Cash discipline is a requirement that must be met at all enterprises. It is established by the norms of the legislation and carried out in accordance with this. In other words, companies in without fail must strictly follow a certain cash limit.

Why do you need to calculate the cash limit?

The cash limit is not an invented value, but the cashed out funds of the company, which are constantly available in the cash desk of the enterprise. It is established by the Central Bank of the Russian Federation, taking into account certain conditions. In situations where, at the end of the working day, an amount remains that is more than the established norm, then the money must be transferred from the cash desk to a banking organization or to other settlement accounts.

For example, for a firm, a limit of 100 thousand rubles is set. If at the end of the working day it is exceeded, then the excess funds are transferred to the bank that services this legal entity. There are some situations when keeping cash in excess of the norm is allowed and is not illegal:

- if the money is intended for the issuance of salary within 3 days from the date of receipt;

- on a weekend or holiday.

In all other situations, the presence at the cash desk of money in excess of the norm is fraught with administrative responsibility for the head: the fine that is imposed on the legal entity is 50 thousand rubles, on the head - 5 thousand rubles.

Economic goal setting a cash limit is aimed at ensuring that the company's money does not lie "dead weight", but works, being on the company's bank accounts. The Federal Tax Service checks the fulfillment of the cash discipline of enterprises once every 2 years. TO violations Facts found include:

- There is no issued order to determine the limit. In this case, any cash on hand is considered to be in excess of the norm.

- Availability of funds in excess of the established norm.

- Availability of funds not held by the accounting department according to the incoming documentation.

- Exceeding the 3-day deadline for issuing salaries to employees.

When should a residual limit be set?

Residual cash limit- these are the funds that are present in the cash desk of the company at the end of a certain period in the form of cash. Its size is set by the enterprise by calculating according to the formula proposed by the Central Bank.

Companies that do not qualify as small businesses must set their own allowable limit. It is this amount that can be in the cash desk of the organization in the form of cash when the working day is over. Funds that exceed the limit, the accounting department should not store in the organization itself, only in a bank or other banking institution.

The calculation is made internally in order to control the amount of residual cash at the end of the working day. The restriction must be established for legal entities that have cash in circulation received from the provision of services or the sale of products. The enterprise should employ more than 100 thousand people and the company's profit for reporting period should be more than 400 thousand rubles.

How to calculate cash limit?

There is an indication of the Central Bank No. 3210, which contains the calculation norms. It provides 2 options:

- According to the amount of cash receipts that the company receives from the sale of products, the performance of work or the provision of services.

- Based on the amount of cash and taking into account the exclusion of money that is intended for companies or other payments to staff.

The head of the organization, as a representative of this legal entity, independently sets the amount of the cash limit in the order, guided by the appendix to the Directive of the Central Bank, in accordance with the nature of the business activity of the enterprise and approves the decision in banking organization.

It is worth noting that legal entities, the number of employees of which is up to 100 people, and the revenue does not exceed 400 million rubles. per year may not determine the residual cash limit of cash. But the waiver of the previous limit, if one has been established, must be executed in the form of a local act - an order of the employer.

This video explains the procedure in more detail and possible ways establishing a cash limit at any enterprise.

Calculation procedure

The Central Bank offers 2 types of settlements (in accordance with Regulation No. 373-P):

- For companies that receive revenue in cash, norm of residuals Money at the checkout is calculated by the formula:

Values of the components of the formula:

- L is the size of the restriction;

- V - the volume of all funds that came in cash to the cash desk of the enterprise;

- P - the number of calendar days for which the cash desk is calculated (no more than 92);

- N - the period during which the money was placed on the bank's current account (no more than 7 days).

- For companies that carry out financial transactions in a non-cash way.

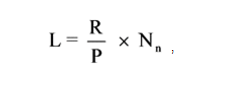

Formula: L = R / P × N

Values:

- L - cash limit according to the order;

- R - amounts issued for the reporting period;

- P - billing period;

- N - the time that has passed since the receipt of cash in the bank (no more than 7 days).

The value of N can be increased for an enterprise up to 14 days if there is no branch in the locality where it is located desired bank.

Calculation example

As an example, consider the settlement period of enterprise X for March 2016. This enterprise makes a profit from the sale of products in cash. Thus, the calculation of the cash desk will be made according to formula No. 1. The duration of the period based on the production calendar was 21 days. The organization transfers cash to the bank every 3 days. In March, the company earned 450,000 rubles. All the values by which the limit can be calculated are known:

V - 450,000 rubles.

