September but pays in October instead. The income statement for September will list$9 ,000 as income, but it will not appear on the cash flow statement until the actual payment is made in October.

The cash flow statement reflects the cash flow from 3 types of activities: operational, financial and investment.

Operating activities are the regular business activities of a company, such as retail sales, housekeeping services or construction. Financial cash flows include the purchase and sale of stocks and bonds and the payment of dividends. Investing covers several various types activities:

Capital expenditures

Financing joint ventures

Placement of funds under a reverse repo transaction

Acquisition of shares in associates and joint ventures

Acquisition of subsidiaries, net of cash received and interests in joint ventures

Buying or selling fixed assets such as buildings, land or equipment.

Buying and selling stocks and bonds.

Providing funds and collecting loans.

Standard accounting practice considers the purchase of fixed assets as an investment. If management spends$ 800 thousand. this month for the purchase of updated equipment for the plant, this transaction will be recorded as a negative entry in the amount$ 800 thousand. in the cash flow statement. If a business sells old equipment for$ 300 thousand. , this is a positive entry. At the end of the month, the investment cash flow will be minus $500 thousand.

Example –Apple

At the end of the reporting year 2017, the companyAppledemonstrated negative investment cash flow of $46, 446 million.

Apple spent over$ 159 billion. for the purchase of securities. Wherein, $31 was repaid in 2017,775 million. valuable papers, A$94,564 million. was sold by the company. Among the significant items of investment cash flowAppleIt is worth noting the capital costs of$12,451 million.

Analysis

Operating cash flow shows how much income a company generates from its core activities. ForApple in 2017he made up$63,598 million. The cash flow statement separates operating and investment income, since income from profitable investments may hide the fact that the company does not generate income in the usual way. If management has spent a significant amount on purchasing fixed assets, the opposite may occur and this will distort the information, if you do not divide the cash flow into operating and investment.

If a corporation operates in an industry that requires significant investment in fixed assets, negative cash flow from investments may be a good sign that funds are being invested in equipment for its business.

Knowing the cash flow from investing activities is one step in measuring free cash flow - the change in your previous earnings. reporting period less any dividends, working capital and capital expenditures. Capital expenditures are included in the statement of cash flows.

Calculation of present value is made only on the basis of discounting cash flow ( cash flow) , under which in general case understand the circulation of money of a certain direction or type of activity, occurring continuously over time. It is advisable to understand the flow of money as the difference between the amounts of money entering the investor’s current account and cash register (money inflows), and the amounts leaving the current account and from the cash register (money outflows).

It is recommended to designate individual entrepreneurs’ cash flows using Ф(t), if they refer to a point in time t, or through Ф(m), if they relate to m one step at a time. Project cash flows are classified depending on individual species activities:

Cash flow from investing activities F I (t); cash flow from operating activities F O (t) cash flow from financing activities F F (t) Within each of these three activities, during any m th calculation period (step) month, quarter, year, cash flow is characterized by:

A) inflow P (m) funds equal to the amount of cash receipts to the current account and to the cash desk (cash inflows are determined by result implementation of IP in in value terms at this step);

b) outflow O(m) funds equal to payments at this step;

V) balance (active balance, effect) equal to the difference between inflow and outflow.

For cash flow from investment activities: To outflows relate capital investments, commissioning costs, project liquidation costs, increase working capital, funds invested in additional funds. This also includes non-capitalized costs (payment of tax on land plot, used for the project, costs for the construction of external infrastructure facilities). Information on investment costs must include information classified by type of cost. The distribution of investment costs over the construction period must be linked to the construction schedule;

TO tributaries sale of assets during and at the end of the project (in this case it is necessary to take into account the payment of relevant taxes, which will be cash outflows), proceeds from decrease working capital.

For cash flow from operational activities:

TO outflows include production costs and taxes;

TO tributaries sales revenue, other and non-operating income, including proceeds from funds invested in additional funds.

TO financial activities include transactions with funds external to the individual entrepreneur, that is, arriving not at the expense of the project. They consist of the company’s own capital (share capital for a joint-stock company) and borrowed funds. For cash flow from financial activities:

TO outflows includes the costs of repaying and servicing loans and debt securities issued by the enterprise (in in full regardless of whether they were included in inflows or in additional funds), as well as, if necessary, for the payment of dividends on shares;

TO tributaries investments of own capital and borrowed funds (subsidies, subsidies, borrowed money, including through the company’s issuance of its own debt obligations.