P - 21 days

Substituting the values into the formula, we get the desired figure: (450,000 / 21) x 3 = 64,286 rubles. The calculation is made on the official letterhead of the enterprise, which is signed Chief Accountant. The document must indicate the date from which the calculation made begins to operate.

The scheme for calculating the cash limit of enterprises was developed by the Central Bank of the Russian Federation and includes specific indicators: the amount of earned funds, the periods of calculation and delivery to the bank. When calculating the limit, it is necessary to take into account important points:

- For the calculation, a period of no more than 92 days is taken into account, taking into account the company's work schedule.

- Income includes the amount received from financial activities company and received at the cash desk in the form of cash.

- The transfer period is set by the enterprise itself, but within the prescribed 7 days or 14 days if the bank branch is removed from the enterprise.

Calculation of the cash balance limit at the cash desk

The cash rate is calculated according to one of the two formulas that are prescribed in the Directive of the Central Bank No. 3210-U. This amount is determined in ruble equivalent. If an incomplete amount is obtained during the calculation, then according to the Letter of the Central Bank No. 36-3 / 1876, it must be rounded according to traditional mathematical rules: the balance equal to 50 kopecks or more is rounded up, the amount that does not reach 50 kopecks reduces the total amount limit.

All enterprises, except small ones, must calculate the limit amount. The calculation formulas introduced in 2012 have not changed to this day, but today companies have the right to choose whether to calculate the rate of income or expenses. If a company conducts financial transactions only on non-cash payment, then their limit is zero. Any amount of cash on hand at the end of the working day will be a violation. In any case, it is necessary to have an order at the enterprise, indicating the size of the limit.

You can download the form of the order to establish a cash limit, and to cancel it -.

In order not to constantly monitor the limit cash desk and not to issue periodically orders to establish a new norm, it is recommended not to indicate the period of its validity in the first order. In this case, it will be considered perpetual by default.

Form for calculating the cash limit

The results of the settlement actions of the accounting department of the enterprise for calculating the cash limit are entered in a special form of form No. 0408020 and are an annex to the order. The document is executed in 2 copies: one remains at the enterprise, the second is provided to the bank that services the company.

Thus, the order acquires the status of an official paper, on the basis of which a cash limit is established in the cash desk of the organization, and it is given permission to use cash that comes to the cash desk as a result of financial transactions.

The application can be drawn up on the official letterhead of the enterprise, it is signed by the chief accountant and the head of the legal entity. The main points of the document:

- Company income.

- Costs and expenses.

- Payments made.

- The time frame in which the legal entity must hand over profits to a banking organization.

- Period of operation of the enterprise.

- Time of delivery of proceeds.

- Limit amount.

- Signatures of responsible persons: chief accountant, director.

- The decision of the banking organization to approve the calculated limit and permission to use funds in excess of the norm.

- Bank manager's signature.

If the company changes in the amount of revenue, that is, it increases or falls, then the limit is recalculated. All actions related to changes must be reflected in the local acts of the company.

How long is the residual cash limit set for?

The instructions of the Central Bank of Russia do not set limits on the time period during which the limit rate should be in effect. Any term may be set at the discretion of the head of the company. Experts recommend not specifying a specific limit period, this is not a violation. In this case, it will be considered indefinite.

There is another side of the problem when there are changes in the size of the company's income in the direction of decreasing or increasing. In this situation, the cash limit should be changed. This is especially necessary if the company's revenue has grown, then more than large sums, so it is appropriate to increase the limit.

The legislative framework

The main documentation covering issues on the cash limit:

- Regulation of the Bank of the Russian Federation No. 18.

- Instruction of the Bank of the Russian Federation No. 3214-U.

- The Tax Code of the Russian Federation (clause 5, article 346.26) - on compliance with the limit by all enterprises, except for small businesses.

- Letter of the Bank of the Russian Federation No. 36-3 / 1876 - on rounding off the value of the limit;

- Code of Administrative Offenses, Art. 2.4, 15.1 - on the responsibility of officials for non-compliance with the rules.

- Code of Administrative Offenses, art. 2.1-2.2 - on the conditions for recognizing officials as guilty of inaction or deliberate acts of accumulating cash at the cash desk in excess of the prescribed norm.

In 2014 Central bank The Russian Federation has made significant changes in the legislative framework regarding the establishment of restrictions on the storage of cash at the cash desk of a legal entity, therefore, before determining the amount and limiting, it is imperative to familiarize yourself in detail with the regulatory legal acts that regulate these issues.

The need to calculate a certain rate of keeping cash has not lost its relevance, despite all the changes that have affected this procedure. Failure to comply with legislative acts is fraught with administrative penalties for officials, so it is still worth setting a money limit and not keeping funds in excess of it.

A lot depends on proper bookkeeping in enterprises. A qualified accountant who professionally and accurately performs his official functions is able to protect the organization from claims from regulatory authorities: the tax service, the labor inspectorate, etc. Among other mandatory procedures that an accountant must carry out include compliance with cash discipline, including setting a cash limit .

Deciphering the concept of "cash limit"

If to speak plain language, then the phrase “cash limit” is deciphered quite simply: this is the maximum allowable amount of cash in a cash vault, safe or cash desk of a commercial company at the end of the day. This norm was introduced by the Central Bank of the Russian Federation, and the accounting department of the enterprise should set this limit individually at the beginning of each calendar year.

Setting and maintaining a cash limit is a headache for many accountants. In order to avoid surpluses, they have to constantly monitor cash, and if money suddenly becomes more than the established norm at the cash desk in the evening, then the accounting department representative needs to go to the bank in order to. Otherwise, it is unlikely that it will be possible to avoid administrative punishment during any verification.

As it was before

Previously, absolutely all enterprises and organizations dealing with cash had to limit the residual funds on hand. Since June 2014, this practice has changed: now some business representatives may not set limits. Not surprisingly, many wanted to exercise this right.

However, audits conducted by the tax authorities found some violations caused by insufficient knowledge legislative framework for unlimited content cash balances and, as a result, applied penalties to a number of enterprises and organizations.

That is why, in order to avoid claims from tax services, you need to exercise the right to an unlimited cash register competently and with a clear understanding of all the rules of this process.

In what cases is it permissible to exceed the limit at the checkout?

As stated in the law, on strictly defined days, enterprises and organizations can quite legitimately allow cash surpluses. In particular:

- If payment is expected wages, social, financial assistance, scholarships, etc., but not more than five working days from the date of withdrawal of money for these purposes from the company's current account;

- If cash transactions are carried out on non-working holidays or weekends, the cash desk may also have amounts above the limit values.

Any other circumstances cannot justify exceeding the limit and will inevitably result in administrative penalties in the form of fines.

Penalties for exceeding the financial limit at the box office

Monetary penalties for exceeding the amount of revenue stored at the cash desk are quite significant:

- Legal entities(enterprises and organizations) may be fined from 40 to 50 thousand rubles.

- Individual entrepreneurs, as well as officials (accountants or managers) of commercial companies are subject to a fine of 4 to 5 thousand rubles.

If you can’t, but really want to: the right to waive the cash limit

This right can be exercised commercial companies related to small business, as well as all individual entrepreneurs and regardless of their tax regime.

Refusal of the limit at the checkout does not imply any special actions, it is enough just to meet certain parameters:

- marginal revenue- no more than 800 thousand excluding VAT for services performed and goods sold;

- limited staff- for the last calendar year the number of employees in the enterprise should not exceed 100 people;

- participation in the authorized capital- no more than a quarter of the share of other legal entities.

If the company falls under these requirements, then it can safely keep unlimited financial resources in cash.

In cases where the right to no cash limit arises not since registration enterprise, and, for some other reason, in the course of its activities, then in order to use it, the management of the enterprise needs to take the following steps:

- In a written decision to cancel the previously issued order on the establishment of a cash limit;

- Issue a new order, where it will be written that from such and such a date there is no cash limit.

Setting a cash limit: procedure and rules

As mentioned above, all large enterprises and organizations are required to introduce cash limits. If this is not done, then by law the cash limit is considered zero. In order to set a limit on the finances stored at the cash desk, the head of an enterprise or organization needs to issue an appropriate order. There is no need to submit any applications or notifications to the tax authority.

Attention! On their own initiative, individual entrepreneurs or legal entities operating in the field of small and medium-sized businesses can set a cash limit.

As a rule, the rationale for such actions is the desire to ensure control over the safety of cash. At the same time, one must understand that if the corresponding order is issued and the cash limit is set, then the accounting department of the enterprise or individual entrepreneur is obliged to comply with it, and take all the excess to the bank. If any violations are found during the audit, the tax inspectorate will certainly resort to administrative punishment.