It is recommended to calculate cash flows from investment, operating and financial activities for each stage of the investment project using special tables.

Cash flows from investment activities are calculated based on Table 1, where the letter "Z" outflows of money are indicated (for the acquisition of assets and increase working capital), accounted for with a minus sign, and the letter "P" cash inflows (from liquidation capital funds And decrease working capital accounted for with a plus sign:

To calculate cash flows from investment activities, it is important to pay attention to the following: the main components of working capital are: inventories of raw materials and finished products, accounts receivable and accounts payable.

Increase working capital is associated either with an increase in inventories and/or accounts receivable(that is, the debt of buyers to the company), or with a decrease in accounts payable (the debt of the enterprise to its suppliers). From a cash flow perspective, an increase in inventory or accounts receivable means that the business has not received real money: finished products and raw materials lie in the warehouse unsold, and buyers of this company’s goods did not transfer money for the delivered products on time. Therefore, these amounts relate to cash outflows. Likewise, if an enterprise reduces accounts payable, that is, it has paid off part of its debts, then these amounts are classified as cash outflows.

Forecasting is the core of any trading system, so professionally made ones can make you extremely wealthy.

Cash flows from operating room activities are calculated according to Table 2.

Variables costs depend on the volume of products produced (costs of raw materials, labor etc.), and permanent costs are not related to the volume of production of goods and services; they are present at any volume of output and can be at the zero step of calculation ( rent, maintenance of the management staff, etc.).

Separate accounting of depreciation for buildings and equipment is determined by its link to the net liquidation value.

When taking into account depreciation expenses, it is necessary to pay attention to a fundamental point: taken into account when assessing investment projects money flows(their inflows and outflows) are not identical to the concepts of income and costs. Asset impairment and depreciation of fixed assets decrease net income; calculation of depreciation deductions is necessary to determine the amount of profit (line 9) and to calculate tax amounts (line 10), but does not involve transactions for transferring money from a current account, therefore depreciation deductions should not be taken into account when calculating money flows. That is why net inflow from operations(line 13) is obtained by summing the projected net income (line 11) with depreciation charges(line 7 plus line 8).

On the other hand, the acquisition of capital assets is not a cost of production and is not taken into account when calculating profits, but is an outflow of money and is included in the calculation of cash flows.

When calculating taxes, it is necessary to keep in mind that if losses are shown in line (9), then in line (10) the tax is taken into account with a minus sign and its amount is added to the amount of profit.

Net salvage value(net cash flow at the liquidation stage of the facility) is determined based on the data given in Table 3:

Market price elements of the object are assessed by the company's managers based on those changes in the market situation that are expected in the area where the investment object is located (for example, a sharp increase in demand for industrial buildings, etc.). Calculations must also be carried out in nominal (forecast) prices, taking into account inflation. We take the item “costs” from Table 1 (these data correspond to initial cost fixed assets at the start of the investment project), and the depreciation values from Table 2. The residual value is defined as the difference between the initial costs (the cost of acquiring real assets) and depreciation. “Dissolution costs” are estimates projected by the firm's managers.

Capital gains (line 6) apply only to land and are defined as the difference between its market (line 1) and residual (line 4) values less liquidation costs. Depreciation costs for land are not charged. Operating income (losses) relates to the remaining elements of capital, that is:

(line 7) = (line 1)[(line 4)+(line 5)]

The net liquidation value of each item is the difference between its market value (line 1) and the amount of tax withheld (line 8). At the same time, we must remember that if there is a negative value (losses) in line 7, then on line 8 the income must be shown with a “minus” sign and its value is added To market value when calculating net liquidation value.

Let us transfer the data from Table 3 to Table 1, keeping in mind that for each element of capital funds at the liquidation step, the costs will be taxes, and the revenues will be their market value.

Based on the data in Tables 1 and 2, you can begin to calculate the net present value of the project.

Cash flows from financial activities F3 It is recommended to calculate according to Table 4:

Current balance of real money b(t) determined through B(t) according to the formula: b(t)=B(t) B (t 1), while the initial value of the balance of accumulated money B (0) is taken to be equal to the value of the amount in the current account of the project participant at the initial moment t = 0. A necessary criterion for making an investment decision in this case is the positive value of the balance of accumulated money B(t)at any stage investment project. A negative balance of accumulated cash indicates the need to attract additional borrowed or own funds.

Thus, using tables (1) (4), using the methodology for calculating the indicators indicated in them, you can find the net present value of the project and determine the feasibility of investing in it.

Enterprise operations including the acquisition and sale of intangible assets, shares of shares in the conditional capital of joint ventures, other securities (not being short-term investments), as well as the issuance of long-term loans to other enterprises and individuals and their subsequent return, represent the main components of its investment activities. .

Investment activities are related to the sale and acquisition of long-term use property

Cash flows arising from investing activities reflect the level of production costs for resources intended to generate income and future cash flows.

Cash flow from investment activities summarized in the section “Investment activities”

Cash flows from investing activities include:

For example, an enterprise receives income from the operation of acquired fixed assets not immediately after their purchase, but throughout the entire period of their purchase, but during the entire period of their operation. Likewise long-term securities may generate future dividend income and influence future cash flows through the amount of dividends received.

We will analyze the cash flow for investment activities at the Zhemchuzhina LLC enterprise for three years (2004-2006)

Table No. 2

Analysis of cash flows for investment activities

|

Indicators |

Off(+/-) 2004-2005 |

Off(+/-) 2005-2006 |

||||

|

Receipt of DS, total |

||||||

|

Interest received |

||||||

|

Dividends received |

||||||

|

Including from abroad |

||||||

|

Other supply |

||||||

|

DS expenses, total |

18 |

|||||

|

Cash payments for the purchase of long-term assets |

||||||

|

Net receipts (disposals) of VA from investment activities |

- 18 |

138 |

-138 |

From table No. 2 and diagram No. 2 it is clear that Zhemchuzhina LLC in 2005, compared to 2004, increased its sales income due to the disposal of long-term assets (81 thousand lei) and other income.

Cash expenses at the enterprise also decreased slightly (- 6 thousand lei) associated with the acquisition of long-term assets.

And in 2006, no investment operations were carried out.

Income from investment property Disposal from investment property

Diagram No. 2. Analysis of cash flows for investment activities

As follows from Table No. 2, Zhemchuzhina LLC does not use the funds received to purchase fixed assets, which would normally be reflected as a negative flow from investment activities. Lack of proper attention to this aspect can provoke difficulties in the process of carrying out operational activities due to insufficient technical potential.

Financial activity of the enterprise- this is a set of operations related to raising capital to finance its activities. The result of financial activity is a change in the size and composition of the enterprise's own and borrowed capital.

Financial activity is an activity the results of which is a change in the size and composition of the equity capital and borrowed funds of the enterprise.

An enterprise is considered to carry out financial activities if it receives resources from investors and owners, returns them, receives and repays loans and pays dividends.

Cash inflows and outflows associated with financial transactions are included in a separate section of the report because this information allows us to predict the future amount of cash to which investors will be entitled.

Cash flows from financing activities are summarized in section "Financial activities".

Information about cash flows resulting from financial activities is very important as it allows users financial reports find out why the company's equity capital increased or decreased, what changes and why occurred in the size and composition of long-term and short-term liabilities. In addition, this information is useful in forecasting future cash flow requirements from investors and creditors. Financial activities are designed to increase the funds at the disposal of the enterprise for financial security operating and investment activities.

For each area of activity it is necessary to sum up the results. It is bad when operating activities are dominated by cash outflows; this indicates that the funds received are not sufficient to ensure the current payments of the enterprise.

Cash flows from financing activities include:

In this case, the lack of funds for current expenses will be covered by borrowed resources. If, in addition, there is an outflow of funds from investment activities, then the Financial independence enterprises.