How to calculate the cash limit

This question is of most interest to beginner accountants. You don’t need to break your head over it - the calculation options are provided for by law:

- By the volume of cash receipts according to the formula:

Limit = Revenue / Settlement period x Days

- By the volume of cash withdrawal (if there is no cash proceeds) according to the formula:

Limit = Issues / Billing period x Days

Explanations:

Revenue- the amount of funds from the sale of services and the sale of goods. If the enterprise has just been created, then here you need to indicate the estimated amount of income;

Billing period– from 1 to 91 days inclusive. It can be chosen absolutely arbitrarily;

days– from 7-14 business days between cash withdrawals. It should be remembered that the smaller the number of days, the less money should remain in the cash register.

Thus, if an enterprise is in force statutory circumstances, it is obliged to strictly observe cash discipline, conduct an evening calculation of daily earnings and transfer balances to the bank, then this must be done in accordance with all the rules and regulations established by the legislator. Otherwise, it is unlikely that it will be possible to avoid administrative sanctions from the controlling structures.

Setting a cash limit is a mandatory procedure for any accountant at the beginning of each year. This norm was introduced by the Central Bank, and from year to year accountants must calculate a different cash limit.

The order of the Central Bank states that absolutely all organizations (legal entities) and individual entrepreneurs are required to determine the limit of cash that is stored at the cash desk. And each firm or company clearly understands that all the proceeds per day cannot be stored in the cash register, for this the concept of a cash limit was introduced - this is the amount that should remain in the safe or vault of the organization at the end of the work shift or day. All funds over this amount must be kept outside the company - in the bank account of the same organization.

This approach, in addition, is also a guarantee of security, it is not for nothing that cash-in-transit vehicles perform their duties every day, serving various enterprises.

Data on how much the cash limit of the enterprise is, are fixed in the constituent document. For example, it may be an order, which must be certified by the signature of the head and his seal.

Control over a particular company lies with the bank that serves it. Inspections by the bank are carried out once every two years, and if a violation is noticed during such an inspection, then the bank employees record this violation, and then they are required to notify tax office. The company can be brought to administrative responsibility, and the violation is issued by the INFS.

Company executives and their accountants need to be clear about what constitutes a violation of cash balances:

- if a limit order is set for the company, but the limit itself is not assigned, then any money in the cash register that goes above the limit (except for salary money and bonuses) will be considered an excess amount;

- if the amount is accumulated, which exceeds the limit and it is in the cash register, then this circumstance is a direct and true violation of the limit;

- it is forbidden to keep cash at the cash desk, which is not carried out according to receipt type documents (cheques, invoices);

- if the cash desk has a limit in the amount of the salary amount of employees, then it must be issued within three days - during this period this amount will not be considered a limit.

All of the above violations can be punished by a fine, which is about 40-50 thousand rubles from companies and organizations, and 4-5 thousand rubles from the official responsible for order at the cash desk of the enterprise. Therefore, it is worth understanding how important it is to comply with the rules on limits at the cash desk, not to exceed them and always keep the cash at the cash desk in perfect condition, confirming this with the appropriate cash documents, and one more thing - it is important to correctly calculate the cash limit. For this, the amount of income that the cashier receives for the work shift is taken into account.

Formulas for calculating the limit at the box office are offered by the Central Bank of the Russian Federation, and there are two such formulas. And these formulas are not chosen for calculation, since they have different purposes: the first is needed for organizations that receive cash proceeds, the second is for those firms in which there is no cash flow.

- The first formula looks like this: L \u003d V / P x N,

L V this case, is the size of the limit,

V- the amount of money that was received by the cashier for the calculated period;

R- the number of days for which the calculation should be made, in this case it cannot be more than 92 days;

N- frequency, calculated in working days, this is the number of placement of money in a bank account, the frequency with which money is transferred to the bank ( maximum value- 7 days).

- The second formula looks a little different: L= R/Pх N, Where

L- all the same limit of money in the box office;

R- the volume of payments that are made from the cash desk of the enterprise for the period under review (money intended for salaries is not taken into account);

R- billing period;

N- the period elapsed between the receipt of funds at the bank on the basis of a check of a check document (also no more than seven days).