We will analyze the cash flow for financial activities at the Zhemchuzhina LLC enterprise for three years (2004-2006)

The data provided in table No. 3 allows us to see that cash receipts from financial activities were associated only with obtaining loans and credits. This is due to the fact that due to a shortage of funds for the operating activities of Zhemchuzhina LLC, it is necessary to attract additional funds to cover its expenses

Table No. 3

Cash flow analysis for financial activities

|

Indicators |

Off(+/-) 2004-2005 |

Off(+/-) 2005-2006 |

||||

|

DS receipts, total |

12 588 |

12 260 |

- 328 |

- 4 923 |

||

|

Cash payments in the form of loans and borrowings |

||||||

|

Cash receipts from the issue of own shares |

||||||

|

DS consumption, total |

9 589 |

10 810 |

+ 3 239 |

+ 1 221 |

||

|

Cash payments on loans and borrowings |

||||||

|

Dividend payments |

||||||

|

Including nerez. |

||||||

|

Cash payments upon repurchase of private shares |

||||||

|

Other DS payments |

||||||

|

Net receipts (payments) of DS |

6 237 |

21 671 |

+15 433 |

-6 144 |

Although it must be said that from year to year loans and borrowings are decreasing, in 2005 compared to 2004 by 327,770 lei, and in 2006 compared to 2005 by 4,922,790 lei. But as can be seen from the table data, this led to the emergence of a negative net inflow (outflow) of funds from financial activities.

Receipt from financial Disposal from financial

activity (thousand l.) activity (thousand l.)

Diagram No. 3. Analysis of cash flows from financial activities.

From the above diagrams you can see, as well as the data balance sheet The enterprise confirmed that the loans received are short-term in nature and require their rapid repayment. Consequently, due to a lack of funds, the enterprise Zhemchuzhina LLC is not able to issue or buy back its own shares.

All three types of activities we considered form a single sum of the enterprise’s monetary resources, normal functioning which is impossible without the constant flow of cash flows from one area to another. The very existence of the three areas of the organization’s activities is aimed at ensuring its performance. Even profitable production - economic activity may not always bring in a sufficient amount of money to purchase non-current assets(real estate or equipment). In such situations, new loans are necessary, the cost of which must be offset by future investment income. In the context of a non-payment crisis, enterprises are forced to seek additional short-term financing for working capital. But expenses for such purposes cannot be offset by future income, since the money was not used for investment.

We will carry out a structural analysis of cash flow at the Zhemchuzhina LLC enterprise.

Structural analysis presents users financial statements detailed information regarding the origin of cash receipts and their further use. The analysis examines the relationships between various channels of cash inflow and outflow. Structural analysis allows you to evaluate the contribution of each component element of cash flow in the formation of the overall flow.

IN economic theory and economic practice, two technical methods are used to carry out structural analysis of cash flows. The essence of the first method is a separate study of the structure of cash receipts and payments, calculating the share of each component element in the total amount of receipts and payments, respectively. When using this method during the preparation process analytical materials Pie charts are often constructed, with the help of which the structure of cash flows is presented in a more accessible form.

Based on the cash flow statement data for the last two years, we will compose an analytical table, construct diagrams and interpret the results obtained.

Using data from column 6 of table No. 4, we present the structure of cash flows at the Zhemchuzhina LLC enterprise in reporting year using diagram No. 4. In 2004, the main elements forming the cash flow at the Zhemchuzhina LLC enterprise are sales receipts (44.84%). Receipts in the form of loans and borrowings amount to 38.39%, and other receipts - 16.77%. this indicates the efficient functioning of the enterprise.

Table No. 4

Separate analysis of the structure of cash receipts and payments

|

Money |

|||||||

|

Cash receipts |

|||||||

|

Sales proceeds |

|||||||

|

Other income from operating activities. |

|||||||

|

Receipts in the form of loans and borrowings |

|||||||

|

Cash proceeds from disposal of long-lived assets |

|||||||

|

Total cash receipts |

19 378 |

||||||

|

Cash payments |

|||||||

|

Payments to suppliers |

|||||||

|

Payments to staff |

|||||||

|

Payment % |

|||||||

|

Income tax payments |

|||||||

|

Other operating payments |

|||||||

|

Payments on loans and borrowings |

|||||||

|

Cash payments for the acquisition of long-term assets |

|||||||

|

Total cash payments |

32 677 |

100 |

18 304 |

Diagram No. 4. Cash receipts and payments at the enterprise Zhemchuzhina LLC in 2006.