But the indicator N may be slightly increased and reach 14 working days, if in the locality at the place of work this enterprise there is simply no bank branch.

We will try to consider the correct calculation of the cash limit using a simple example:

The enterprise "Ivolga" for 92 days of working days received a profit in the amount of 4 million rubles. The store is open seven days a week, and cash is handed over to the bank every other day. From the specified information, you can already form a formula:

4,000,000 / 92×2 = 87,000 rubles

If the proceeds are sent to the bank account less often, then the limit will be higher. If once a week, then the limit will be 217,000 rubles.

Let's look at another example:

The Sekunda-Service enterprise does not accept cash from customers, the enterprise operates from Monday to Friday, and money is received at the bank branch according to the submitted check - once a week. The volume of withdrawals from the cashier's cash desk in April amounted to 560,000 rubles. Here, the cash limit is calculated using formula No. 2 and looks like this:

560,000 / 22×5 = 127,000 rubles

Both the first and second examples have one identical condition - the money set aside for paying salaries to company employees is not taken into account for calculation.

Sometimes there are difficulties with determining the frequency with which it is necessary to deposit money in the bank. This indicator can be determined:

- based on the agreement with the bank, if it has a given period;

- outcomes from the total number of days that occurs between collections, if the proceeds must be handed over to collectors;

- from the time intervals in fact between the days of cash delivery to the bank - if the company does it on its own, without the help of collectors.

When determining the value of the limit by the formula, it is most likely that the result will be a value with fractions. In this case, you need to take into account that the value of the cash limit (that is, L) must have a ruble expression. A fair question arises: what to do with the pennies? Representatives of the Central Bank advise using the rules of mathematics: values up to 50 kopecks are discarded, and over 50 kopecks are rounded up to the full value. Such rounding is quite legitimate and such cases will not lead to violations.

The provisions of the order do not provide for some reason to revise the size of the cash limit. This rule is explained by an additional Letter from officials from the Central Bank of the Russian Federation. It says the following: if the volume of cash receipts changes or the rules for issuing funds are adjusted, then the need to review the limit value on the cash desk is assigned to the business entity, that is, the head of the enterprise.

The provisions of the order do not provide for some reason to revise the size of the cash limit. This rule is explained by an additional Letter from officials from the Central Bank of the Russian Federation. It says the following: if the volume of cash receipts changes or the rules for issuing funds are adjusted, then the need to review the limit value on the cash desk is assigned to the business entity, that is, the head of the enterprise.

It can be concluded that it is quite possible to work with the previous cash limit also with a decrease in revenue and with a complete transition to work by bank transfer, and vice versa, if previously work was carried out by bank transfer, and now cash has begun to be accepted. Also, with an increase in revenue, accounting department companies have the right to recalculate the cash limit, which is understandable.

Let's clarify for understanding: in order for the cash limit to be set, you need:

- make a calculation this indicator;

- have an Order or instruction to set a limit.

The cash limit is a mandatory procedure for almost every company (if there is an order), and responsible employees must adhere to this value when working with cash and non-cash funds.

Budget employees like everyone else economic entities those carrying out cash transactions are required to conduct. When administering budget accounting cash flow should be guided by:

- Orders of the Ministry of Finance No. 157n dated 012.2010, No. 174n dated 12.16.2010

- Instructions of the Central Bank of Russia No. 3210-U dated March 11, 2014.

- Order of the Treasury of the Russian Federation No. 8n dated 10.10.2008

- Law "On CCP" dated May 22, 2003 No. 54-FZ.

For violation of the procedure for conducting cash transactions, administrative liability is provided in the form of fines:

- on executive- up to 5,000 rubles,

- on entity- up to 50,000 rubles (Article 15.1 of the Code of Administrative Offenses).

Cash balance limit for 2019

The maximum allowable amount of cash that can be stored in specially equipped premises for cash transactions in a state institution after the completion of the work shift and the withdrawal of the balance on cash book, is called the cash balance limit.

The organization independently determines the cash balance limit, this is enshrined in clause 2 of the Instructions of the Central Bank No. 3210-U. But this does not mean that the head or other official of a state institution has the right to set any amount of money.

The correct calculation of the cash balance limit must be carried out in a certain order, otherwise the organization may be punished. Moreover, the calculations made will have to be fixed in the local act of the budgetary institution. Also at the disposal of the head must be appointed responsible persons, usually it is the cashier and the chief accountant.

The approved maximum allowable amounts can be recalculated at any time, or not recalculated at all, this is stated in paragraphs 8, 9 of the Letter Central Bank RF dated February 15, 2012 No. 36-3/25. What does it mean? If the organization increases cash money turnover, the recalculation can be made on any day. Conversely, if the organization notices a decrease in cash flow, then it is not necessary to reduce the limit.

How to calculate cash balance limit

The procedure for calculating is fixed in the Appendix to the Instructions of the Central Bank No. 3210-U. The algorithm provides for two types of calculations: on receipts or on disposals. In order for an organization to make the correct calculations, it should determine which transactions are more.

For example, state-financed organization The Museum accepts payment for tickets in cash. 90% of the organization's expenses are made by non-cash payments. Therefore, the maximum allowable amount of cash must be calculated in the first way - by receipts. Or vice versa, the state institution "Rural School" gives employees cash on account (travel allowance, purchase of fuel, spare parts, household and stationery). Proceeds from entrepreneurial activity missing. In this case, you need to calculate by disposals.

The cash balance limit at the cash desk is set according to the formulas. Let's analyze each separately.

Calculation of the balance limit on receipts

- V - the total indicator of cash receipts from the sale of goods / works / services in rubles, for a specific billing period.

- Nc - the period of time between the days of delivery to the bank of the cash received from the sale.

Retirement Limit Calculation

- L - determined the maximum allowable amount of cash balance.

- R is the total indicator of cash withdrawals for a specific billing period. Exception: payment of wages, scholarships, state benefits and other similar payments.

- P - number of days in billing period. The period is set by the institution independently, and cannot be less than 1 business day and not more than 92 business days.

- Nn - the period of time between the days of receiving cash by checks in a banking organization, with the exception of funds for the payment of wages, scholarships, benefits.

Indicators Nn and Nc cannot be more than 7 days. Exception: the organization of the public sector is located in an area where there are no banking organizations, then the indicators cannot be more than 14 days.

Calculation of the cash balance limit in the cash register of 2019 of a separate institution

If there are separate divisions or branches, then the calculation of the maximum allowable cash balance should be made taking into account some features.

First of all, we determine the independence of a separate subdivision according to the following criteria.

|

Option 1 |

Option 2 |

|

|---|---|---|

|

The receipt of cash at the cash desk of a separate subdivision is carried out |

Through the cash desk of the parent organization |

Through the office of a banking organization |

|

Cash withdrawal is made |

To the cash desk of the head office |

To a current account opened with a banking organization |

|

Checking account |

Opened in the name of the parent organization |

Opened in the name of a separate subdivision (independent settlement account) |

|

Specially equipped place for cash storage and cash transactions |

Only suitable for cash flow transactions |

Fully equipped |

If a branch or territorial branch is characterized in accordance with the first option, then the calculated indicators for the unit for the billing period should be included in the calculation of the cash balance limit. If the branch corresponds to the second option, for such a separate subdivision, you should make your own calculation of the cash limit, separate from the calculations of the parent state institution.

We form an order to approve the cash limit

A unified form for the order of the head, as well as required details not provided for by law. An order or instruction is formed in any order on the letterhead of the institution.

The calculation of the limit does not take into account payments to employees: salaries, scholarships, benefits, etc. But dividends do not apply to such payments. Therefore, if the organization does not have cash proceeds, calculate the limit based on the volume of previously paid dividends. Such a conclusion can be drawn based on the provisions of paragraph 2 of the appendix to the Bank of Russia Directive No. 3210-U dated March 11, 2014 and Article 43 tax code RF.

In order for the limit to be with a margin, it is not necessary to take all the days of dividend payments. Indeed, for the billing period, only limit value- 92 working days. Include in the calculation the days when the amount of payments was maximum. It may be one day.

For example, in the previous year, dividends totaling 100,000 rubles. paid within three days:

- first day - 2000 rubles;

- the second - 60,000 rubles;

- third - 38,000 rubles.

When calculating the cash balance limit, it is optimal to include only the second day in the calculation, when the payout amount was the largest.

The company receives money in the bank only for the payment of dividends, so the frequency of receiving money in the bank for calculation was taken as maximum - 7 days. As a result, the limit will be 420,000 rubles. (60,000 rubles: 1 day × 7 days).