From the data in table No. 4 and the information presented in diagram No. 4, it follows that a significant part of payments falls on suppliers (61.25%), 19.45% - on payments on loans and borrowings, 14.2% - on other operational expenses, and the rest is the share of payments to staff (2.11%), interest payments (2.55%)

In 2005, receipts from sales decreased to 36.57%, and receipts in the form of loans and borrowings increased to 56.11%.

In 2006, as in 2004, receipts from sales were higher (than receipts in the form of loans and borrowings (37.86%)

In 2005, most of the payments go to repay loans and borrowings (44.06%), and in 2006 this item accumulates the main amount - 52.18% of total amount payments. The share of suppliers accounts for 39.97% in 2005, and in 2006 - 37.93%.

Among structural changes the appearance in the reporting year of payments for income tax, whose share was 0.03% of the total amount cash payments.

The political factor, as mentioned above, significantly influenced operational activities. Consequently, this is what provoked the enterprise Zhemchuzhina LLC to acquire more credit, which entails an annual increase in loan payments.

Having analyzed three recent years functioning of Zhemchuzhina LLC, we can come to the conclusion that the situation regarding the inflow and outflow of funds is quite stable. This is due to the fact that the enterprise has specialists who try to use funds efficiently, control both the flow and outflow, thereby trying to sustain the enterprise during the crisis and prevent it from going bankrupt.

Among the structural changes, the emergence of income tax payments in the reporting year, the share of which amounted to 0.03% of the total amount of cash payments, stands out. In the long term, the direct method of calculating the amount of cash flows makes it possible to assess the level of liquidity of the enterprise.

Let's analyze cash flow using the coefficient method. This method is often used in foreign analytical practice to assess the situation regarding cash flows. The peculiarity of the method is the calculation financial ratios, which reflect the different ratios between funds received and used. These ratios are very numerous and varied, but for the most part, they characterize the ability of the enterprise to satisfy certain needs due to the availability of funds.

In particular, using this method in the analysis of cash flows, the coefficients presented in table No. 5 can be calculated.

The results of the analysis (conducted in table No. 5) indicate that the level of cash flow adequacy at the Zhemchuzhina LLC enterprise has sharply increased.

Table No. 5

Analysis of cash flow ratios for Zhemchuzhina LLC

Diagram No. 5

If in 2004 the enterprise generated, as a result of operating activities, a net operating flow, which was one time less than what the enterprise required, then in 2006. The situation has developed that the company satisfies its needs almost 100%. This is due to the fact that Zhemchuzhina LLC used a loan.

Diagram No. 6

As can be seen from diagram No. 6, calculation of the degree of coverage of cash flow obligations shows that during 2004. and 2005 the situation is characterized by the absolute inability of the enterprise to repay debts without external financing. In 2006 The enterprise Zhemchuzhina LLC, with the help of cash received from operating activities, covered 11% of the total amount of liabilities existing at the end of the year. This indicates that the company has become more creditworthy.

The adequacy ratio is at a very low level absolute liquidity assets at the Zhemchuzhina LLC enterprise.

Diagram No. 7

If in 2005 it increased by 3.74 days (from 1.66 in 2004 to 6.21 in 2005), then in 2006 decreased significantly at the end of 2006. Zhemchuzhina LLC has absolutely liquid assets in an amount that would allow average transaction payments to be made within 0.70 days.

Diagram No. 8

From the calculations made in table No. 5 and diagram No. 8, it follows that the degree of reinvestment of funds into the enterprise Zhemchuzhina LLC in 2005. (18.01%) exceeded the recommended level (8-10%).

And in 2004 and 2006 reinvestment of funds did not take place at all due to the formation of an operational clean flow from operating activities.

In the long term, the direct method of calculating the amount of cash flows makes it possible to assess the level of liquidity of the enterprise.

In operational financial management, the direct method can be used to monitor the process of generating revenue from the sale of products (works, services) and draw conclusions regarding the adequacy of funds to pay financial obligations.

The disadvantage of this method is that it does not take into account the relationships between the obtained financial result(profit) and changes in the absolute amount of funds of the enterprise.