Newly established organization

If the organization was created recently, then determine the limit

Separate divisions

If the organization has separate subdivisions, set a cash balance limit for each of them. At the same time, the procedure for calculating the cash balance limit for structural divisions organizations (branches, representative offices, geographically remote outlets, etc.) depends on where they donate cash.

If a separate subdivision credits revenue to the current account, bypassing the cash desk of the parent organization, set a limit for it without taking into account the limits of other subdivisions and the limit of the parent organization. That is, in this case, the cash balance limit will need to be set separately for:

- parent organization;

- separate division of the organization. Provided that the money is not handed over to the cash desk of the parent organization.

But what if a separate subdivision was created recently and there is no movement of money in its cash desk yet? Then, to determine the limit, use based on the expected cash proceeds, and in its absence - issuance of cash. This procedure follows from clauses 1 and 2 of the appendix to Bank of Russia Directive No. 3210-U dated March 11, 2014.

An example of determining the cash limit for a new division of the organization. Cash deposited in the bank

In January, Hermes Trading Firm LLC opened a separate subdivision. The proceeds will be credited to the bank account. The calculation of the cash balance limit is based on the expected volume of receipts for goods.

The department has a five-day work week. Therefore, the billing period is 57 business days (17 days + 20 days + 20 days).

According to the plan, sales volume by months:

- in January - 600,000 rubles;

- in February - 800,000 rubles;

- in March - 800,000 rubles.

Total allowable cash balance limit on hand:

- 115,789 rubles. (2,200,000 rubles: 57 days × 3 days).

Based on these data, the head of the organization set by his order the limit of the cash balance for the unit in the amount of 115,789 rubles.

If separate divisions hand over the proceeds only to the head office, then total amount the cash balance limit for the organization as a whole should include:

- balance limit in the cash desk of the parent organization;

- balance limits for all separate divisions.

For example, in this case, you can calculate the total limit for the whole organization, taking into account the revenue of all separate divisions. And then distribute it between the main (central) cash desk and divisions based on the share of revenue of each division. Arrange the distribution by order of the head of the organization, drawn up in an arbitrary form.

This procedure follows from paragraph 5 of clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014.

An example of determining the cash limit for a new division of the organization. Cash is handed over to the central cash desk

In January, Hermes Trading Firm LLC opened a separate subdivision. The division will credit the proceeds to the central cash desk.

LLC “Trading firm “Hermes”” calculates the cash balance limit based on accounting data based on the volume of cash receipts for January, February and March previous year. And then distribute the limit between the head office and the subdivision. The proceeds are deposited in the bank every fifth day.

Hermes is open seven days a week from 10 am to 10 pm. Therefore, the billing period is 90 working days (31 days + 28 days + 31 days).

The turnover in the debit of account 50 "Cashier" in correspondence with the credit of account 90 "Sales", as well as the credit of account 62 "Settlements with buyers and customers" in terms of cash advances received in the billing period, which were set off in the same period, amounted to 2 RUB 699,998:

- in January - 887,388 rubles;

- in February - 802,015 rubles;

- in March - 1,010,595 rubles.

The Hermes accountant calculated the allowable cash balance limit on hand, taking into account rounding:

150 000 rub. (2,699,998 rubles: 90 days × 5 days).

The volume of goods in the warehouse of the division is equal to 1/4 of the total volume of goods. Thus, according to the plan, the revenue of the unit will be a quarter of the revenue of the entire organization.

The accountant distributed the limit as follows:

- 37 500 rub. (150,000 rubles × 1/4) - cash limit for the unit;

- RUB 112,500 (150,000 rubles × 3/4) - cash desk limit for the head office.

Based on these data, the head of the organization set a cash balance limit for the organization in the amount of 150,000 rubles in one order, where the limits for the head office and division of the organization are separately allocated.

How often to review the limit

Situation: can the organization review the cash balance limit monthly, quarterly?

Yes maybe.

The head of the organization independently sets the cash balance limit for the organization as a whole and separately for its separate divisions (paragraph 2, clause 2 of the Bank of Russia Directive of March 11, 2014 No. 3210-U). Moreover, the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U does not stipulate for what period the cash limit should be set. Therefore, the manager can set and review the cash balance limit for a month, quarter, year or other reasonable period. For example, a change in the volume of cash receipts for goods sold (work performed, services rendered) or the volume of cash withdrawals may be the basis for the next revision of the cash balance limit.

Similar clarifications are contained in the letter of the Bank of Russia dated February 15, 2012 No. 36-3/25.